Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

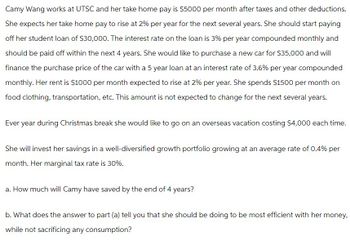

Transcribed Image Text:Camy Wang works at UTSC and her take home pay is $5000 per month after taxes and other deductions.

She expects her take home pay to rise at 2% per year for the next several years. She should start paying

off her student loan of $30,000. The interest rate on the loan is 3% per year compounded monthly and

should be paid off within the next 4 years. She would like to purchase a new car for $35,000 and will

finance the purchase price of the car with a 5 year loan at an interest rate of 3.6% per year compounded

monthly. Her rent is $1000 per month expected to rise at 2% per year. She spends $1500 per month on

food clothing, transportation, etc. This amount is not expected to change for the next several years.

Ever year during Christmas break she would like to go on an overseas vacation costing $4,000 each time.

She will invest her savings in a well-diversified growth portfolio growing at an average rate of 0.4% per

month. Her marginal tax rate is 30%.

a. How much will Camy have saved by the end of 4 years?

b. What does the answer to part (a) tell you that she should be doing to be most efficient with her money,

while not sacrificing any consumption?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- Genevieve has decided to start saving up for a vacation in two years, when she graduates from university. She already has $1,000 saved today. For the first year, she plans on making end-ofmonth contributions of $300 and then switching to end-of-quarter contributions of $1,000 in the second year. If the account can earn 5% compounded semi-annually in the first year and 6% compounded quarterly in the second year, how much money will she have saved when she graduatearrow_forwardNatasha is going to take out an unsubsidized student loan of $13,500 at a 4.2% APR, compounded monthly, to pay for her last 2 semesters of college. She will begin paying off the loan in 9 months with monthly payments lasting for 12 years, and she's wondering what her monthly payment will be. She's also wondering what her monthly payment would have been if her student loan had been subsidized instead of unsubsidized. Help Natasha figure it out. Part I: What is the periodic interest rate of the student loan that Natasha is going to take out? Part II: What is the total amount that Natasha will owe when she starts making payments? Part III: How many monthly payments will Natasha have made once her loan is paid off? Part IV: What will Natasha's monthly payment be? Part V: What would Natasha's monthly payment have been if her student loan was subsidized instead of unsubsidized?arrow_forwardMegan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Round your answers for the following questions to the nearest dollar. Megan's Aunt Karroll told her that she would give Megan $1,400 at the end of each year for the next three years to help with her college expenses. Assuming an annual interest rate of 5 percent, what is the present value of that stream of payments? (Hint: Use Appendix A-4 or the Garman/Forgue companion website.) Round Present Value of Series of Equal Amounts in intermediate calculations to four decimal places. $arrow_forward

- Please do the following questions with full workingarrow_forwardYour daughter just turned 5 years old. You plan to send her to college beginning on her 18th birthday. You will need to make payments of $8,000 at the beginning of each year for three years. If you can invest in an account that earns an annual effective rate of 4%, how much money will you need to put aside today to cover these payments?arrow_forwardKristina is going to finance new office equipment at a 5% rate over a 1.5 year term. If she can afford monthly payments of $125, how much can she pay for the new office equipment? Round your answer to the nearest dollar.arrow_forward

- Davadene has two student loans. one is for $8000 at an APR of 5% for 10 years; the second is for $15,000 at an interest rate of 6% for 12 years. Davadene is considering consolidating the loans and has found a bank that will loan her $23,000 for 8 years at an annual interest rate of 5.5%. If she is trying to pay off the loans and pay the least amount of interest, should Davadene take the consolidation option? Defend your answer.arrow_forwardMichael and Ava want to know how much it will cost to put their daughter Lily through college. She will begin college in 13 years. Assume college costs $12,000 per year today. Lily will attend college for 4 years. College costs increase 4.0% each year. How much money do Michael and Ava need to have on hand on the day Lily BEGINS college, in order to fund her entire college degree? (Assume the money will earn 6% annual interest while it is in her college savings account). Lily will spend the entire amount available during her college years. Each year of college she will withdraw more than the prior year (the amount will increase by the college cost inflation rate). (amortize the balance in her account to zero at the end of the 4 college years...base calculations on a growing annuity withdrawal schedule). (amortize the balance in her account to zero at the end of the 4 college years). O $73,292.32 O $69,235.87 O $48,000.00 O $79,923.53arrow_forwardRick wishes to purchase a new car and can afford monthly payments of up to $275 per month. Finance is available and the terms are that the loan lasts for 6 years, and the annual interest rate is 8%. What is the maximum price for a car that Ryan's budget can afford?Round your answer to the nearest hundred dollars.arrow_forward

- A couple is saving for their newborn daughter’s college education. She will need $25,000 per year for a four-year college program, which she will start when she is 18. What uniform deposits starting 2 years from now and continuing through year 17 are needed, if the account earns interest at 4%?arrow_forwardBecca wants to save $900 per quarter for 3 years towards the purchase of an appliance. She feels that she can earn 5.42% compounded quarterly for this period of time. If she starts immediately, what is the most expensive appliance that she can purchase?arrow_forwardSuppose that you are saving for college for a child. That child was just born and you will have to make 4 equal tuition payments over a four year period with the first occurring in exactly 18 years. Each successive tuition payment is made exactly a year after the prior payment. You also plan on buying this child a car in exactly 15 years using this same savings. You will pay $30,000 at that time for the car. You will be depositing money every year with the first check deposited into savings today and the last one the day the first tuition check is due. If you want to be able to pay $65,000 each year for tuition, how much do you have to save per year? Assume the discount rate is 10 percent per year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning