FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

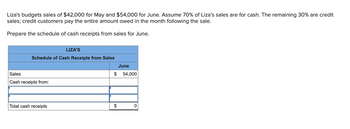

Transcribed Image Text:Liza's budgets sales of $42,000 for May and $54,000 for June. Assume 70% of Liza's sales are for cash. The remaining 30% are credit

sales; credit customers pay the entire amount owed in the month following the sale.

Prepare the schedule of cash receipts from sales for June.

Schedule of Cash Receipts from Sales

Sales

Cash receipts from:

LIZA'S

Total cash receipts

$

June

54,000

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Garda purchased $700,000 of merchandise in August and budgets merchandise purchases of $710,000 in September Merchandise purchases are paid as follows: 15% in the month of purchase and 85% in the month after the purchase. Prepare a schedule of cash payments for merchandise purchases for September, GARDA Schedule of Cash Payments for Merchandise Purchases September Merchandise purchases Cash payments for Current period purchases 710,000 Prior period purchases Total cash payments for merchandise purchasesarrow_forwardSchedule of Cash Collections of Accounts Receivable Furry Friends Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $300,000 June 370,000 July 530,000 All sales are on account. 53 percent of sales are expected to be collected in the month of the sale, 36% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. Furry Friends Supplies Inc. Schedule of Collections from Sales For the Three Months Ending May 31 May June July May sales on account: Collected in May fill in the blank 1 Collected in June fill in the blank 2 Collected in July fill in the blank 3 June sales on account: Collected in June fill in the blank 4 Collected in July fill in the blank 5 July sales on account: Collected in July…arrow_forward5 At Lyman Company, past experience reveals that 10% of sales are for cash and the remaining 90% are on credit. Lyman Company expects to collect 30% of its credit sales in the month of sale, 50% in the month following sale, and 18% in the second month following sale. Which ONE of the following is part of the cash collections expected to be made in January? O Cash sales from the preceding December O Cash collections of credit sales from the preceding December O Cash collections of credit sales from the preceding September O Cash sales from the preceding Novemberarrow_forward

- mni.3arrow_forwardSchedule of Cash Collections of Accounts Receivable Bark & Purr Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $160,000 June 230,000 July 350,000 All sales are on account. 53 percent of sales are expected to be collected in the month of the sale, 37% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. May June July May sales on account: Collected in May $fill in the blank 1 Collected in June $fill in the blank 2 Collected in July $fill in the blank 3 June sales on account: Collected in June fill in the blank 4 Collected in July fill in the blank 5 July sales on account: Collected in July fill in the blank 6 Total cash collected $fill in the blank 7 $fill in the blank 8 $fill in the…arrow_forwardZilly Company budgets sales of $156,000 for June. Zilly pays a sales manager a monthly salary of $5,300 and a commission of 8% of that month's sales dollars. Prepare a selling expense budget for June. Budgeted sales ZILLY COMPANY Selling Expense Budget Junearrow_forward

- subject - accountingarrow_forwardCash Budget LeeAnn Ortiz owns a retail store that sells new and used sporting equipment. LeeAnn has requested a cash budget for October. After examining the records of the company, you find the following: Cash balance on October 1 is $1,130. Actual sales for August and September are as follows: August September Cash sales $6,000 $4,500 Credit sales 58,000 62,000 Total sales $64,000 $66,500 Credit sales are collected over a three-month period: 40 percent in the month of sale, 36 percent in the next month, and 22 percent in the second month after the sale. The remaining sales are uncollectible. Inventory purchases average 70 percent of a month's total sales. Of those purchases, 45 percent are paid for in the month of purchase. The remaining 55 percent are paid for in the following month. Salaries and wages total $3,850 per month. Rent is $3,150 per month. Taxes to be paid in October are $1,635. LeeAnn usually withdraws $3,500 each month as…arrow_forwardHello - Where does the opening balance of cash come from (how is it derived) in Step 3. Preparing a Cash Budget? (see included picture. THANK YOU!! pzarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education