Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please answer parts D, E, and F from the attached instructions

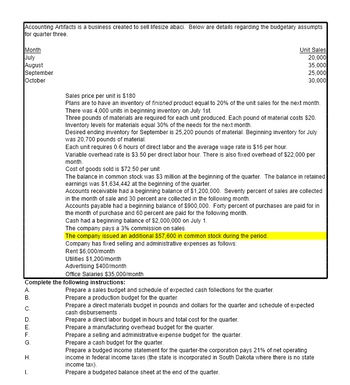

Transcribed Image Text:Accounting Artifacts is a business created to sell lifesize abaci. Below are details regarding the budgetary assumpts

for quarter three.

Month

July

August

September

October

A.

ABC

B.

Complete the following instructions:

D.

DEFG

E.

F.

G.

H.

I.

Sales price per unit is $180

Plans are to have an inventory of finished product equal to 20% of the unit sales for the next month.

There was 4,000 units in beginning inventory on July 1st.

Three pounds of materials are required for each unit produced. Each pound of material costs $20.

Inventory levels for materials equal 30% of the needs for the next month.

Desired ending inventory for September is 25,200 pounds of material. Beginning inventory for July

was 20,700 pounds of material.

Each unit requires 0.6 hours of direct labor and the average wage rate is $16 per hour.

Variable overhead rate is $3.50 per direct labor hour. There is also fixed overhead of $22,000 per

month.

Cost of goods sold is $72.50 per unit

The balance in common stock was $3 million at the beginning of the quarter. The balance in retained

earnings was $1,634,442 at the beginning of the quarter.

Accounts receivable had a beginning balance of $1,200,000. Seventy percent of sales are collected

in the month of sale and 30 percent are collected in the following month.

Accounts payable had a beginning balance of $900,000. Forty percent of purchases are paid for in

the month of purchase and 60 percent are paid for the following month.

Cash had a beginning balance of $2,000,000 on July 1.

The company pays a 3% commission on sales.

The company issued an additional $57,600 in common stock during the period.

Company has fixed selling and administrative expenses as follows:

Rent $6,000/month

Utilities $1,200/month

Advertising $400/month

Unit Sales

20,000

35,000

25,000

30,000

Office Salaries $35,000/month

Prepare a sales budget and schedule of expected cash follections for the quarter.

Prepare a production budget for the quarter.

Prepare a direct materials budget in pounds and dollars for the quarter and schedule of expected

cash disbursements.

Prepare a direct labor budget in hours and total cost for the quarter.

Prepare a manufacturing overhead budget for the quarter.

Prepare a selling and administrative expense budget for the quarter.

Prepare a cash budget for the quarter.

Prepare a budged income statement for the quarter-the corporation pays 21% of net operating

income in federal income taxes (the state is incorporated in South Dakota where there is no state

income tax).

Prepare a budgeted balance sheet at the end of the quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardLens & Shades sells sunglasses for $37 each and is estimating sales of 21,000 units in January and 19,000 in February. Each lens consist of 2.00 mm of plastic costing $2.50 per mm, 1.7 oz of dye costing $2.80 per ounce. and 0.50 hours direct labor at a labor rate of $18 per unit. Desired inventory levels are: Prepare a sales budget, production budget, direct materials budget for silicon and solution, and a direct labor budget.arrow_forwardSports Socks has a policy of always paying within the discount period and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 85% of its payments are made in the month of purchase and 15% are made the following month. The direct materials budget provides for purchases of $129,582 in November, $294,872 in December, $239,582 in January, and $234,837 in February. What is the balance in accounts payable for January 31, and February 28?arrow_forward

- Rehydrator makes a nutrition additive and expects to sell 3,000 units in January, 2,000 in February, 2,500 in March, 2,700 in April. and 2,900 in May. The required ending inventory is 20% of the next months sales, and the beginning inventory on January 1 was 600 units. Prepare a production budget for the first four months of the year.arrow_forwardPalmgren Company produces consumer products. The sales budget for four months of the year is presented below. Company policy requires that ending inventories for each month be 25 percent of next months sales. At the beginning of July, the beginning inventory of consumer products met that policy. Required: Prepare a production budget for the third quarter of the year. Show the number of units that should be produced each month as well as for the quarter in total.arrow_forwardLens Junction sells lenses for $45 each and is estimating sales of 15,000 units in January and 18,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $18 per hour. Desired inventory levels are: Â Prepare a sales budget, production budget. direct materials budget for silicon and solution, and a direct labor budget.arrow_forward

- Drainee purchases direct materials each month. Its payment history shows that 65% is paid in the month of purchase with the remaining balance paid the month after purchase. Prepare a cash payment schedule for January using this data: in December through February, it purchased $22,000, $25,000, and $23,000 respectively.arrow_forwardsub : Accounting pls answer ASAP.Please type the answer. dnt CHATGPT. i ll upvote.arrow_forwardAlyssum, Inc., a merchandising company, has provided the following extracts from their budget for the first quarter of the forthcoming year: Jan Feb Purchases on account $262,000 $294,000 March $360,000 The vendors have required the following terms of payment Month of purchase First month after the purchase Second month after the purchase 30% 35% 35% Calculate the total payment on account for the month of March. O A. $360,000 OB. $180,030 OC. $136,220 OD. $302,600 13arrow_forward

- Prepare a master budget for the three-month period ending June 30 that includes a merchandise purchases budget in units and in dollars. Show the budget by month and in total. (Round unit cost to 2 decimal places.)arrow_forwardAt the beginning of the year, Dow inventory of $200,000. During th purchased goods costing $800,000 reported ending inventory of $ $1,050,000, their cost of goods sol must be............... The Stacy Company makes and sells R. Budgeted sales for April are $3 budgeted at 30% of sales dollars. If is budgeted at $40,000, the administrative expenses are: -$133,333 - $60,000 - $102,000 - $78,000. CALIN CORPORATION HAS TOTAL CURRENT ASSETS OF $61 $230,000, TOTAL STOCKHOLDERS EQUITY OF $1,183,000, TO $958,000, TOTAL ASSETS OF $1,573,000, AND TOTAL LIABILI THE COMPANY'S WORKING CAPITAL ISarrow_forwardTimpco, a retailer, makes both cash and credit sales (i.e., sales on open account). Information regarding budgeted sales for the last quarter of the year is as follows: OctoberNovemberDecemberCash sales$ 60,000$ 55,000$ 75,000Credit sales60,00066,00082,500Total$ 120,000$ 121,000$ 157,500 Past experience shows that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale; the remaining 40% are collected in the month following the month of sale. Customers are granted a 1.5% discount for payment within 10 days of billing. Approximately 75% of collectible credit sales take advantage of the cash discount. Inventory purchases each month are 100% of the cost of the following month’s projected sales. (The gross profit rate for Timpco is approximately 30%.) All merchandise purchases are made on credit, with 20% paid in the month of purchase and the remainder paid in the following month. No cash discounts for early payment are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning