FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

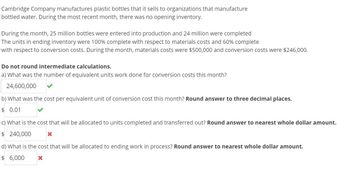

Transcribed Image Text:Cambridge Company manufactures plastic bottles that it sells to organizations that manufacture

bottled water. During the most recent month, there was no opening inventory.

During the month, 25 million bottles were entered into production and 24 million were completed

The units in ending inventory were 100% complete with respect to materials costs and 60% complete

with respect to conversion costs. During the month, materials costs were $500,000 and conversion costs were $246,000.

Do not round intermediate calculations.

a) What was the number of equivalent units work done for conversion costs this month?

24,600,000

b) What was the cost per equivalent unit of conversion cost this month? Round answer to three decimal places.

$ 0.01

c) What is the cost that will be allocated to units completed and transferred out? Round answer to nearest whole dollar amount.

$ 240,000

d) What is the cost that will be allocated to ending work in process? Round answer to nearest whole dollar amount.

$ 6,000

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Yellowstone Company began operations on January 1 to produce a single product. It used an absorption costing system with a planned production volume of 100,000 units. During its first year of operations, the planned production volume was achieved, and there were no fixed selling or administrative expenses. Inventory on December 31 was 20,000 units, and operating income for the year was $240,000. Required: 1. If Yellowstone Company had used variable costing, its operating income would have been $220,000. Compute the break-even point in units under variable costing. 2. Draw a profit-volume graph for Yellowstone Company. (Use variable costing.)arrow_forwardStrait Co. manufactures office furniture. During the most productive month of the year, 3,100 desks were manufactured at a total cost of $82,600. In the month of lowest production, the company made 1,160 desks at a cost of $58,100. Using the high-low method of cost estimation, total fixed costs arearrow_forwardB&B Inc. is a manufacturer of digital cameras. It has two departments: assembly and testing. In January, the company incurred $850,000 on direct materials and $956,800 on conversion costs for a total manufacturing cost of $1,806,800. Read the requirements. Requirement 1. Assume there was no beginning inventory of any kind on January 1. During January, 15,000 cameras were placed into production and all 15,000 were fully completed at the end of the month. What is the unit cost of an assembled camera in January? (Round your answers to the nearest cent.) Direct materials cost per unit Conversion cost per unit Assembly department cost per unitarrow_forward

- Osage, Inc., manufactures and sells lamps. The company produces only when it receives orders and, therefore, has no inventories. The following information is available for the current month: Master Bu (based on bu Actual (based on actual orders for 450,000 units) orders for 4 units) Sales revenue $4,974,000 $4,800,01 Less Variable costs Materials 1,536,000 244,000 579,100 420,000 $2,779,100 $2,194,900 1,536,01 312,00 528,01 432,00 Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin $2,808,00 $1,992,00 Less Fixed costs 883,100 289,000 197,000 $1,369,100 $ 825,800 Manufacturing overhead Marketing 855,01 289,00 176,00 $1,320,00 $ 672,00 Administrative Total fixed costs Operating profits Required: Prepare a flexible budget for Osage, Inc. (Do not round intermediate calculations.) OSAGE, INC. Flexible Budget Sales revenue Variable costs: Materials Direct labor Variable overhead Variable marketing and administrative Total variable…arrow_forwardPlease answer full question .arrow_forwardTambin Inc. produces a gasoline additive that, when added to the gas tank of the average automobile, is designed to increase gas mileage by 15%. The company's controller suspects that the year-end dollar balances shown below in the inventory accounts may be incorrect Work in process, December 31 (materials 100% complete; conversion 50% complete) Finished goods, December 31 Work in process, beginning of year (materials 100% complete; conversion 80% complete) Started into production Costs added during the year Units completed during the year There were no finished goods inventories at the beginning of the year. The company uses the weighted-average method of process costing. There is only one processing department A review of the company's inventory and cost records shows the following: Equivalent units of production Cost per equivalent unit Materials Cost of ending work in process inventory Cost of finished goods inventory CLEANS Materials Leave de 255 PA JAPAAE 2015 slen Required: 1.…arrow_forward

- harshalarrow_forwardMontrose Instrumentation produces measurement equipment. One component, used in a variety of the company's products, is critical and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of the component to produce three month's worth of sales (one component is used in each unit of product in which it is used). On February 1, the company has 40,000 components in stock. Sales of the units in which the component is used in each of the next six months are estimated to be as follows: February March April May June July 34,750 28,750 30,250 35,800 32,400 44,360 Parts are purchased at a wholesale price of $55. The vendor has a financing arrangement by which Montrose pays 40 percent of the purchase price in the month when the components are delivered and 60 percent in the following month. Montrose purchased 42,500 parts in January. Required: a. Estimate purchases of the component (in units) for February and March. b. Estimate the cash disbursements…arrow_forwardMontrose Instrumentation produces measurement equipment. One component, used in a variety of the company's products, is critical and the supply chain often breaks. For that reason, Montrose has a policy to hold in inventory enough of the component to produce three month's worth of sales (one component is used in each unit of product in which it is used). On February 1, the company has 31,000 components in stock. Sales of the units in which the component is used in each of the next six months are estimated to be as follows: February 32,500 March 26,500 April 28,000 May 33,550 June 30,150 July 42,110 Parts are purchased at a wholesale price of $46. The vendor has a financing arrangement by which Montrose pays 40 percent of the purchase price in the month when the components are delivered and 60 percent in the following month. Montrose purchased 38,000 parts in January. Required: Estimate purchases of the component (in units) for February and March. Estimate the cash…arrow_forward

- The Macon Company uses the high-low method to determine its cost equation. The following information was gathered for the past year: Machine Hours Direct Labor Costs Busiest month (June) 24,000 $ 282,400 Slowest month (December) 18,000 $ 220,000 If Macon expects to use 20,000 machine hours next month, what are the estimated direct labor costs?arrow_forwardI want the correct answer with helparrow_forward17. Calculate the prime costs and conversion costs if a company incurs the following to produce wine glasses: $4,000 for molten glass, $15,000 paid to employees who create the glasses, and $2,000 paid to employees who repair equipment used in the production facilities. 28. As of January 1, 20Y5, Tippy Cup Co. had a balance of $15,000 for raw materials inventory. The company's ending balance of raw materials inventory totaled $13,900. Every four months, the company purchases 250 pounds of raw materials at $25 a pound. Calculate the cost of direct materials used for the year. 29. Tippy Cup Co. also incurred $10,550 for factory overhead and 250 hours of direct labor at $10.30 per hour. Using the cost of direct materials used calculated in Exercise 28, determine the total manufacturing costs incurred for the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education