FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

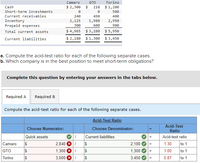

Transcribed Image Text:The image presents financial data for three companies: Camaro, GTO, and Torino, along with a task to compute the acid-test ratio and determine which company is best positioned to meet short-term obligations.

### Financial Data Table

- **Camaro:**

- **Cash:** $2,300

- **Short-term investments:** $0

- **Current receivables:** $240

- **Inventory:** $2,125

- **Prepaid expenses:** $300

- **Total current assets:** $4,965

- **Current liabilities:** $2,180

- **GTO:**

- **Cash:** $210

- **Short-term investments:** $0

- **Current receivables:** $490

- **Inventory:** $1,980

- **Prepaid expenses:** $600

- **Total current assets:** $3,280

- **Current liabilities:** $1,300

- **Torino:**

- **Cash:** $1,200

- **Short-term investments:** $500

- **Current receivables:** $400

- **Inventory:** $2,950

- **Prepaid expenses:** $900

- **Total current assets:** $5,950

- **Current liabilities:** $3,450

### Instructions

a. **Compute the acid-test ratio for each case.**

b. **Determine which company is best positioned to meet short-term obligations.**

### Acid-Test Ratio Calculation

A detailed table is provided for computing the acid-test ratio:

- **Camaro:**

- **Quick assets:** $2,840

- **Current liabilities:** $2,180

- **Acid-test ratio:** 1.30 to 1

- **GTO:**

- **Quick assets:** $1,300

- **Current liabilities:** $1,300

- **Acid-test ratio:** 1.00 to 1

- **Torino:**

- **Quick assets:** $3,000

- **Current liabilities:** $3,450

- **Acid-test ratio:** 0.87 to 1

**Explanation of Quick Assets:**

Quick assets are calculated by adding cash, short-term investments, and current receivables.

**Conclusion:**

The acid-test ratio is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question Content Area The following information pertains to Tanzi Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Cash and short-term investments $41,912 Accounts receivable (net) 29,707 Inventory 28,654 Property, plant and equipment 293,074 Total Assets $393,347 Liabilities and Stockholders' Equity Current liabilities $58,253 Long-term liabilities 97,633 Stockholders' equity-common 237,461 Total Liabilities and stockholders' equity $393,347 Income Statement Sales $80,900 Cost of goods sold 36,405 Gross margin $44,495 Operating expenses 25,209 Net income $19,286 Number of shares of common stock 6,546 Market price of common stock $35 What is the current ratio for this company? Round your answer to two decimal places. Select the correct answer. 1.23 2.22 0.72 1.72arrow_forwardRatios Calculated Year 1 Year 2 3.64 +Q+ Price-to-cash-flow 5.20 Inventory turnover 10.40 Debt-to-equity 0.70 8.32 0.56 Year 3 2.91 6.66 0.45 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. Cold Goose Metal Works Inc.'s ability to meet its debt obligations has improved since its debt-to-equity ratio decreased from 0.70 to 0.45. A decline in the inventory turnover ratio can be explained by the new Inventory management system that the company recently adopted, which led to more efficient inventory management. A decline in the debt-to-equity ratio implies a decline in the creditworthiness of the firm. A plausible reason why Cold Goose Metal Works Inc.'s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future.arrow_forwardPrivett Company Line Item Description Amount Accounts payable $27,815 Accounts receivable 70,978 Accrued liabilities 6,525 Cash 22,970 Intangible assets 43,640 Inventory 74,446 Long-term investments 100,209 Long-term liabilities 78,528 Marketable securities 34,768 Notes payable (short-term) 25,264 Prepaid expenses 2,065 Property, plant, and equipment 646,687 Based on the data for Privett Company, what is the amount of working capital? a. $205,227 b. $995,763 c. $128,716 d. $145,623arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education