Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

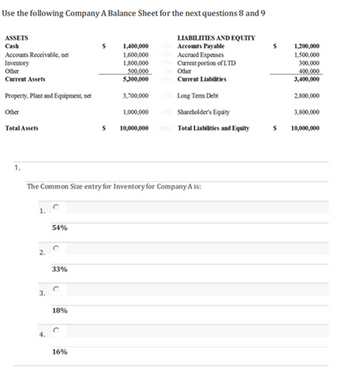

Transcribed Image Text:Use the following Company A Balance Sheet for the next questions 8 and 9

ASSETS

Cash

Accounts Receivable, net

Inventory

Other

Current Assets

Property, Plant and Equipment, net

Other

Total Assets

1.

1.

2.

3.

The Common Size entry for Inventory for Company A is:

54%

33%

18%

S

16%

$

LIABILITIES AND EQUITY

Accounts Payable

Accrued Expenses

Current portion of LTD

Other

1,400,000

1,600,000

1,800,000

500,000

5,300,000

20%Current Liabilities

3,700,000

Long Term Debt

1,000,000

Shareholder's Equity

10,000,000 100% Total Liabilities and Equity

1,200,000

1,500,000

300,000

400,000

3,400,000

2,800,000

3,800,000

$ 10,000,000

Expert Solution

arrow_forward

Step 1

The Common size entry is determined by computing the value of the asset to the Total asset value and converting it to a percentage value.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities Year 2 $219,100 Total liabilities and stockholders' equity 124, 400 19,700 10,000 1,700 20, 100 175,900 $ 43,200 $ 38,500 15,800 54,300 64,300 118,600 Stockholders' equity Common stock (43,000 shares) Retained earnings Total stockholders' equity 159,000 $277,600 $ 4,800 $ 7,200 2,800 2,800 36,600 31, 100 101,600 94, 100 3,900 2,900 149,700 138, 100 106,400 106,400 21,500 0 $277,600 $244,500 Year 1 $182,800 114,900 44, 100 101, 100 17,700 9,000 1,700 16,900 146,400 $36,400 $ 34,200 16, 200 50,400 65,300 115,700 114,900…arrow_forwardPlease analyze company Savola using below table of common size balance sheet compared to other companies:arrow_forwardPlease help me with all answers I will give upvote thankuarrow_forward

- balance sheets Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity Problem 13-5A (Algo) Part 1 $ 19,500 37,400 84,640 5,900 350,000 $ 497,440 $ 33,000 56,400 134,500 6,900 304,400 $ 535,200 $ 68,340 86,800 190,000 152,300 $ 497,440 $ 535,200 $ 91,300 115,000 206,000 122,900 statement Sales Cost of goods sold Interest expense Income tax expense Net income Basic earnings per share Cash dividends per share Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) invent sales in inventory, and () days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company…arrow_forwardFinancial statements of Rukavina Corporation follow: Comparative Balance Sheet Assets: Cash and cash equivalents Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity: Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Income Statement Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income taxes Net income $ 560 392 BERSA 168 112 $ 39 Ending Beginning Balance Balance $ 30 51 42 426 213 $336 $ 83 216 85 (48) $ 336 $ 35 56 43 400 200 $ 334 $ 69 260 84 (79) $ 334 Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities for the year was:arrow_forwardCurrent assets: Cash and marketable securities Accounts receivable Inventory Total Assets Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets Total Total assets Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses 2024 VALIUM'S MEDICAL SUPPLY CORPORATION Balance Sheet as of December 31, 2024 and 2023 (in millions of dollars) $ 72 187 312 $ 571 Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2023 $ 71 181 291 $ 543 $ 1,073 146 $ 927 134 $ 1,061 $ 1,632 $ 1,446 $ 882 113 $ 769 134 $ 903 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousand shares) Retained earnings Total VALIUM'S MEDICAL SUPPLY CORPORATION Income Statement for Years Ending December 31, 2024 and…arrow_forward

- q. 13 A company has $628 in inventory, $1,921 in net fixed assets, $300 in accounts receivable, $141 in cash, and $354 in accounts payable. What are the company’s total current assets? $769 $1,069 $2,990 $1,123 $1,423arrow_forwardOperating activities: Net earnings Non-cash items Add: Depreciation LAURENT COMPANY Statement of Cash Flows For the year 31 December 20X8 Changes to working ital: Add: Decrease in accounts receivable Less: Increase in accounts payable Less: Increase in inventory Investing activities: Decrease in long-term bank loan Purchase of long-term investment Financing activities: Sold long-term investment Paid cash dividend Net change in cash Opening cash Closing cash Chemisie ہےarrow_forwardAssets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Depreciation Net plant and equipment Other long-term assets Total Total assets Net sales (all credit) Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2821 $ 75 115 200 $390 ROA ROE $580 110 $470 50 $520 $910 Less: Depreciation Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings Per (common) share data: 96 96 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 2020 $ 65 110 198 $365 DuPont Analysis times times $471 100 $371 LAK OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020…arrow_forward

- Question 1 The following are financial statements of Crane Company. Crane CompanyIncome StatementFor the Year Ended December 31, 2022 Net sales $2,192,500 Cost of goods sold 1,010,500 Selling and administrative expenses 900,500 Interest expense 78,000 Income tax expense 62,500 Net income $ 141,000 Crane CompanyBalance SheetDecember 31, 2022 Assets Current assets Cash $ 55,100 Debt investments 89,000 Accounts receivable (net) 168,400 Inventory 236,500 Total current assets 549,000 Plant assets (net) 572,500 Total assets $ 1,121,500 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 152,000 Income taxes payable 31,000 Total current liabilities 183,000 Bonds payable 220,740 Total liabilities 403,740 Stockholders’ equity Common stock 345,000 Retained earnings 372,760…arrow_forwardH1. Accountarrow_forwardCarriveau Corporation's most recent balance sheet appears below: Comparative Balance Sheet Ending Balance Beginning Balance Assets: Current assets: Cash and cash equivalents $ 46 $ 35 Accounts receivable 42 25 Inventory 56 75 Total current assets 144 135 Property, plant, and equipment 831 556 Less accumulated depreciation 298 272 Net property, plant, and equipment 533 284 Total assets $ 677 $ 419 Liabilities and stockholders' equity: Current liabilities: Accounts payable $ 61 $ 71 Accrued liabilities 26 22 Income taxes payable 49 25 Total current liabilities 136 118 Bonds payable 123 172 Total liabilities 259 290 Stockholders’ equity: Common stock 91 86 Retained earnings 327 43 Total stockholders’ equity 418 129 Total liabilities and stockholders'…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education