Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Costing

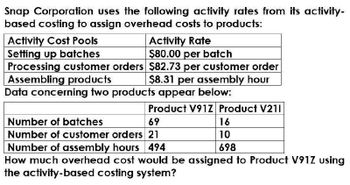

Transcribed Image Text:Snap Corporation uses the following activity rates from its activity-

based costing to assign overhead costs to products:

Activity Cost Pools

Setting up batches

Activity Rate

$80.00 per batch

Processing customer orders $82.73 per customer order

Assembling products

Data concerning two products appear below:

$8.31 per assembly hour

Product V91Z Product V211

Number of batches

69

16

Number of customer orders 21

10

Number of assembly hours 494

698

How much overhead cost would be assigned to Product V91Z using

the activity-based costing system?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Medical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardUsing the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forwardRoberts Company produces two weed eaters: basic and advanced. The company has four activities: machining, engineering, receiving, and inspection. Information on these activities and their drivers is given below. Overhead costs: Required: 1. Calculate the four activity rates. 2. Calculate the unit costs using activity rates. Also, calculate the overhead cost per unit. 3. What if consumption ratios instead of activity rates were used to assign costs instead of activity rates? Show the cost assignment for the inspection activity.arrow_forward

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardA company is using process costing with the first-in, first-out (FIFO) method, and all costs are added evenly throughout the manufacturing process. If there are 5,000 units in beginning work in process inventory (30% complete), 10,000 units in ending work in process inventory (60% complete), and 25,000 units started in process this period, how many equivalent units are there for this period? a. 22,500 units. b. 26,000 units. c. 24,500 units. d. 25,000 units.arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- Allocating selling and administrative expenses using activity-based costing Shrute Inc. manufactures office copiers, which are sold to retailers. The price and cost of goods sold for each copier are as follows: In addition, the company incurs selling and administrative expenses of 414,030. The company wishes to assign these costs to its three major retail customers, The Warehouse, Kosmo Co., and Supply Universe. These expenses are related to its three major nonmanufacturing activities: customer service, sales order processing, and advertising support. The advertising support is in the form of advertisements that are placed by Shrute Inc. to support the retailers sale of Shrute copiers to consumers. The budgeted activity costs and activity bases associated with these activities are: Activity-base usage and unit volume information for the three customers is as follows: Instructions Determine the activity rates for each of the three nonmanufacturing activities. Determine the activity costs allocated to the three customers, using the activity rates in (1). Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports should disclose the gross profit and operating income associated with each customer. Provide recommendations to management, based on the profitability reports in (3).arrow_forwardOverhead costs are assigned to each product based on __________________. A. the proportion of that products use of the cost driver B. a predetermined overhead rate for a single cost driver C. price of the product D. machine hours per productarrow_forwardDesjariais Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products. Activity Coat Pools Setting up batches Assembling products Processing customer orders. Data concerning two products appear below: Number of batches Number of assembly hours. Number of customer orders a. Product S96U b. Product QO6F Overhead cost Activity Rate $ 123.70 per batch $ 7.32 per assembly hour $ 59.76 per customer order Product S960 36 192 23 Required: a. How much overhead cost would be assigned to Product S96U using the company's activity-based costing system? b. How much overhead cost would be assigned to Product Q06F using the company's activity-based costing system? Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Product 006F 45 870 42arrow_forward

- Az-Zain Sdn Bhd uses the following activity rates from its activity-based costing to assign overhead costs to products. Activity Cost Pools Activity Rate Setting up batches RM86.50 per batch Assembling products RM4.63 per assembly hour Processing customer orders RM52.16 per customer order Data concerning two products appear below: Product J00A Product S06U Number of batches 34 43 Number of assembly hours 105 812 Number of customer orders 17 32 1. How much overhead cost would be assigned to Product J00A using the company's activity-based costing system? 2. How much overhead cost would be assigned to Product S06U using the company's activity-based costing system?arrow_forwardDesjarlais Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products. Activity Cost Pools Activity Rate Setting up batches $ 83.25 per batch Assembling products $ 13.88 per assembly hour Processing customer orders $ 61.41 per customer order Data concerning two products appear below: Product S96U Product Q06F Number of batches 33 45 Number of assembly hours 104 844 Number of customer orders 16 33 Required: a. How much overhead cost would be assigned to Product S96U using the company's activity-based costing system? (Round your intermediate calculations and final answer to 2 decimal places.) b. How much overhead cost would be assigned to Product Q06F using the company's activity-based costing system? (Round your intermediate calculations and final answer to 2 decimal places.)arrow_forwardKapoor Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products. Activity Cost Pools Setting up batches Activity Rate $86.50 per batch Assembling products $4.63 per assembly hour Processing customer orders $52.16 per customer order + Data concerning two products appear below: + + P Number of batches 34 Number of assembly hours 105 Number of customer orders 17+ P ܒܝ Product J00A Product S06U 43P 812+ 32- Overhead Cost:< P Required: a. How much overhead cost would be assigned to Product J00A using the company's activity- based costing system? + b. How much overhead cost would be assigned to Product S06U using the company's activity-based costing system? There are some expenses incurred at the time of manufacturing of products and services that are not directly attributable to the finished products. These expenses are known as manufacturing overheads or indirect expenses.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub