Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need answer financial accounting question

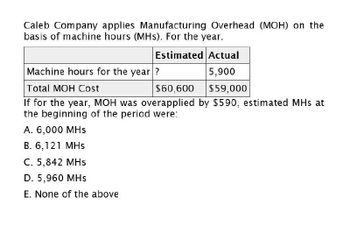

Transcribed Image Text:Caleb Company applies Manufacturing Overhead (MOH) on the

basis of machine hours (MHS). For the year.

Machine hours for the year?

Total MOH Cost

Estimated Actual

5,900

$59,000

$60,600

If for the year, MOH was overapplied by $590, estimated MHs at

the beginning of the period were:

A. 6,000 MHS

B. 6, 121 MHs

C. 5,842 MHS

D. 5,960 MHS

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Coops Stoops estimated its annual overhead to be $85,000 and based its predetermined overhead rate on 24,286 direct labor hours. At the end of the year, actual overhead was $90,000 and the total direct labor hours were 24,100. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardA company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardA company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forwardA company estimated 100,000 direct labor hours and $800,000 in overhead. The actual overhead was $805,100, and there were 99,900 direct labor hours. What is the predetermined overhead rate, and how much was applied during the year?arrow_forward

- When setting its predetermined overhead application rate. Tasty Turtle estimated its overhead would be $75,000 and manufacturing would require 25,000 machine hours in the next year. At the end of the year, it found that actual overhead was $74,000 and manufacturing required 24,000 machine hours. Determine the predetermined overhead rate. What is the overhead applied during the year? Prepare the journal entry to eliminate the under- or over applied overhead.arrow_forwardComacho Chemical Co. recorded costs for the month of 18,900 for materials, 44,100 for labor, and 26,250 for factory overhead. There was no beginning work in process, 8,000 units were finished, and 3,000 units were in process at the end of the period, two-thirds completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forwardPocono Cement Forms expects $900,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 60,000 or its expected machine hours of 30,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,550 in direct material cost, 90 direct labor hours, and 75 machine hours. Wages are paid at $16 per hour.arrow_forward

- Orinder Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 275,800, direct labor cost was 153,000, and overhead cost was 267,300. There were 25,000 units produced. Unit manufacturing cost (rounded to the nearest cent) is a. 28.40 b. 27.98 c. 34.95 d. 27.55arrow_forwardEvent Forms expects $120,000 in overhead during the next year. It doesn't know whether it should apply overhead on the basis of its anticipated direct labor hours of 6,000 or its expected machine hours of 5,000. What would be the product cost under each predetermined allocation rate if the last job incurred $3,500 in direct material cost, 55 direct labor hours, and 55 machine hours? Wages are paid at $17 per hour.arrow_forwardThe actual overhead for a company is $74,539. Overhead was based on 6,000 direct labor hours and was $2,539 under applied for the year. What is the overhead application rate per direct labor hour? What is the journal entry to dispose of the under applied overhead?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,