Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Turor, need your advice

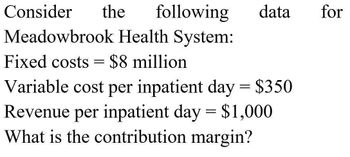

Transcribed Image Text:Consider

the following

Meadowbrook Health System:

Fixed costs = $8 million

data

for

Variable cost per inpatient day = $350

Revenue per inpatient day = $1,000

What is the contribution margin?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the cost formula, the term 128,000,000 a. is the total variable cost. b. is the dependent variable. c. is the variable rate. d. is the total fixed cost. e. cannot be determined from the above formula. Use the following information for Multiple-Choice Questions 3-4 through 3-7: The following cost formula was developed by using monthly data for a hospital. Total Cost = 128,000,000 + (12,000 Number of Patient Days)arrow_forwardAssume that Valley Forge Hospital has only the following three payer groups: Payer Number of Average Revenue Cost Admissions Admission PennCare $3,000 Medicare $4,000 Commercial $2,500 1,000 4,000 8,000 per Admission $5,000 $4,500 $7,000 Variable per The hospital's fixed costs are $38 million. a. Using the profit/loss format from our textbook and PowerPoints in this module, determine the hospital's net income, therefore showing your work to demonstrate how you got to the net income answer. b. Assume that half of the 100,000 covered lives in the commercial payer group (above) will be moved into a capitated plan. All utilization and cost data remain the same. What PMPM rate will the hospital have to charge to retain its Part A net income (what you calculated above)?arrow_forwardAssume that Valley Forge Hospital has only the following three payer groups: Number of Average Revenue Payer Cost Admissions Admission PennCare $3,000 Medicare $4,000 Commercial $2,500 1,000 4,000 8,000 per Admission $5,000 $4,500 $7,000 Variable per The hospital's fixed costs are $38 million. c. What overall net income would be produced if the admission rate of the capitated group (from part B above) were reduced from the commercial level (originally listed as $2,500 total from above) by 10 percent? d. For this same capitated group, assuming that utilization reduction also occurs, what overall net income would be produced if the variable cost per admission for this same capitated group were lowered to $2,200 (from the original $2,500 listed above)?arrow_forward

- 1. Bronx Lebanon Diagnostic Care has the following cost structure: Fixed Costs $800,000 Variable cost per procedure $35 Charge (revenue) per procedure $110 Assume that the Bronx Lebanon Diagnostic Care expects to perform 7,500 procedures in the coming year. a. Construct the groups base case projected P & L statement. Insert your response here. b. What is the group’s contribution margin? Insert your response here. c. What is the breakeven point? (in number of procedures) Insert your response here. d. Let say they contract with one HMO for all 7,500 procedures and the plan proposes a 20 percent discount from charges. Answer questions a,b,c under these conditions.arrow_forwardHow do you solve for contribution margin? For general accounting questionarrow_forward7arrow_forward

- In the cost formula, the term 12,000 a. is the variable rate. b. is the dependent variable. c. is the independent variable. d. is the intercept. e. cannot be determined from the above formula. Use the following information for Multiple-Choice Questions 3-4 through 3-7: The following cost formula was developed by using monthly data for a hospital. Total Cost = 128,000,000 + (12,000 Number of Patient Days)arrow_forwardThe Two Cost Systems Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service linesthe Emergency Room (ER) and the Operating Room (OR). SHHs current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal 300,000. The table below shows expected patient volume for both lines. Calculate the amount of nursing costs that the current cost system assigns to the ER and to the OR.arrow_forwardThe Audiology Department at Randall Clinic offers many services to the clinic’s patients. The three most common, along with cost and utilization data, are as follows: Service Variable cost per service Annual Direct fixed Cost Annual number of visits Basic examination $5 $50,000 30,000 Advanced examination 7 30,000 1,500 Therapy section 10 40,000 500 What is the fee schedule for these services, assuming that the goal is to cover only variable and direct fixed costs? Assume that the Audiology Department is allocated $100,000 in total overhead by the clinic, and the department director has allocated $50,000 of this amount to the three services listed above. What is the fee schedule assuming that these overhead costs must be covered? (To answer this question, assume that the allocation of overhead costs to each service is made on the basis of number of visits.) Assume that these services must make a combined profit of $25,000. Now, what is the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT