Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Cost Account

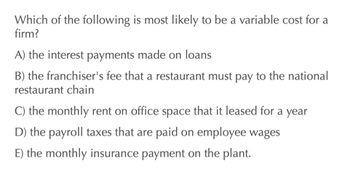

Transcribed Image Text:Which of the following is most likely to be a variable cost for a

firm?

A) the interest payments made on loans

B) the franchiser's fee that a restaurant must pay to the national

restaurant chain

C) the monthly rent on office space that it leased for a year

D) the payroll taxes that are paid on employee wages

E) the monthly insurance payment on the plant.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following statements is true about using hourly cost rates in Projects? A/They won’t appear in the Payroll Expenses view in the dashboard for the Project B/They appear on the Project Profitability report C/They are added to the Project when you enter a bill for your subcontractor D/They are intended for employees paid using QuickBooks Payrollarrow_forwardWhat is a good response to? The FASB has outlined a specific way to deal with costs that affect more than one accounting period. The primary location for this outline can be found in ASC 270 - Interim Reporting. One example is pre-paid expenses, such as prepaid rent or prepaid insurance. Normally, a company will pay the entire year of insurance in one lump sum. However, this payment will be in "effect" for the entire year so it must be allocated over the 12 months. The FASB outlines that these costs should be allocated appropriately to the report prepared. ASC 270-10-45-13 Next is depreciation. This method of expensing assets over a certain lifetime will require spreading that cost over each month for the entire life of the asset. For this, it should be recorded evenly over each interim period. ASC 270-10-45-14 Finally, amortization of intangible assets. This applies towards assets like trademarks or patents. They are recognized annually, divided by the useful life. The…arrow_forwardAssume the credit terms offered to your firm by your suppliers are 2/20, net 40. Calculate the cost of the trade credit if your firm does not take the discount and pays on day 40. (Hint: Use a 365-day year.)arrow_forward

- An example of an uncontrollable cost would include all of the following except______. A. real estate taxes charged by the county in which the business operates B. per-gallon cost of fuel for the companys delivery trucks C. hourly rate of pay for the companys purchasing manager D. federal income tax rate paid by the companyarrow_forwardnaruarrow_forwardA supplier hands you an invoice for $47,000 with the terms 4/20, net 180. a. ) What is the effective annual cost (expressed as an APR) if you forgo the discount and pay after 180 days?b. )What is the effective annual cost (expressed as an APR) if you pay after 200 days?arrow_forward

- sarrow_forwardThe cost data for BC Billing Solutions for the year 2020 is as follows: A. Using the high-low method, express the company’s overtime wages as an equation wherexrepresents number of invoices processed. Assume BC has monthly fixed costs of $3,800. B. Predict the overtime wages if 9,000 invoices are processed. D. Using Excel, create a scatter graph of the cost data and explain the relationship between the number of invoices processed and overtime wage expense.arrow_forwardBurnham Industries incurs these costs for the month: What is the prime cost?arrow_forward

- Identifying Fixed, Variable, Mixed, and Step Costs Consider each of the following independent situations: a. A computer service agreement in which a company pays 150 per month and 15 per hour of technical time b. Fuel cost of the companys fleet of motor vehicles c. The cost of beer for a bar d. The cost of computer printers and copiers at your college e. Rent for a dental office f. The salary of a receptionist in a law firm g. The wages of counter help in a fast-food restaurant h. The salaries of dental hygienists in a three-dentist office. One hygienist can take care of 120 cleanings per month. i. Electricity cost which includes a 15 per month billing charge and an additional amount depending on the number of kilowatt-hours used Required: 1. For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost. (Hint: First, consider what the driver or output measure is. If additional assumptions are necessary to support your cost type decision, be sure to write them down.) Example: Raw materials used in productionVariable cost 2. CONCEPTUAL CONNECTION Change your assumption(s) for each situation so that the cost type changes to a different cost type. List the new cost type and the changed assumption(s) that gave rise to it. Example: Raw materials used in production. Changed assumptionthe materials are difficult to obtain, and a years worth must be contracted for in advance. Now, this is a fixed cost. (This is the case with diamond sales by DeBeers Inc. to its sightholders. See the following website for information: www.keyguide.net/sightholders/.)arrow_forwardYour company plans to hire an employee at a yearly salaryof $70,000. Someone in your company says the actual costwill be lower because of payroll deductions. Someone elsesays it will be higher. Who is right? What is likely to bethe total cost to the company? Explain.arrow_forwardBurnham Industries incurs these costs for the month: A. What Is the prime cost? B. What is the conversion cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT  Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning