FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

As part of your analysis, you are required to investigate Insignia Corporation Limited’s cash flows .

Required: Using the financial statement provided:

Calculate the following for 2020:

Operating Cash Flow

Net Capital Spending

Change in Net Working Capital

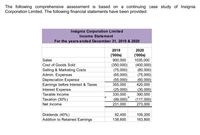

Transcribed Image Text:The following comprehensive assessment is based on a continuing case study of Insignia

Corporation Limited. The following financial statements have been provided:

Insignia Corporation Limited

Income Statement

For the years ended December 31, 2019 & 2020

2019

2020

('000s)

900,000

(350,000)

(75,000)

(65,000)

(55,000)

355,000

('000s)

1035,000

(400,000)

(80,000)

(75,000)

(60,000)

420,000

Sales

Cost of Goods Sold

Selling & Marketing Costs

Admin. Expenses

Depreciation Expense

Earnings before Interest & Taxes

Interest Expense

(25,000)

330,000

(30,000)

390,000

Taxable Income

Taxation (30%)

(99,000)

231,000

(117,000)

273,000

Net Income

Dividends (40%)

Addition to Retained Earnings

92,400

109,200

138,600

163,800

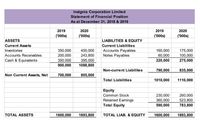

Transcribed Image Text:Insignia Corporation Limited

Statement of Financial Position

As at December 31, 2018 & 2019

2019

2020

2019

2020

('000s)

('000s)

('000s)

('000s)

ASSETS

LIABILITIES & EQUITY

Current Assets

Current Liabilities

Accounts Payables

Notes Payables

Inventories

175,000

100,000

350,000

450,000

243,800

160,000

60,000

Accounts Receivables

200,000

Cash & Equivalents

350,000

395,000

220,000

275,000

900,000

1088,800

Non-current Liabilites

790,000

835,000

Non Current Assets, Net

700,000

805,000

Total Liabilities

1010,000

1110,000

Equity

Common Stock

230,000

260,000

Retained Earnings

Total Equity

360,000

590,000

523,800

783,800

TOTAL ASSETS

1600,000

1893,800

TOTAL LIAB. & EQUITY

1600,000

1893,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the first step in preparing a financial plan? Group of answer choices A forecast of revenue over some future time period Estimate how many additional assets the company will need Estimate the funds needed to implement the strategies Determine the expected level of profits for future periodsarrow_forwardprepare the direct and indirect method statement of Cash flow for 2022.arrow_forwardPlease could you answer the attached question, thanks.arrow_forward

- 2. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2021? (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)arrow_forwardHere are cash flows for a project under consideration. C(0)= -$8160, C(1)=6180, and C(2)=20280. What is the IRR of the project?arrow_forwardTitle How will what you learned in this problem help you evaluate an investment? Description Preparing the statement of cash flows—direct method Use the Rolling Hills data from Problem 14-27A. Requirements 1. Prepare the 2012 statement of cash flows by the direct method. 2. How will what you learned in this problem help you evaluate an investment?arrow_forward

- Which of the following activities caused the greatest change in cash during the year? HINTS: You can find the breakdown of these activities on the Statements of Cash Flows. Multiple Choice O Operating activities Investing activities Financing activitiesarrow_forwardReview the CFLO from operations for Q1 2022 for GE (link below) and answer the following: Make sure you expand the cashflow from continuing operations link to see the details. https://finance.yahoo.com/quote/GE/cash-flow?p=GE (Links to an external site.) 4. Why is depreciation added back in the statement of cashlfow?arrow_forwardWhich one of the following is a capital structure decision? Group of answer choices Determining the level of accounts receivables. Determining how many shares of stock to issue. Determining how much inventory to keep on hand. Deciding whether or not to purchase a new machine for the production line. Determining how much money should be kept in the checking account.arrow_forward

- Requirement 1. Prepare the statement of cash flows of Morston Educational Supply for the year ended Dec 31,2024. Use the indirect method to report cash flows from operating. Requirement 2. If morston plans similar activity for 2025 what is it’s expected free cash flow? Select the labels and enter the amounts to calculate morstons expected free cash flow for 2025arrow_forwardCash outflows related to dividend payments will appear in the the Statement of Cash Flows. section on Investing Financing Operatingarrow_forward2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education