FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

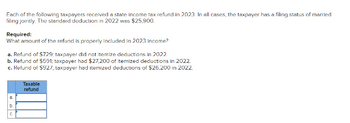

Transcribed Image Text:Fach of the following taxpayers received a state income tax refund in 2023 In all cases, the taxpayer has a filing status of married

filing jointly. The standard deduction in 2022 was $25,900.

Required:

What amount of the refund is properly included in 2023 income?

a. Refund of $729; taxpayer did not itemize deductions in 2022

b. Refund of $591; taxpayer had $27,200 of itemized deductions in 2022.

c. Refund of $927;, taxpayer had itemized deductions of $26,200 in 2022.

C

Taxable

refund

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Each of the following taxpayers has 2022 taxable income before the standard deduction as shown. Determine from the tax table provided, the amount of the income tax (before an credits) for each of the following taxpayers for 2022: Taxpayer(s) Allen Boyd Caldwell Dell Evans Filing Status Single MFS MFJ H of H Single Taxable Income Before the Standard Deduction $34,600 37,175 62,710 49,513 57,397 Income Taxarrow_forwardA married couple filing jointly have a combined total adjusted grossincome of $110,000. They have computed that their allowableitemized deductions are $5000. Compute their federal income tax.arrow_forward7arrow_forward

- The Kigali's are married and file a joint return. Their AGI (earned income) was $14,610 and federal income tax withholding was $850.. They had no itemized deductions and two dependent children, ages 18 and 19. Required: If the Kigali's are entitled to a $4,716 earned income credit, compute their income tax refund. Assume the taxable year is 2023. Use Standard Deduction Table. Tax Refundarrow_forwardIn 2019, Lisa and Fred, a married couple, had taxable income of $300,000. If they were to file separate tax returns, Lisa would have reported taxable income of $125,000 and Fred would have reported taxable income of $175,000. Use Tax Rate Schedule for reference. What is the couple’s marriage penalty or benefit? (Do not round intermediate calculations.) 2019 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,700 10% of taxable income $ 9,700 $ 39,475 $970 plus 12% of the excess over $9,700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14,382.50 plus 24% of the excess over $84,200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160,725 $204,100 $510,300 $46,628.50 plus 35% of the excess over $204,100 $510,300 — $153,798.50 plus 37% of the excess over $510,300 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The…arrow_forwardWhitney recurved $77,099 of taxable income in 2022. - she files as head of household. What is the income tax liability?arrow_forward

- A taxpayer has unutilized or excess Creditable Withholding Taxes (CWT) for the taxable year The taxpayer has collected its CWT certificates or BIR Form 2307 from its income payors/customers. 1. What are the options of the taxpayer in relation to its unutilized or excess CWT? 2. Assuming during the review of the taxpayer for his Annual Income Tax Return filed for the year 2019, the taxpayer decided to apply for a refund instead of its initial decision of carrying the excess forward to the next taxable periods. Is the application valid?arrow_forwardHardevarrow_forwardCompute the taxable income for 2023 in each of the following independent situations. Click here to access the Exhibits 3.4 and 3.5 to use if required. a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $29,000. AGI Less: Itemized deductions Taxable income b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000. AGI Less: Standard deduction Taxable income AGI Less: Standard deduction c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $76,800 and itemized deductions of $10,100. Taxable income $125,000 AGI Less: Standard deduction $80,000 d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education