Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:27

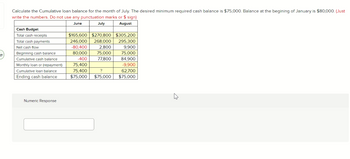

Calculate the Cumulative loan balance for the month of July. The desired minimum required cash balance is $75,000. Balance at the begining of January is $80,000. (Just

write the numbers. Do not use any punctuation marks or $ sign)

June

August

Cash Budget

Total cash receipts

Total cash payments

Net cash flow

Beginning cash balance

Cumulative cash balance

Monthly loan or (repayment)

Cumulative loan balance

Ending cash balance

Numeric Response

July

$165,600 $270,800 $305,200

246,000 268,000

295.300

-80,400

80,000

-400

75,400

75,400

$75,000

2,800

75,000

77,800

?

$75,000

9,900

75,000

84,900

-9,900

62,700

$75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,760,000 Quarter 2 5,620,000 Quarter 3 3,060,000 Quarter 4 7,720,000 In Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,310,000 and for the fourth quarter of the current year are $7,350,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year 4, current year 1, next year 2, next year 3. next vear 4, next year 2. Construct a cash receipts budget for…arrow_forwardDo not give solution in imagearrow_forwardPlease don't give image formatarrow_forward

- the second quarter of 2021: Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Beginning cash balance Cash receipts Cash collections from credit sales Total cash available Cash disbursements The company predicts that 5 percent of its credit sales will never be collected, 30 percent of its sales will be collected in the month of the sale, and the remaining 65 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. Purchases Wages, taxes, and expenses Interest In March 2021, credit sales were $190,000 and credit purchases were $130,000. Using this information, complete the following cash budget: (Do not round intermediate calculations. Leave no cells blank - be certain to enter "0" wherever required.) Equipment purchases April May June $320,000 $300,000 $360,000 128,000 151,000 176,000 Total cash disbursements 44,000 11,000 80,000 Ending cash balance 11,500 11,000 150,000 $…arrow_forwardSchedule of Cash Payments Tadpole Learning Systems Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $184,900 April 172,000 May 156,500 Depreciation, insurance, and property taxes represent $39,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taves for the year will be paid in November. 71% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, Apri, and May. Enter all amounts as positive numbers. TADPOLE LEARNING SYSTEMS INC. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March Apr May March expenses Paid in March Paid in April Apri expenses Paidin April Pad in May May expenses Prepare a…arrow_forwardand cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $ 517,000 409,500 480,000 $ 459,400 351,900 524,000 Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Answer is complete but not entirely correct. KAYAK COMPANY Beginning cash balance Add: Cash receipts Cash Budget January February March SA 40,000 $ 40,000 $ 74,168 517,000 409,500 480,000 557,000 449,500…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Built-Tight is preparing its master budget. Budgeted sales and cash payments follow: July $ 56,000 August $ 72,000 September $ 56,000 Budgeted sales Budgeted cash payments for Direct materials 15,560 3,440 19,600 12,840 2,760 16,200 13,160 2,840 16,600 Direct labor Overhead Sales to customers are 20% cash and 80% on credit. Sales in June were $53,500. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $47,000 in cash and $4,400 in loans payable. A minimum cash balance of $47,000 is required. Loans are obtained at the end of any month when the preliminary cash balance is below $47,000. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. Any preliminary cash balance above $47,000 is used to repay loans at month-end. Expenses are paid in the month incurred and consist of sales…arrow_forwardDon't give answer in image formatarrow_forwardPlease help me with show all calculation thankuarrow_forward

- please answer within 30 minutes. Projected Cash Receipts,Romaris Brothers Inc. needs a cash receipts schedule for the months of April, May, and June. Actual Sales: February = $500,000, March = $500,000. Forecast Sales: April =$560,000, May= $610,000, June= $650,000, July= $650,000, Assuming that sales are the only source of cash inflows and that 30% of them are for cash and the remainder are collected evenly over the following 2 months. Prepare a schedule of projected cash receipts for April, May and June. Projected Cash Disbursements Romaris Brothers Inc. needs a cash disbursement schedule for the months of April, May, and June. The following information was collected from financial records: Purchases: Purchases are calculated as 50% of the next month’s sales, 15% of purchases are made in cash, 60% of purchases are paid for 1 month after purchase, and the remaining 25% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $9,000 per month. Wages and…arrow_forwardAswer correctly. Options already selected are not all correct. Revise and answer.arrow_forwardRaghubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education