FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

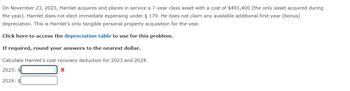

Transcribed Image Text:On November 23, 2023, Hamlet acquires and places in service a 7-year class asset with a cost of $491,400 (the only asset acquired during

the year). Hamlet does not elect immediate expensing under § 179. He does not claim any available additional first-year (bonus)

depreciation. This is Hamlet's only tangible personal property acquisition for the year.

Click here to access the depreciation table to use for this problem.

If required, round your answers to the nearest dollar.

Calculate Hamlet's cost recovery deduction for 2023 and 2024.

2023: $

X

2024: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Year 01234 Proj Y Proj Z ($420,000) ($420,000) 400,000 182,000 185,000 156,000 146,000 175,000 The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have an 11% cost of capital. 6. What is each project's initial NPV without replication? 7. What is each project's equivalent annual annuity? 8. Now apply the replacement chain approach to determine the shorter projects' extended NPV. Which project should be chosen? 9. Now assume that the cost to replicate Project Y in 2 years will increase to $600,000 because of inflationary pressures. How should the analysis be handled now, and which project should be chosen?arrow_forwardPlease answer question 8 [Para. 5-a-8]arrow_forwardWith interest at 10%, what is the benefit-cost ratio for this government project? Initial Cost $243,606 Additional costs at the end of $32,572/year year 1 and year 2 Benefits at end of year 1 and year 2 $0/year Annual benefits at end of year 3 through year 10 Enter your answer as follow: 12.34 $90,556/yeararrow_forward

- Question 35 (1.3 points) Listen You are the project monitor for a house project in Toronto. You have been provided with the following progress data for the project. What would be the certified loan advance for Draw 2? Project Financing Project Name Estimated Property Value Total Construction Cost Loan-to-value (LTV) Ratio Progress Draw Schedule Draw 1 Draw 2 Draw 3 Draw 4 Draw ABC House $1,000,000 $700,000 70.0% % Completion to Date 30% 50% 80% 100% $108,000 $161,000 $126,000 $144,000arrow_forwardi need the answer quicklyarrow_forwardThe following is a four-year forecast for Torino Marine. Year 2022 2023 2024 2025 Free cash flow ($ millions) −52 73 90 112 Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change. Torino Marine’s weighted-average cost of capital is 10 percent and its tax rate is 30 percent. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place. Estimate the fair market value per share of Torino Marine’s equity at the end of 2021 if the company has 37 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $270 million. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: 2024 2025 2026 Cost incurred during the year $ 2,059, 000 $ 2,627,000 $ 2,655,400 Estimated costs to complete as of year - end 5, 041, 000 2,414, 000 0 Billings during the year 2, 190, 000 2, 496,000 5, 314,000 Cash collections during the year 1,895,000 2,400,000 5, 705, 000 Westgate recognizes revenue over time according to percentage of completion. 2 - a. In the journal below, complete the necessary journal entries for the year 2024 (credit "Cash, Materials, etc." for construction costs incurred). 2- b. In the journal below, complete the necessary journal entries for the year 2025 (credit "Cash, Materials, etc." for construction costs incurred). 2- c. In the journal…arrow_forwardDo not give solution in imagearrow_forwardDo not give solution in imagearrow_forward

- I'm not sure if I am doing this correctly.arrow_forwardPlease answer only question B, because I sent already A in a separate question. Thank you! a) The following payments are agreed for the purchase of a property at the nominal annual interest rate of 0.8%:- 100,000 euros on 01.01.2022- 50,000 Euro on 01.07.2022- 200,000 euros on 01.03.2023 What is the value of these payments on the valuation date 01.01.2022 with1. linear interest calculation?2. monthly interest at the relative interest rate?3. relative mixed interest?4. continuous interest calculation? b) On 01.01.2022, EUR 347,942.42 is paid into an account at 0.8% annual interest. At On which date (day.month.year) in 2022, the year 2022 has 365 days, will the value of the interest rate, does the value of the deposit exceed 350,000 euros for the first time?arrow_forwardD-77 A beautiful bridge is being built over the river that runs through a major city in your state. The cont of the bridge is estimated at $600 million. Annual costs of the bridge will be $200,000, and the bridge is estimated to last a very long time. If accoun- tants in city hall use 3% as the interest rate for analysis, what is the annualized cost of the bridyo project? (a) $18 million (b) $18.2 million (c) $20,000 million (d) $219,500 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education