Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

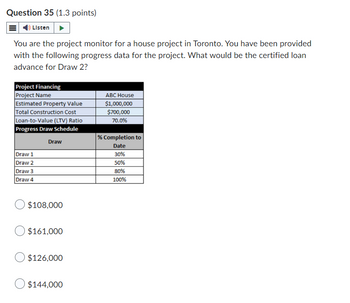

Transcribed Image Text:Question 35 (1.3 points)

Listen

You are the project monitor for a house project in Toronto. You have been provided

with the following progress data for the project. What would be the certified loan

advance for Draw 2?

Project Financing

Project Name

Estimated Property Value

Total Construction Cost

Loan-to-value (LTV) Ratio

Progress Draw Schedule

Draw 1

Draw 2

Draw 3

Draw 4

Draw

ABC House

$1,000,000

$700,000

70.0%

% Completion to

Date

30%

50%

80%

100%

$108,000

$161,000

$126,000

$144,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- i will 5 upvotes urgent A firm wants to sponsor a new engineering lab at a local university. This requires $4.0M to construct the lab, $1.5M to equip it, and $750,000 every 6 years for new equipment. What is the required endowment if the university will earn 8% interest on the funds?arrow_forwardDon’t need all the information provided to solve the problem Net working capital should be $40,000 in year 1arrow_forwardHelparrow_forward

- Bare Associates International 9990 Fairfax Blvd, Suite 100 Fairfax VA 22030 www.bareinternational.com Ms. Nicole Hartford BARE Invoice No.: 3073773 PSB Academy Pte Ltd Client Invoice No.: 15 Sioux Ln Suite 114 Gaithersburg MD, 20878 Purchase Order No.: Invoice Date: Oct 18, 2024 Payment Due: Oct 21, 2024 Please pay from this invoice and mention the BARE Invoice Number on your remittance. Date Completed Assignment ID Unit Fees Expenses *Credits Total Due Count: 0 Sub Total: Type Project/Description Fees *Credits Total Due Prepay Project cost - Initial (10%) + Project cost-fieldwork start (40%) of Mystery Shopping Services 2024 $ 6,477.75 $1,000.00 $ 6,477.75 Count: $ 1.00 Sub Total: $6,477.75 Invoice Sub Total: $ 6,477.75 Late Fees: $ - *Sum of Credits: $ - Total: $ 6,477.75 Payments $ - Total Due: $ 7,000.00arrow_forwardezt.prod.mheducation.com/Me x ezt.prod.mheducation.com/Me octorio.com/secured #lockdown nabled: Exam 5 Saved NEXIGO ezt.prod.mheducation.com/Me x + Assume that a company is considering a capital investment project with a four-year time horizon and the following cash flows: Cost of new equipment Working capital required $ 210,000 $ 50,000 ☆ Σ Help Save & Exit Su Annual net cash inflows Maintenance and repairs in third year Salvage value of equipment in fourth year. $ 100,000 $ 40,000 $ 25,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The working capital will be released at the end of the project and the company's required rate of return is 17%. The net present value of the project is closest to: Multiple Choice $(25,190). $39,390. D Q Search B F9 10 *- F11 F12 + & * ( # $ % 3 4 5 6 7 8 9 0 E R T Y U O P D F G H V B N M K L PrtSc + Insert Delete 9:25 F ↓ 6/21/20 Backspace Num 7 11 Enter 4 e Alt Ctri…arrow_forwardplease provide step by step solutionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education