Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Part B please

Transcribed Image Text:Monty Manufacturing Company is considering three new projects, each requiring an equipment investment of $25,200. Each project will last for 3 years and produce the following cash flows.

Year

1

2

3

Total

AA

(a)

10,000

$8,000 $10,900 $12,000

11,000

16,000

BB

$34,000 $32,700

10,900

Click here to view PV tables.

10,900

Payback period

The salvage value for each of the projects is zero. Monty uses straight-line depreciation. Monty will not accept any project with a payback period over 2.2 years. Monty's minimum required rate of return is 12%.

Most desirable

Least desirable

CC

Your answer has been saved. See score details after the due date.

Compute each project's payback period. (Round answers to 2 decimal places, e.g. 52.75.)

10,000

$33,000

Project CC

Project AA

AA

Indicating the most desirable project and the least desirable project using this method.

2.72 years

BB

2.31 years

CC

2.20 years

Attempts: 1 of 1 used

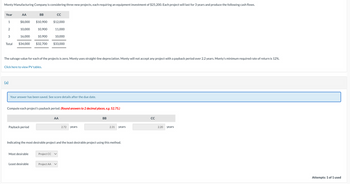

Transcribed Image Text:(b)

Compute the net present value of each project. (Use the above table.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275.)

Net present value $

Most desirable

Least desirable

Indicating the most desirable project and the least desirable project using this method.

Save for Later

AA

Project CC

Project AA

Project BB

$

BB

CC

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Can you answer part 4arrow_forwardProblem 9-25 Fudge factors An oil company executive is considering investing $10.1 million in one or both of two wells: well 1 is expected to produce oil worth $3.01 million a year for 10 years; well 2 is expected to produce $2.01 million for 15 years. These are real (inflation-adjusted) cash flows. The beta for producing wells is 0.91. The market risk premium is 9%, the nominal risk-free interest rate is 7%, and expected inflation is 3%. The two wells are intended to develop a previously discovered oil field. Unfortunately there is still a 21% chance of a dry hole in each case. A dry hole means zero cash flows and a complete loss of the $10.1 million investment. Ignore taxes and make further assumptions as necessary. a. What is the correct real discount rate for cash flows from developed wells? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Real discount rate b. The oil company executive proposes to add 20 percentage points to the…arrow_forwardDefine direct quotearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education