Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

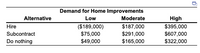

Question

Build-Rite Construction has received favorable publicity from guest appearances on a public TV home improvement program. Public TV programming decisions seem to be unpredictable, so Build-Rite cannot estimate the probability of continued benefits from its relationship with the show. Demand for home improvements next year may be either low or high. But Build-Rite must decide now whether to hire more employees, do nothing, or develop subcontracts with other home improvement contractors. Build-Rite has developed the following payoff table:

Transcribed Image Text:c. The best decision according to laplace criterion is alternative

and the weighted payoff for this decision is $

(Enter your response as an integer.)

Transcribed Image Text:Demand for Home Improvements

Alternative

Low

Moderate

High

$395,000

Hire

$187,000

($189,000)

$75,000

$49,000

Subcontract

$291,000

$165,000

$607,000

$322,000

Do nothing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- A software company has designed a new line of products. The management is reviewing the best marketing strategy (Aggressive, Basic and Cautious) to introduce the most profitable product. The market conditions are denoted by Strong or Weak. Management's best estimate of profit (in £ Mils) are given in the following payoff table. Probabilities of a Strong or Weak market are 0.55 and 0.45 respectively. Please help the company choose the best option. Show step by step working of your calculations. Options Aggressive Basic Cautious State of nature Strong 30 20 5 Weak -8 7 15arrow_forwardMavis and John have joined forces to start M&J Food Products, a processor of packaged shredded lettuce for institutional use. John has years of food processing experience, and Mavis has extensive commercial food preparation experience. The process will consist of opening crates of lettuce and then sorting, washing, slicing, preserving, and finally packaging the prepared lettuce. Together, with help from vendors, they think they can adequately estimate demand, fixed costs, revenues, and variable cost per 5-pound bag of lettuce. They think a largely manual process will have monthly fixed cost of $50,000and a variable cost of $2.50 per bag. They expect to sell 75,000 bags of lettuce per month. They expect to sell the shredded lettuce for $3.25 per 5-pound bag. John and Mavis has been contacted by a vendor to consider a more mechanized process. This new process will have monthly fixed cost of $125,000 per month with a variable cost of $1.75 per bag. Based on the above scenario: Should…arrow_forwardJoel Deaine, CEO of Deaine Enterprises Incorporated (DEI), is considering a special offer to manufacture a new line of women’s clothing for a large department store chain. DEI has specialized in designer women’s clothing sold in small, upscale retail clothing stores throughout the country. To protect the very elite brand image, DEI has not sold clothing to large department stores. The current offer, however, might be too good to turn down. The department store is willing to commit to a large order, which would be very profitable to DEI, and the order would be renewed automatically for two more years, presumably to continue after that point. Required: Determine Joel’s competitive strategy (cost leadership or differentiation) and use this strategy to analyze the choice Joel faces.arrow_forward

- Calculate the sales variance in dollars and the sales variance as a percentage given the following information: last year's sales $2,825,000; this year's sales $3,000,500. $5,825,500 and 9.41% $175,500 and 6.21% $5,825,500 and 10.62% $175,500 and 9.41%arrow_forwardSuppose you're a financial analyst at a company, and you are recommending whether the company should invest in Project A or Project B. Each of the two projects has been proposed by a lead engineer, but the company can only invest in creating one of them this year, and so your manager wants you to give her advice on which one to invest in. Your company's WACC is 9%. Project A Project 8 Year Cash Flow Year Cash Flow $3 ilio, ntialinvestment $2 milion proft $4 ilion pofit $A milion proft $2 milion proft $0, projet loseout $3 ilion, ntia ivestment $0 $0 $0 $0 $14 milion poit 1 1 2 2 3 3 4 4 5 5 Calculate the net present value (NPV) of and decide which one is better. S 유arrow_forwardDescribe a risk payoff matrix and give an example.arrow_forward

- Explain two approaches a seller can use to estimate variable consideration, and when each approach is likely to be more appropriate.arrow_forwardCase Study One: Consulting Services International Ltd Consulting Services International Ltd ( CSI Ltd) is a company incorporated in Hong Kong. The company is part of a multi- national group and acts as a holding company for a number of other entities. The group provides corporate management consulting services in various countries across the globe. CSI Ltd owns 80% of the shares in Consulting Services Australia Ltd (CSA) which is incorporated in Australia and carries on a business undertaking corporate consulting in Australia through various physical offices. CSI Ltd's main activities are raising finance and investing in order to generate funds and effectively manage the other companies in the group. CSI also provides centralised management and head office services to the other international companies in the group for fees at market value. The main income sources of CSI are therefore investment income, interest on loans to other companies and service fees. CSI's main head office is…arrow_forwardLakewood Fashions must decide how many lots of assorted ski wear to order for its three stores. Information on pricing, sales, and inventory costs has led to the following payoff table, in thousands. Order size 1 lot 2 lots 3 lots (a) Show a regret table. Order size 1 lot 2 lots 3 lots 13 9 6 Low 13 9 6 Low Demand Medium 16 24 32 16 24 32 High 16 32 61 Demand Medium (b) What decision should be made by the optimist? O 1 lot O2 lots 3 lots 16 32 61 High Maximum Regret 2:06 PMarrow_forward

- Scenario One: An 86-year widow comes in monthly to have her blood drawn and monitored ever since her heart attack 2 years ago. Her husband has recently passed away and she has no family nearby to help her. She has Medicare but does not have supplemental insurance to cover office visits. When leaving the office today, she starts to cry and tell you that she can no longer afford her blood pressure medications, cholesterol medications, blood work, and office visits each month. She will not be able to get her medications refilled unless she sees the doctor and has blood work each month. She currently owes $180 on her account today. Scenario 2: A 19-year-old mother of 3 children, all under the age of 5, brings in all of the kids today for their recommended check-ups and vaccinations. She does not have insurance for any of the children as she was denied Medicaid based on a previous fraud. She has been diligent paying for the children’s healthcare, with assistance from a grandmother, but she…arrow_forwardDeep Blue Seaways currently outsources all its IT works to a number of leading consultancies.Your firm, SFS, have just won a £3 million contract from DBS that will require you the Project Manager to execute. You are pretty certain from your experience with Deep Blue Seaways that this project is seriously underfunded by possibly as much as £1 million. You are to replace their outdated finance systems with your company’s renowned Finance Wizard product, a system that processes all financial information, and produces an infinite array of management information reports that have been proved to improve strategic decision making in existing user companies by significant margins. Deep Blue Seaways comprises of an Head Office and 4 divisions. From your previous dealings with this company you know that the Finance Heads of each Division are not renowned for their co-operative approach with each other. In addition, the project that you have won will result in major changes (in terms of work…arrow_forward1. Kirsten is trying to decide where to go for her well-earned vacation. She would like to camp, but if the weather is bad, she will have to go to a motel. Given the costs and probabilities of bad weather given below, which destination should she choose? Camping cost Motel cost Probability of bad weather Nevada $21.2 $80.9 0.2 Oregon $15.9 $84.6 0.4 California $30 $95 0.1 a. California, because its EMV = $33.14 b. Nevada, because its EMV = $33.14 c. California, because its EMV = $36.5 d. Any of the 3 choices. e. Oregon, because its EMV = $43.38 f. Nevada, because its EMV = $43.38 g. None of the 3 choices. h. Oregon, because its EMV is $36.50.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.