FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. What amount of warranty expense should be shown on Crassula's income statement for the year ended December 31, 2021?

2. What amount of warranty liability should be shown on Crassula's

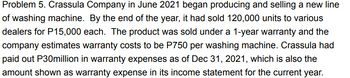

Transcribed Image Text:Problem 5. Crassula Company in June 2021 began producing and selling a new line

of washing machine. By the end of the year, it had sold 120,000 units to various

dealers for P15,000 each. The product was sold under a 1-year warranty and the

company estimates warranty costs to be P750 per washing machine. Crassula had

paid out P30million in warranty expenses as of Dec 31, 2021, which is also the

amount shown as warranty expense in its income statement for the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the annual social security withholding for an executive whose annual gross earnings are 98485?arrow_forwardTo match revenues and expenses properly, should the expense for employee vacation pay be recorded in the period during which the vacation privilege is earned or during the period in which the vacation is taken?arrow_forwardM8arrow_forward

- Form 940 for 2020 (IRS), how do I determine the total payments to all employees?arrow_forwardWhat are the 2019 tax rates for FICA Social Security and FICA Medicare? What are the 2019 maximum taxable earnings amounts for each of these taxes?arrow_forwardExplain (with reasons) how and where (including class/category where applicable) each of theevents/transactions described below would be treated, recognised and/or disclosed in thefinancial reports of Vurture Ltd for the year ended 30 June 2021.Note: You need to consider whether information about the event or transaction needs to bepresented separately. Journal entries and actual disclosure notes are NOT required.(a) On 5 July 2021, the government announced new regulations relating to the sale anduse of the flying exo-suits. Part of the new regulations require that from 1 September2021 exo-suits can only be sold to persons who have a 'Flying Exo-Suit Permit'. A personmust apply to the government for a permit and pay a fee of $400. The permit must beprovided before an exo-suit can be sold. Vulture sells two types of exo-suits: aneconomic exo-suit and an advanced exo-suit, and sales have been increasing forVulture Ltd over the last 3 years. There is expected to be a significant increase…arrow_forward

- For the tax year 2021-22, what is the deadline to file a self-assessment tax return if submitted manually? 31 January 2022 31 January 2023 31 October 2022 6th April 2023arrow_forwardConcerning accounting for warranties, which of the following statements is true? Federal income tax regulations require companies to accrue warranty expense in the year of the sale. The modified cash basis method is required for tax reporting. The modified cash basis method uses a percentage of completion approach to warranty revenue recognition. The modified cash basis recognizes warranty expense when cash is received on the sale.arrow_forwardWhich of the following should be included in gross income? A. Interest from a educational savings bond used for tuition B. Interest from a corporate bond C. Interest from a state of lowa bond D. Interst from a local school bondarrow_forward

- 1. Which of the following must be included in the gross income of the recipient in 2021? a.Unemployment compensation b.Child support payments c.Welfare payments d.Gifts e.All of these choices are included in gross income. 2. All of the following must be included in gross income, except: a.Gambling winnings b.Jury duty fees c.Dividends d.Gifts e.Partnership income 3. All of the following amounts are excluded from gross income, except: a.Gifts b.Veterans' benefits c.Tips and gratuities d.Child support payments e.Scholarship grants for tuitionarrow_forwardThe maximum amount of self employment income subject to social security (OASDI) tax in 2018 is?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education