FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

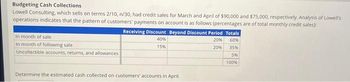

Transcribed Image Text:Budgeting Cash Collections

Lowell Consulting, which sells on terms 2/10, n/30, had credit sales for March and April of $90,000 and $75,000, respectively. Analysis of Lowell's

operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales)

In month of sale

in month of following sale

Uncollectible accounts, returns, and allowances

Receiving Discount Beyond Discount Period Totals

20%

60%

20%

35%

5%

100%

40%

15%

Determine the estimated cash collected on customers' accounts in April.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Schedule of Cash Collections of Accounts Receivable Furry Friends Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $300,000 June 370,000 July 530,000 All sales are on account. 53 percent of sales are expected to be collected in the month of the sale, 36% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. Furry Friends Supplies Inc. Schedule of Collections from Sales For the Three Months Ending May 31 May June July May sales on account: Collected in May fill in the blank 1 Collected in June fill in the blank 2 Collected in July fill in the blank 3 June sales on account: Collected in June fill in the blank 4 Collected in July fill in the blank 5 July sales on account: Collected in July…arrow_forwardNOT GRADED Budgeting Cash CollectionsSpencer Consulting, which invoices its clients on terms 2/10, n/30, had credit sales for May and June of $175,000 and $200,000, respectively. Analysis of Spencer's operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales): Receiving Discount Beyond Discount Period Totals In month of sale 50% 20% 70% In month of following sale 15% 10% 25% Uncollectible accounts, returns, and allowances 5% 100% Determine the estimated cash collected on customers' accounts in June. $Answerarrow_forward5 At Lyman Company, past experience reveals that 10% of sales are for cash and the remaining 90% are on credit. Lyman Company expects to collect 30% of its credit sales in the month of sale, 50% in the month following sale, and 18% in the second month following sale. Which ONE of the following is part of the cash collections expected to be made in January? O Cash sales from the preceding December O Cash collections of credit sales from the preceding December O Cash collections of credit sales from the preceding September O Cash sales from the preceding Novemberarrow_forward

- Schedule of Cash Collections of Accounts Receivable Bark & Purr Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $160,000 June 230,000 July 350,000 All sales are on account. 53 percent of sales are expected to be collected in the month of the sale, 37% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. May June July May sales on account: Collected in May $fill in the blank 1 Collected in June $fill in the blank 2 Collected in July $fill in the blank 3 June sales on account: Collected in June fill in the blank 4 Collected in July fill in the blank 5 July sales on account: Collected in July fill in the blank 6 Total cash collected $fill in the blank 7 $fill in the blank 8 $fill in the…arrow_forwardPlease do not give solution in image format thankuarrow_forwardAccounting Consider the following third-quarter budget data for TAP & Brothers: TAP & Brothers Third-Quarter Budget Data July August September Credit Sales 256,167 262,962 282,872 Credit Purchases 97,465 111,565 137,292 Wages, Taxes, and Expenses 26,506 31,621 33,707 Interest 7,239 7,773 8,091 Equipment Purchases 54,832 61,271 0 The company predicts that 4% of its credit sales will never be collected, 30% of its sales will be collected in the month of the sale, and the remaining 66% will be collected in the following month. Credit purchases will be paid in the month following the purchase. In June, credit sales were $138,282, and credit purchases were $102,770 July’s beginning cash is $184,797 If TAP maintains a policy of always keeping a minimum cash balance of $75,000 as a buffer against uncertainty and forecasting errors, what is the cash surplus/deficit at the end of the quarter (i.e., end of…arrow_forward

- Don't give answer in image formatarrow_forwardX-Tel budgets sales of $55,000 for April, $110,000 for May, and $70,000 for June. Sales are 50% cash and 50% on credit. All credit sales are collected in the month following the sale. Total sales for March were $13,000. Prepare a schedule of cash receipts from sales for April, May, and June Sales Cash receipts from: Total cash receipts X-TEL Schedule of Cash Receipts from Sales April $ $ 55,000 $ 0 $ May 110,000 $ 0 $ June 70,000 0arrow_forwardmn.2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education