Concept explainers

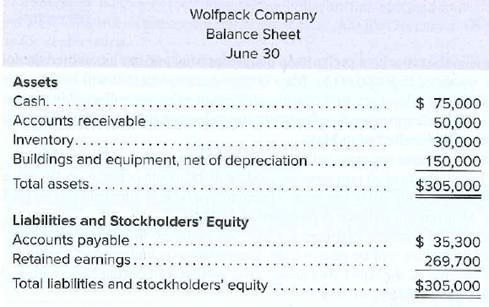

Wolfpack Company is a merchandising company that is preparing a budget for the month of July. It has provided the following information:

Budgeting Assumptions:

1. All sales are on account. Thirty percent of the credit sales are collected in the month of sale and the remaining 70% are collected in the month subsequent to the sale. The

2. All merchandise purchases are on account. Twenty percent of merchandise inventory purchases are paid in the month of the purchase and the remaining 80% is paid in the month after the purchase.

3. The budgeted inventory balance at July 31 is $22,000.

4.

5. The company’s

Required:

1. For the month of July, calculate the following:

a. Budgeted sales

b. Budgeted merchandise purchases

c. Budgeted cost of goods sold

d. Budgeted net operating income

2. Prepare a budgeted balance sheet as of July 31.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 13 images

- Assume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $42,000 and $74,000, respectively. The company expects to collect 35% of its credit sales in the month of the sale and the remaining 65% in the following month. What amount of cash collections from credit sales would the company include in its cash budget for the second month?arrow_forwardiiiiarrow_forwardPreparing a Cash Budget La Famiglia Pizzeria provided the following information for the month of October: Sales are budgeted to be $158,000. About 85% of sales is cash; the remainder is on account. La Famiglia expects that, on average, 70% of credit sales will be paid in the month of sale, and 28% will be paid in the following month. Food and supplies purchases, all on account, are expected to be $106,000. La Famiglia pays 25% in the month of purchase and 75% in the month following purchase. Most of the work is done by the owners, who typically withdraw $6,000 a month from the business as their salary. (Note: The $6,000 is a payment in total to the two owners, not per person.) Various part-time workers cost $7,300 per month. They are paid for their work weekly, so on average 90% of their wages are paid in the month incurred and the remaining 10% in the next month. Utilities average $5,950 per month. Rent on the building is $4,100 per month. Insurance is paid quarterly; the next…arrow_forward

- Accounting Consider the following third-quarter budget data for TAP & Brothers: TAP & Brothers Third-Quarter Budget Data July August September Credit Sales 256,167 262,962 282,872 Credit Purchases 97,465 111,565 137,292 Wages, Taxes, and Expenses 26,506 31,621 33,707 Interest 7,239 7,773 8,091 Equipment Purchases 54,832 61,271 0 The company predicts that 4% of its credit sales will never be collected, 30% of its sales will be collected in the month of the sale, and the remaining 66% will be collected in the following month. Credit purchases will be paid in the month following the purchase. In June, credit sales were $138,282, and credit purchases were $102,770 July’s beginning cash is $184,797 If TAP maintains a policy of always keeping a minimum cash balance of $75,000 as a buffer against uncertainty and forecasting errors, what is the cash surplus/deficit at the end of the quarter (i.e., end of…arrow_forwardAhmed Company purchases all merchandise on credit. It recently budgeted the month-end accounts payable balances below. Cash payments on accounts payable during each month are expected to be June, $1,450,000; July, $1,300,000; and August, $1,300,000. Hint: Use the relation (Beg. Accounts Payable + Purchases on Credit - Payments on Accounts Payable = End. Accounts Payable) to solve for budgeted purchases. Accounts payable May 31 June 30 $ 130,000 $ 110,000 Ending accounts payable Add: Cash paid on accounts payable Total accounts payable Less: Beginning accounts payable Budgeted merchandise purchases Computing budgeted merchandise purchases from accounts payable Budgeted amounts: $ June July 31 $ 400,000 0 0 $ July 0 August 31 $ 170,000 0 $ August 0 0arrow_forwardPrepare a budgeted balance sheet at March 31 using the following information from Zimmer Company. a. The cash budget for March shows an ending loan balance of $20,000 and an ending cash balance of $75,000. b. The sales budget for March shows sales of $140,000. Accounts receivable at the end of March are budgeted to be 60% of March sales. c. The merchandise purchases budget shows that $91,000 in merchandise will be purchased on credit in March. Purchases on credit are paid 100% in the month following the purchase. d. Ending merchandise inventory for March is budgeted to be 800 units at a cost of $35 each. e. Income taxes payable of $28,000 are budgeted at the end of March. f. Accounting records at the end of March show budgeted equipment of $82,000 with accumulated depreciation of $35,000. g. Common stock of $35,000 and retained earnings of $60,000 are budgeted at the end of March. ZIMMER COMPANY Budgeted Balance Sheet As of March 31 $ 0 0 0arrow_forward

- answer all the requirementarrow_forwardBudgeting for a Merchandising Firm Goldberg Company is a retail sporting goods store thatuses an accrual accounting system. Facts regarding its operations follow:∙ Sales are budgeted at $250,000 for December and $225,000 for January, terms 1/eom, n/60.∙ Collections are expected to be 50% in the month of sale and 48% in the month following the sale.Two percent of sales are expected to be uncollectible and recorded in an allowance account at theend of the month of sale. Bad debts expense is included as part of operating expenses.∙ Gross margin is 30% of gross sales.∙ All accounts receivable are from credit sales. Bad debts are written off against the allowanceaccount at the end of the month following the month of sale.∙ Goldberg desires to have 80% of the merchandise for the following month’s sales on hand at the endof each month. Payment for merchandise is made in the month following the month of purchase.∙ Other monthly operating expenses to be paid in cash total $25,000.∙ Annual…arrow_forward1. Prepare a budgeted income statement for the month ended July 31st. Use an absorption format. a. Calculate the estimated operating cycle for the month of July. (Hint: Use 30 days in the numerator to calculate the average collection period and the average sales period.)arrow_forward

- The following information is available to assist you in preparing a company's cash budget. a. The cash balance on July 1 is $41,000. b. Actual sales for May and June and expected sales for July are as follows: May $ 68,400 $ 87,400 $ 95,800 $ 415,000 $ 614,000 $ 692,000 June July Cash sales Sales on account Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected In the second month following sale. The remaining 2% is uncollectible. C. Purchases of inventory will total $376,000 for July. Thirty percent of a month's Inventory purchases are paid during the month of purchase. The accounts payable remaining from June's inventory purchases total $174,500, all of which will be paid in July. d. Selling and administrative expenses are budgeted at $452,000 for July. Of this amount, $63,500 is for depreciation. e. A new web server for the Marketing Department costing $86,500 will be…arrow_forwardAssume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $42,000 and $78,000, respectively. The company expects to collect 35% of its credit sales in the month of the sale, 55% in the following month, and 10% is deemed uncollectible. What amount of cash collections from credit sales would the company include in its cash budget for the second month? Multiple Choice $50, 400 $42,900 $27,300 $58, 200arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education