ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

3. Effects of a government budget deficit

Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget.

|

Real Interest Rate

|

National Saving

|

Domestic Investment

|

Net Capital Outflow

|

|---|---|---|---|

|

(Percent)

|

(Billions of dollars)

|

(Billions of dollars)

|

(Billions of dollars)

|

| 7 | 60 | 30 | -10 |

| 6 | 55 | 40 | -5 |

| 5 | 50 | 50 | 0 |

| 4 | 45 | 60 | 5 |

| 3 | 40 | 70 | 10 |

| 2 | 35 | 80 | 15 |

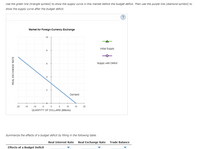

Transcribed Image Text:Use the green line (triangle symbol) to show the supply curve in this market before the budget deficit. Then use the purple line (diamond symbol) to

show the supply curve after the budget deficit.

Market for Foreign-Currency Exchange

10

Initial Supply

8

6

Supply with Deficit

4

Demand

-20

-15

-10

-5

5

10

15

20

QUANTITY OF DOLLARS (Billions)

Summarize the effects of a budget deficit by filling in the following table.

Real Interest Rate

Real Exchange Rate

Trade Balance

Effects of a Budget Deficit

REAL EXCHANGE RATE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question - , unofficial financial If the country's GDP is $2300, private saving is $200, net exports are account is $300, net transfers are -$100, primary budget deficit is $450, then investment is equal to $100.arrow_forward5. International effects and domestic feedback of fiscal and monetary policy The following graph shows the aggregate demand (AD) and the aggregate supply (AS) curves for the United States, an open economy. Suppose that U.S. government spending increases, increasing the budget deficit. Assume that there is no crowding out. On the following graph, show only the domestic effect of increased government spending on aggregate demand and aggregate supply in the United States. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther. PRICE LEVEL REAL GDP Aggregate Supply Aggregate Demand Aggregate Demand Aggregate Supply ?arrow_forwardNot use Ai and chatptarrow_forward

- Ee 365.arrow_forwardEffects of a government budget deficit Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget. Real Interest Rate National Saving Domestic Investment Net Capital Outflow (Percent) (Billions of dollars) (Billions of dollars) (Billions of dollars) 7 40 25 -15 6 35 30 -10 5 30 35 -5 4 25 40 0 3 20 45 5 2 15 50 10 On the following graph, plot the relationship between the real interest rate and net capital outflow by using the green points (triangle symbol) to plot the points from the initial data table. Then use the black point (X symbol) to indicate the level of net capital outflow at the equilibrium real interest rate you derived in the previous graph. Because of the…arrow_forwardDo number 4arrow_forward

- 14. Suppose that Korea has been in recession and many economists have concerns about the long-term recession. Therefore, the Bank of Korea and the government are preparing stimulus packages for the economy. (1) Using both AA and DD curves, describe the effect of the government’s temporarily expansionary fiscal policy on the change of equilibrium of national output and foreign exchange rate. (2) The Korean government decides to annually spend an extra budget on constructing and maintaining social infrastructure forever. Using both AA and DD curves, describe the impact of the government’s policy on the change of equilibrium of national output and foreign exchange rate.arrow_forward1. A college wants to produce an effigy for the student carnival. Preliminary studiesmade it possible to establish that the production of these effigies requires fixed costs of $2,008and variable costs (materials, labor, energy) of $0.90 per effigy. One of therequirements of the college being not to make a deficit, he had a market study carried out.It appears from this study that by selling these effigies for $3.75 we can hope to sell them1,000, whereas by setting the price at $2.50, the potential sales are 3,000.a) Express the demand in terms of the selling price and representgraphically this function.b) Express the cost of production as a function of the selling price.c) Express the income in terms of the selling price and determine the price that thecollege should fix to maximize the income from this sale of effigies.d) Represent the income function and the cost function on the same system of axesand determine the prices corresponding to the break-even thresholds and numbereffigies…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education