Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Don't use

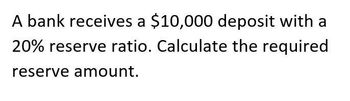

Transcribed Image Text:A bank receives a $10,000 deposit with a

20% reserve ratio. Calculate the required

reserve amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forwardWhat is the journal entry to record an NSF check, from J. Smith for 250, that is returned with the bank statement? a. Cash 250 DR; NSF Check 250 CR b. Accounts Receivable 250 DR; Cash 250 CR c. NSF Check 250 DR; Accounts Receivable 250 CR d. Cash 250 DR; Accounts Receivable 250 CR e. Cash 250 DR; Miscellaneous Expense 250 DRarrow_forwardCalculating the net costs of checking accounts. Determine the annual net cost of these checking accounts: a. Monthly fee 4, check-processing fee of 20 cents, average of 23 checks written per month b. Annual interest of 1.5 percent paid if balance exceeds 750, 8 monthly fee if account falls below minimum balance, average monthly balance 815, account falls below 750 during four monthsarrow_forward

- Can the 10,000 note be repaid on May 1? Explain.arrow_forwardAssume that an organization asserts that it has $35 million in net accounts receivable. Describe specifically what management is asserting with respect to net accounts receivable.arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $4,587 Book balance: $5,577 Deposits in transit: $1,546 Outstanding checks: $956 Interest income: $56 NSF check: $456arrow_forward

- A customer was unable to pay the accounts receivable on time in the amount of $34,000. The customer was able to negotiate with the company and transferred the accounts receivable into a note that includes interest, along with an up-front cash payment of $6,000. The note maturity date is 24 months with a 15% annual interest rate. What is the entry to recognize this transfer?arrow_forwardRefer to the present value table information on the previous page. What amount should Brett have in his bank account today, before withdrawal, if he needs 2,000 each year for 4 years, with the first withdrawal to be made today and each subsequent withdrawal at 1-year intervals? (Brett is to have exactly a zero balance in his bank account after the fourth withdrawal.) a. 2,000 + (2,000 0.926) + (2,000 0. 857) + (2,000 0.794) b. 2,0000.7354 c. (2,000 0.926) + (2,000 0.857) + (2,000 0.794) + (2,000 0.735) d. 2,0000.9264arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $4,021 Book balance: $2,928 Deposits in transit: $1,111 Outstanding checks: $679 Bank charges: $35 Notes receivable: $1,325; interest: $235arrow_forward

- Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardA customer takes out a loan of $130,000 on January 1, with a maturity date of 36 months, and an annual interest rate of 11%. If 6 months have passed since note establishment, what would be the recorded interest figure at that time? A. $7,150 B. $65,000 C. $14,300 D. $2,383arrow_forwardSouth Rims has an accounts receivable balance at the end of 2018 of $357,470. The net credit sales for the year are $769,346. The balance at the end of 2017 was $325,300. What is the accounts receivable turnover rate for 2018 (rounded to two decimal places)? A. 2.02 times B. 2.25 times C. 2.15 times D. 1.13 timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT