FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

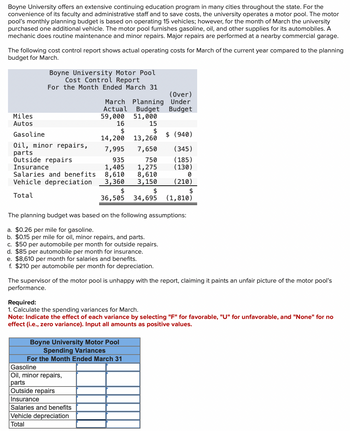

Transcribed Image Text:Boyne University offers an extensive continuing education program in many cities throughout the state. For the

convenience of its faculty and administrative staff and to save costs, the university operates a motor pool. The motor

pool's monthly planning budget is based on operating 15 vehicles; however, for the month of March the university

purchased one additional vehicle. The motor pool furnishes gasoline, oil, and other supplies for its automobiles. A

mechanic does routine maintenance and minor repairs. Major repairs are performed at a nearby commercial garage.

The following cost control report shows actual operating costs for March of the current year compared to the planning

budget for March.

Boyne University Motor Pool

Cost Control Report

For the Month Ended March 31

(Over)

March Planning Under

Actual

Budget Budget

51,000

Miles

Autos

Gasoline

13,260

Oil, minor repairs,

7,650

parts

Outside repairs

935

750

Insurance

1,405

1,275

Salaries and benefits

8,610

8,610

Vehicle depreciation 3,360 3,150

$

Total

36,505 34,695

59,000

16

$

14,200

7,995

Gasoline

Oil, minor repairs,

parts

Outside repairs

Insurance

Salaries and benefits

Vehicle depreciation

Total

15

$

c. $50 per automobile per month for outside repairs.

d. $85 per automobile per month for insurance.

e. $8,610 per month for salaries and benefits.

f. $210 per automobile per month for depreciation.

The planning budget was based on the following assumptions:

a. $0.26 per mile for gasoline.

b. $0.15 per mile for oil, minor repairs, and parts.

$ (940)

Boyne University Motor Pool

Spending Variances

For the Month Ended March 31

(345)

(185)

(130)

0

(210)

(1,810)

The supervisor of the motor pool is unhappy with the report, claiming it paints an unfair picture of the motor pool's

performance.

Required:

1. Calculate the spending variances for March.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e., zero variance). Input all amounts as positive values.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alpine Township contracts with Dragoon Environmental Services (DES) to provide solid waste collection to households and businesses. Until recently, DES had an exclusive franchise to provide this service in Alpine, which meant that other waste collection firms could not operate legally in the township. The price per pound of waste collected was regulated at 24 percent above the average total cost of collection.. Cost data for the most recent year of operations for DES are as follows: Administrative cost Operating costs-trucks Other collection costs $ 480,000 1,536,000 384,000 Data on customers for the most recent year are as follows: Households Businesses 11,520 2,880 4,000 12,000 Number of customers Waste collected (tons) The Township Board of Alpine is considering allowing other private waste haulers to collect waste from businesses but not from households. Service to businesses from other waste collection firms would not be subject to price regulation. Based on information from…arrow_forwardFree Wheels has a plant that assembles bicycles. The plant currently has a small cafeteria for the workers but the kitchen equipment is in need of a substantial overhaul. Free Wheels has been offered a contract by Beasteats to supply food to the workers. The particulars of the situation are shown in the table. Should Free Wheels continue with the in-house food services or contract the services to Beasteats? (Hint: Create a table with the columns for year (for 0-8 years), In-house current cost, contract current cost, in-house PW, and contract PW). Food Service: In-House Versus Contract Food service labour (hours/year) Wage rate (real, time 1, $/hour) Overhead cost (real, time 1, S/year) Kitchen equipment first cost (current, time 0, S) Contract cost, years 1 to 3 (current S) Contract cost, years 4 to 6 (current S) Current dollar MARR Expected annual inflation rate Study period (years) 6000 15 18 000 25 000 55 000 63 700 22% 5% 6arrow_forwardMarchant Urban Diner is a charity supported by donations that provides free meals to the homeless. The diner's budget for June was based on 2,200 meals, but the diner actually served 1,800 meals. The diner's director has provided the following cost data to use in the budget: groceries, $3.85 per meal; kitchen operations, $4,300 per month plus $1.70 per meal; administrative expenses, $2,000 per month plus $0.45 per meal; and fundraising expenses, $1,100 per month. Required:Prepare the diner's flexible budget for the actual number of meals served in June. What is the amount of total expenses under the flexible budget?arrow_forward

- I need some assistance with question 3 of this paper using the information on the document provided to prepare a contribution approach income statement.arrow_forwardCamp Rainbow offers overnight summer camp programs for children ages 10 to 14 every summer during June and July. Each camp session is one week and can accommodate up to 200 children. The camp is not coed, so boys attend during the odd-numbered weeks and girls attend during the even-numbered weeks. While at the camp, participants make crafts, participate in various sports, help care for the camp's resident animals, have cookouts and hayrides, and help assemble toys for local underprivileged children. The camp provides all food as well as materials for all craft classes and the toys to be assembled. One cabin can accommodate up to 10 children, and one camp counselor is assigned to each cabin. Three camp managers are on-site regardless of the number of campers enrolled. Following is the cost information for Camp Rainbow's operations last summer: Week Campers 116 138 154 98 102 134 122 108 12345678 Number of Cost to Run Camp $9,330 11,300 12,200 8,000 8,530 10,390 9,830 8,950 E5-14 (Algo)…arrow_forwardRadig Travel offers helicopter service from suburban towns to John F. Kennedy International Airport in New York City. Each of its fourteen helicopters makes between 1,100 and 2,200 round-trips per year. The records indicate that a helicopter that has made 1,100 round-trips in the year incurs an average operating cost of $500 per round-trip, and one that has made 2,200 round-trips in the year incurs an average operating cost of $400 per round-trip. Read the requirements LOADING... . Requirement 1. Using the high-low method, estimate the linear relationship y=a+bX, where y is the total annual operating cost of a helicopter and X is the number of round-trips it makes to JFK airport during the year. = + Requirement 2. Give examples of costs that would be included in a and in b. Begin by selecting which type of costs "a" and "b" represent, then select the costs that correlate with that cost type, use each cost only once.…arrow_forward

- ackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors- home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Total Home Nursing Meals On Wheels House - keeping Revenues $ 929,000 $ 268, 000 $ 408,000 $ 253,000 Variable expenses 481,000 115,000 209,000 157,000 Contribution margin 448,000 153,000 199,000 96,000 Fixed expenses: Depreciation 69,000 8,300 40, 500 20, 200 Liability insurance 43,200 20, 300 7,600 15,300 Program administrators' salaries 114,600 40,700 38,400 35, 500 General administrative overhead *185,800 53, 600 81, 600 50, 600 Total fixed expenses 412,600 122,900 168, 100 121,600 Net operating income (loss) $ 35, 400 $ 30,100 $ 30,900 $ (25,600) * Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers…arrow_forwardPlease help mearrow_forwardIvanhoe Magazine Ltd. is a small company run by two enterprising university students. They publish an issue of the magazine once a month from September through April. The magazine reports on various university activities and provides information such as how to get the best concert tickets, where to get the best pizza for the best price, where the good study spots are, and how to get library staff to help with research. The magazine is sold either on a prepaid subscription basis for $12 for all eight issues, or for $2 per issue. During September, 1,650 subscriptions were sold. Up to the end of December, a total of 10,725 single copies were sold. The company also pre-sells advertising space in the magazine to local businesses that focus on the student market. During July and August, the company signed up several businesses and collected $16,500 in advertising revenues. The advertisements are to be included in all eight issues of the magazine. The cost of printing and distributing the…arrow_forward

- Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and theother in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services functionin the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of $160,000 per year and a budg-eted variable rate of $65 per hour of professional time. The normal usage of the legal services cen-ter is 2,600 hours per year for the Yuma office and 1,400 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year.Required:1. Determine the amount of legal services support center costs that should be assigned to eachoffice. 2. Since the offices produce services, not tangible products, what purpose is served by allocat-ing the budgeted costs? 3. Now, assume that during the year, the legal services center incurred actual fixed costs of$163,000 and actual variable…arrow_forwardThe University of Cincinnati Center for Business Analytics is an outreach center that collaborates with industry partners on applied research and continuing education in business analytics. One of the programs offered by the center is a quarterly Business Intelligence Symposium. Each symposium features three speakers on the real-world use of analytics. Each of the corporate members of the center (there are currently 10) receives five free seats to each symposium. Nonmembers wishing to attend must pay $75 per person. Each attendee receives breakfast, lunch, and free parking. The following are the costs incurred for putting on this event: Rental cost for the auditorium: Registration Processing: Speaker Costs: 3@$800 Continental Breakfast: Lunch: Parking: $150 $8.50 per person $2,400 $4.00 per person $7.00 per person $5.00 per person (a) The Center for Business Analytics is considering a refund policy for no-shows. No refund would be given for members who do not attend, but for nonmembers…arrow_forwardanswer in text form please (without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education