FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

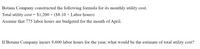

Transcribed Image Text:Botana Company constructed the following formula for its monthly utility cost.

Total utility cost = $1,200 + ($8.10 × Labor hours)

Assume that 775 labor hours are budgeted for the month of April.

If Botana Company incurs 9,600 labor hours for the year, what would be the estimate of total utility cost?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $1,425,000.arrow_forwardMiller Company's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (25, 800 units) $ 232,200 $ 9.00 Variable expenses 139,320 5.40 Contribution margin 92,880 $ 3.60 Fixed expenses 54,180 Net operating income $ 38,700 Required: (Consider each of the four requirements independently): Assume the sales volume increases by 4, 128 units: What is the revised net operating income? What is the percent increase in unit sales? Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 23 % ? What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 7 % ? What is the revised net operating income if the selling price per unit increases by 20%, variable…arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Sales (7,800 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 265,200 148, 200 117,000 55,700 $ 61,300 Required: (Consider each case independently): Per Unit $ 34.00 19.00 $15.00 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is 6,800 units?arrow_forward

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 33.00 18.00 $ 15.00 Sales (8,800 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): Total $ 290,400 158,400 132,000 54,100 $ 77,900 1. What would be the revised net operating income per month if the sales volume increases by 40 units? 2. What would be the revised net operating income per month if the sales volume decreases by 40 units? 3. What would be the revised net operating income per month if the sales volume is 7,800 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardPresented here is the income statement for Big Sky Incorporated for the month of February: Sales $ 60,000 Cost of goods sold 51,900 Gross profit $ 8, 100 Operating expenses 15,200 Operating loss $ (7,100) Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 19%. Required: Rearrange the preceding income statement to the contribution margin format. If sales increase by 10%, what will be the firm's operating income (or loss)? Calculate the amount of revenue required for Big Sky to break even.arrow_forwardNathan Davidson, financial analyst at LMN Corporation, is examining the behavior of quarterly utility costs for budgeting purposes. Davidson collects the following data on machine-hours worked and utility costs for the past 8 quarters: (Click the icon to view the data.) Read the requirements. Requirement 1. Estimate the cost function for the quarterly data using the high-low method. (Complete all answer boxes.) Data table + Quarter Machine-Hours Utility Costs Quarter 1 100,000 $ 265,000 Quarter 2 55,000 200,000 Quarter 3 90,000 250,000 Quarter 4 105,000 280,000 Quarter 5 70,000 220,000 Quarter 6 95,000 260,000 Quarter 7 85,000 275,000 Quarter 8 80,000 245,000 Print Done - ☑ Requirements 1. Estimate the cost function for the quarterly data using the high-low method. 2. Plot and comment on the estimated cost function. 3. Davidson anticipates that LMN will operate machines for 105,000 hours in quarter 9. Calculate the predicted utility costs in quarter 9 using the cost function estimated…arrow_forward

- Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost per Month $ 20,900 Cost per Repair-Hour. $ 15.00 $ 7.78 $8.35 $ 1.80 Wages and salaries. Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses For example, wages and salaries should be $20,900 plus $15.00 per repair-hour. The company expected to work 2,500 repair-hours In May, but actually worked 2,400 repair-hours. The company expects its sales to be $45.00 per repair-hour. Revenue Expenses: $ 2,760 $ 5,790 $ 4,640 $ 3,850 Required: Compute the company's activity variances for May. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero variance). Input all amounts as positive values.) Jake's Roof Repair Activity Variances For the Month Ended May 31 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net operating…arrow_forwardPlease give me correct answer with explanation..arrow_forwardDetermine the unit contribution margin and contribution margin ratio. Last month, Laredo Company sold 450 units for $25 each. During the month, fixed costs were $2,520 and variable costs were $9 per unit.arrow_forward

- Compute for the total cost per month using costing labor cost by the given data Compute for the percentage weight of the monetary benefit, non monetary benefit, and deferred monetary benefit Compute for the percentage of cost relevant to the sales of total labor cost, given that there are 40 employees in the company and the revenue of the company is 2,500,000 monthly.arrow_forwardAssume that a company provided the following cost formulas for three of its expenses (where q refers to the number of hours worked): Rent (fixed) $ 3,000 Supplies (variable) $ 4.00q Utilities (mixed) $150 + $0.75q The company’s planned level of activity was 2,000 hours and its actual level of activity was 1,900 hours. If these are the company’s only three expenses and the company uses revenue formula of $8.40q for budgeting purposes, what net operating income would appear in the company’s flexible budget?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 33.00 19.00 $ 14.00 Sales (8,500 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 280,500 161,500 119,000 54,700 $ 64,300 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per month if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 7,500 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education