FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

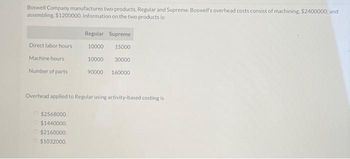

Transcribed Image Text:Boswell Company manufactures two products, Regular and Supreme. Boswell's overhead costs consist of machining. $2400000; and

assembling. $1200000. Information on the two products is:

Direct labor hours

Machine hours

Number of parts

Regular Supreme

10000 15000

30000

90000 160000

Ⓒ$2568000

$1440000.

$2160000.

$1032000.

10000

Overhead applied to Regular using activity-based costing is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maxey & Sons manufactures two types of storage cabinets—Type A and Type B—and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Type A Type BAnticipated volume (units) 24,000 45,000 Direct-material cost per unit $ 28 $ 42 Direct-labor cost per unit 33 33 The controller, who is studying the use of activity-based costing, has determined that the firm’s overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities’ three respective cost drivers, follow. Type A Type B TotalSetups 140 100 240 Machine hours 48,000 67,500 115,500 Outgoing shipments 200 150 350 The firm’s total…arrow_forwardBrannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? $144.00 $18.00 $180.00 $30.00arrow_forwardRahularrow_forward

- Kunkel Company makes two products and uses a conventional costing system in which a single plantwide predetermined overhead rate is computed based on direct labor - hours. Data for the two products for the upcoming year follow: Mercon Wurcon Direct materials cost per unit $ 12.00 $ 9.00 Direct labor cost per unit $ 15.00 $ 17.00 Direct labor - hours per unit 0.50 3.25 Number of units produced 2,000 4,000 These products are customized to some degree for specific customers. Required: 1. The company's manufacturing overhead costs for the year are expected to be $560,000. Using the company's conventional costing system, compute the unit product costs for the two products. 2. Management is considering an activity - based costing system in which half of the overhead would continue to be allocated on the basis of direct labor - hours and half would be allocated on the basis of engineering design time. This time is expected to be distributed as follows during the upcoming year: Mercon Wurcon…arrow_forwardBeerfield Company manufactures product M in its factory. Production of M requires 2 pounds of material P, costing $10 per pound and 0.5 hour of direct labor costing, $16 per hour. The variable overhead rate is $14 per direct labor hour, and the fixed overhead rate is $18 per direct labor hour. What is the standard product cost for product M? Direct material Answer Direct labor Answer Variable overhead Answer Fixed overhead Answer Standard product cost per unit Answerarrow_forwardOne of Concord Company's activity cost pools is machine setups with estimated overhead of $220000. Concord produces sparklers (320 setups) and lighters (680 setups). How much of the machine setup cost pool should be assigned to sparklers? $220000 $70400 O $110000 O $149600arrow_forward

- Maxey & Sons manufactures two types of storage cabinets—Type A and Type B—and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Type A Type BAnticipated volume (units) 24,000 45,000 Direct-material cost per unit $ 28 $ 42 Direct-labor cost per unit 33 33 The controller, who is studying the use of activity-based costing, has determined that the firm’s overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities’ three respective cost drivers, follow. Type A Type B TotalSetups 140 100 240 Machine hours 48,000 67,500 115,500 Outgoing shipments 200 150 350 The firm’s total…arrow_forwardAileen Co manufactures two components, L and M. Both components are manufactured on the machine ZX. The following cost information per unit of L and M is available: Direct material Direct labour Variable overhead Fixed overhead Total cost L M ($) ($) 12 18 25 15 8 7 6 46 10 55 Component L requires three hours on machine ZX and component M requires five hours. Manufacturing requirements show a need for 1,500 units of each component per week. The maximum number of machine ZX hours available per week is 10,000. An external supplier has offered to supply Aileen Co with the components for a price of $57 per component L and $55 per component M. Identify, by clicking on the relevant boxes in the table below, whether each of the following statements are true or false. would be cheaper for Aileen Co to produce all the components in-house if the hours on machine ZX were available Aileen Co should purchase 400 units of component M from the external supplier TRUE TRUE FALSE FALSEarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education