Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need answer of this question solution general accounting

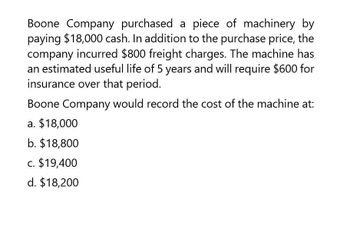

Transcribed Image Text:Boone Company purchased a piece of machinery by

paying $18,000 cash. In addition to the purchase price, the

company incurred $800 freight charges. The machine has

an estimated useful life of 5 years and will require $600 for

insurance over that period.

Boone Company would record the cost of the machine at:

a. $18,000

b. $18,800

c. $19,400

d. $18,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Garcia Co. owns equipment that costs $76,800, with accumulated depreciation of $40,800. Garcia sells the equipment for cash. Record the journal entry for the sale of the equipment if Garcia were to sell the equipment for the following amounts: A. $47,000 cash B. $36,000 cash C. $31,000 casharrow_forwardColquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardSteele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following transactions: Paid shipping of $1,000 Paid installation fees of $2,000 Pays annual maintenance cost of $200 Received a 5% discount on $25,000 sales price Determine the acquisition cost of the equipment.arrow_forward

- ABC Ltd. Incurred the following costs related to the purchase of a machine: $10,500 Invoice price Insurance during transit Pouring cement slab on which the machine must be mounted Interest expense on debt used to buy the asset Shipping costs Annual service contract cost ö $14,600 $12,100 What is the amount capitalized to the balance sheet for the machine? $11,800 200 $13,600 1,000 2,500 100 300arrow_forwardSolvearrow_forwardGRACE Co. recently acquired two items of equipment. Acquired a press at an invoice price of P5,000,000 subject to a 5% cash discount which was taken. Costs of freight and insurance during shipment were P50,000 and installation cost amounted to P200,000. The cost of testing the equipment is P50,000 while the administration cost has amounted to P30,000. Acquired a welding machine at an invoice price of P3,000,000 subject to a 10% cash discount which was not taken. Additional welding supplies were acquired at a cost of P100,000. Required: What is the total increase in the equipment account as a result of the transactions?arrow_forward

- Owearrow_forwardJamela Company acquired a welding machine on account with an invoice price of P5,000,000 subject to a cash discount of 10% which was not taken. Jamela Company incurred freight and insurance during shipment of P50,000 and testing and installation cost of P150,000. Welding supplies were acquired at a cost of P80,000. The residual value is 10% of its total cost while its estimated useful life is 5 years. What is the cost of the new welding machine? How much is the depreciable amount of the new welding machine? How much is the annual depreciation using the straight line method? Please include an explanation. Thank you!arrow_forwardALPHA Company purchased equipment on 1/1/N with an invoice price of $80,000. Purchase taxes $16,000. Other costs incurred were freight costs, $1,100; installation wiring and foundation, $2,200; material and labor costs in testing equipment, $700; fire insurance policy for the factory is, $1,400. The equipment is estimated to have a $5,000 salvage value at the end of its 5-year useful service life. Required: (a)Compute the acquisition cost of the equipment. (b)If the double-declining-balance method of depreciation was used for the machine, prepare the depreciation schedule for the full period. (c) Based on which criteria companies choose the depreciation methods for their depreciable assets?arrow_forward

- ALPHA Company purchased equipment on 1/1/N with an invoice price of $80,000. Purchase taxes $16,000. Other costs incurred were freight costs, $1,100; installation wiring and foundation, $2,200; material and labor costs in testing equipment, $700; fire insurance policy for the factory is, $1,400. The equipment is estimated to have a $5,000 salvage value at the end of its 5-year useful service life. Required: (b) If the double-declining-balance method of depreciation was used for the machine, prepare the depreciation schedule for the full period. Answer: Depreciation schedule: Year Beginning book value Declining balance rate Annual depreciation expenses Accumulated depreciation Book value 2017 2018 2019 2020 2021arrow_forwardJamela Company acquired a welding machine on account with an invoice price of P5,000,000 subject to a cash discount of 10% which was not taken. Jamela Company incurred freight and insurance during shipment of P50,000 and testing and installation cost of P150,000. Welding supplies were acquired at a cost of P80,000. The residual value is 10% of its total cost while its estimated useful life is 5 years. Question: What is the cost of the new welding machine? Please include explanation in each capitalizable costs.arrow_forwardLax Company recently acquired two items of equipment. The transactions are described as follows: * * Acquired a press at an invoice price of P3,000,000 subject to a 5% cash discount which was taken. Costs of freight and insurance during shipment were P50,000 and installation cost amounted to P200,000. Acquired a welding machine at an invoice price of P2,000,000 subject to a 10% cash discount which was not taken. Additional welding supplies were acquired at a cost of P100,000. The increase in the equipment account as a result of the above transactions should be a. 4,900,000 b. 5,000,000 c. 5,100,000 d. 5,200,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT