Cost accumulation in two departments

Country Products manufactures quilt racks. Pine stock is introduced in Department 1, where the raw material is cut and assembled. In Department 2, completed racks are stained and packaged for shipment. Department 1 applies

| Department 1 | Department 2 | |

|---|---|---|

| Expected overhead | $465,000 | $380,600 |

| Expected DLHs | 4,000 | 22,000 |

| Expected MHs | 30,000 | 2,500 |

Sue Power contacted Country Products to produce 500 quilt racks as a special order. Power wanted the racks made from teak and to be made larger than the company’s normal racks. Country Products designated Power’s order as Job #462.

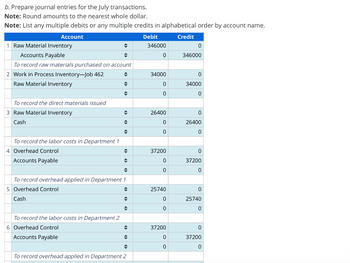

During July, Country Products purchased $346,000 of raw material on account, of which $19,000 was teak. Requistions were issued for $340,000 of raw material, including all the teak. There were 285 direct labor hours worked (at a rate of $11 per DLH) and 2,400 machine hours recorded in Department 1; of these hours, 25 DLHs and 320 MHs were on Job#462. Department 2 had 1,430 DLHs (at a rate of $18 per DLH) and 180 MHs; of these, 158 DLHs and 20 MHs were worked on Job #462. Assume that all wages are paid in cash.

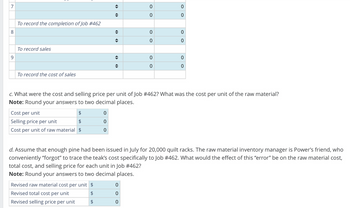

Job #462 was completed on July 28 and shipped to Power. She was billed cost plus 20 percent.

a. What are the predetermined overhead rates for Departments 1 and 2?

Step by stepSolved in 2 steps

- please helparrow_forwardQuestion 7. Part 4. Please fill in the blanks in the same format as the questionarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- The following account balances at the beginning of January were selected from the general ledger of Fresh Bagel Manufacturing Company: K Work in process inventory $0 Raw materials inventory Finished goods inventory $28,800 $40,200 (Click the icon to view additional data.) What is the work in process inventory balance on January 31? OA. $27,280 OB. $98,031 OC. $69,231 OD. $7280 COarrow_forwardUsing the information given, complete the following: a. Prepare the January income statement for Sorensen Manufacturing Company. Round your answers to the nearest dollar. Sorensen Manufacturing Company Income Statement For the Month Ended January 31 b. Determine the inventory balances at the end of the first mon operations. Round your answers to the nearest dollar. Sorensen Manufacturing Company Inventory Balances For the Month Ended January 31 Inventory balances on January 31 : Materials Work in process Finished goods $ $ $ The following events took place for Sorensen Manufacturing Company during January, the first month of its operations as a producer of digita video monitors: a. Purchased $236, 000 of materials. b. Used $169, 920 of direct materials in production. c. Incurred $424, 800 of direct labor wages. d. Incurred $169,900 of factory overhead. e. Transferred $ 717,400 of work in process to finished goods. f. Sold goods for $1,132,800. g. Sold goods with a cost of $637,200. h.…arrow_forwardAzzarelli, Corp makes picture frames and reports the following for the month of May: Description Amount Purchases of materials on account 53,330 Subcategory,Materials requisitions: Direct Materials 49,730 Indirect Materials 1,280 Subcategory,Labor costs incurred (not yet paid): Direct Materials 24,520 Indirect Materials 1,920 Journalize the entries at the end of the month to record the transactions relating to materials and labor.Journal Date Description Debit Credit May 31 May 31 May 31 May 31 May 31 May 31 May 31 May 31arrow_forward

- Prepare journal entries to record the following production activities. 1. Transferred completed goods from the Assembly department to finished goods inventory. The goods cost $143,000. 2. Sold $451,000 of goods on credit. Their cost is $166,000. View transaction list Journal entry worksheet O O Carrow_forwardZang Co. manufactures its products in a continuous process involving two departments, Machining and Assembly. Prepare journal entries to record the following transactions related to production during June: If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $180,000. fill in the blank ebb198fb5044008_2 fill in the blank ebb198fb5044008_4 b. Materials requisitioned by: Machining, $73,000 direct and $9,000 indirect materials; Assembly, $4,900 indirect materials. fill in the blank bc86e1f3a046016_2 fill in the blank bc86e1f3a046016_3 fill in the blank bc86e1f3a046016_5 fill in the blank bc86e1f3a046016_6 fill in the blank bc86e1f3a046016_8 fill in the blank bc86e1f3a046016_9 fill in the blank bc86e1f3a046016_11 fill in the blank bc86e1f3a046016_12 c. Direct labor used by Machining, $23,000; Assembly, $47,000. fill in the blank e1ca5ffd1ff8fbf_2 fill in the blank…arrow_forwardAccounting records for Antoinette Designs (AD) for November show the following (each entry is the total of the actual entries for the account for the month): Account Titles Work-in-Process Inventory (Direct Labor) Wages Payable Direct Materials Inventory Accounts Payable Finished Goods Inventory Work-in-Process Inventory Cost of Goods Solda Finished Goods Inventory Debit 7,200 122,130 136,800 131,400 Credit 7,200 Required: a. What was the finished goods inventory balance on November 30? b. How much manufacturing overhead was applied for November? c. What was the manufacturing overhead rate for November? d. How much manufacturing overhead was incurred for November? e. What was the Work-in-Process Inventory on November 1? f. What was the Work-in-Process Inventory on November 30? 122,130 136,800 131,400 aThis entry does not include any over- or underapplied overhead. Over- or underapplied overhead is written off to Cost of Goods Sold once for the month. For November, the amount written…arrow_forward

- The T-accounts below provide selected data about Company J’s financial results for the year: Raw Materials Inventory Jan 1 bal. P22,500 ? Credits Debits P75,000 Dec. 31 bal P18,000 Finished Goods Jan 1 bal. P90,000 ? Credits Debits ? Dec. 31 bal P72,000 Factory Overhead Debits P111,000 ? Credits Work In Process Jan 1 bal. P52,500 P282,000 Credits Direct Materials P72,000 Direct Labor P90,000 Factory Overhead P112,500 Dec 31 Bal. ? Manufacturing Wages Payable Debits P111,000 P66,000 Jan 1 Bal P99,000 Credits Cost of Goods Sold Debits ? The amount of over- (under-) applied overhead is a.(P1,500) b.P10,500 c. P1,500 d.(P10,500)arrow_forwardThe following balances appear on the accounts of Greusel Fabrication: March 11 (Beginning) $ 45,000 March 31 (Ending) $50,000 75,200 71,000 51,500 47,200 Direct materials used during the month amount to $534,000 and the cost of goods sold for the month was $1,526,000. Required: Prepare a cost of goods sold statement. Direct materials inventory Work-in-process inventory Finished goods inventory Manufacturing costs Direct materials Materials available GREUSEL FABRICATION Cost of Goods Sold Statement For the Month Ended March 31arrow_forwardProblem 1.a.: Computation of Direct Material Used.Akari Inc. provided the following information for its raw material inventory account at the end of the current month:Raw Materials (RM) InventoryAccounts $ Accounts $Beginning balance $22,600 Direct materials (DM) used ?Purchase $88,400 Indirect materials used $7,600Ending Balance $27,200Required: Compute the missing information for the direct materials used during the current month.Solution: Formula: Beginning RM+ RM Purchased= Total RM available for use- Ending RM= RM used- Indirect material used= DM usedarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning