Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Answer the below in descending order and to zero decimal places. Thank you

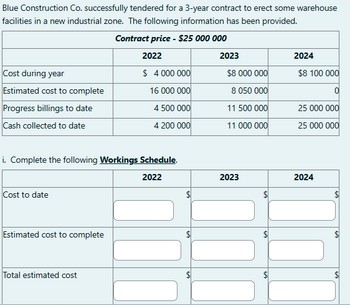

Transcribed Image Text:Blue Construction Co. successfully tendered for a 3-year contract to erect some warehouse

facilities in a new industrial zone. The following information has been provided.

Contract price - $25 000 000

2022

2023

2024

Cost during year

$ 4000 000

$8 000 000

$8 100 000

Estimated cost to complete

16 000 000

8 050 000

이

Progress billings to date

4 500 000

11 500 000

25 000 000

Cash collected to date

4 200 000

11 000 000

25 000 000

i. Complete the following Workings Schedule.

2022

2023

2024

Cost to date

Estimated cost to complete

Total estimated cost

+A

+A

+A

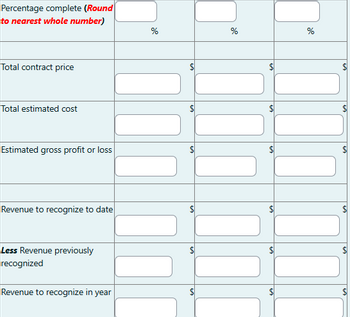

Transcribed Image Text:Percentage complete (Round

to nearest whole number)

Total contract price

Total estimated cost

Estimated gross profit or loss

Revenue to recognize to date

Less Revenue previously

recognized

Revenue to recognize in year

%

EA

de

%

%

$

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- BnD Construction Co. successfully tendered for a 3-year contract to erect some warehouse facilities in Gros Islet. The following information has been provided. Contract price - $25 000 000 2021 2022 2023 Cost during year $ 4 000 000 $8 000 000 $8 100 000 Estimated cost to complete 16 000 000 8 050 000 0 Progress billings to date 4 500 000 11 500 000 25 000 000 Cash collected to date 4 200 000 11 000 000 25 000 000 i. Complete the following Workings Schedule. Do not enter negative values in the schedule. 2021 2022 2023 Cost to date $Answer 29 Question 3 $Answer 30 Question 3 $Answer 31 Question 3 Estimated cost to complete $Answer 32 Question 3 $Answer 33 Question 3 $Answer 34 Question 3 Total estimated cost $Answer 35 Question 3 $Answer 36 Question 3 $Answer 37 Question 3 Percentage complete (Round to nearest whole number) Answer 38 Question 3% Answer 39 Question 3%…arrow_forwardProvide proper solutionarrow_forwardBnD Construction Co. successfully tendered for a 3-year contract to erect some warehouse facilities in Gros Islet. The following information has been provided. Contract price - $25 000 000 Cost during year Estimated cost to complete Progress billings to date Cash collected to date Prepare the following journal entries: 1. To record construction cost 2. To record billings 3. To record collections 4. To record revenue 2021 $ 4 000 000 16 000 000 4 500 000 4 200 000 2022 $8 000 000 8 050 000 11 500 000 11 000 000 2023 $8 100 000 이 25 000 000 25 000 000arrow_forward

- BnD Construction Co. successfully tendered for a 3-year contract to erect some warehouse facilities in Gros Islet. The following information has been provided. Time left 2:20:2 Contract price - $25 000 000 2021 $ 4 000 000 Cast during year Estimated cost to complete Progress billings to date Cash collected to date Cast to date Estimated cost to complete Total estimated cost Percentage complete (Round to nearest whole number) Total contract price Total estimated cast i Complete the following Workings Schedule. Do not enter negative values in the schedule. Estimated gross profit or loss Revenue to recognize to date Less Revenue previously recognized Revenue to recognize in year Estimated gross profitto recognize to date 16 000 000 4 500 000 4 200 000 Less Gross profit or lass previously recognized 2022 2021 $8 000 000 8 050 000 11 500 000 11 000 000 2023 2022 $8 100 000 0 25 000 000 25 000 000 2023 %arrow_forwardIn 20x1, XYZ Company enters into a construction contract with a customer. The contract price is P10,000,000.Information on the contract follows:20X1 20X2 20X3Contract costs incurred during the year P2,645,132 P236,451 P2,657,000Estimated costs to complete 2,697,451 2,116,777 -Progress Billings 5,000,000 3,000,000 2,000,000Collections on progress billings 2,000,000 4,000,000 4,000,000 Using the cost-to-cost method, Note: Use up to two (2) decimal places in presenting the answer for percentage of completion. Use six (6)decimal places when applying the percentage.1. Percentage of completion for 20x1 _____________2. Revenue that should be recognized in 20x1 _____________3. Realized gross profit in 20x1 _____________4. Balance of "Contract Liability" at the end of 20x1 _____________arrow_forwardIn 20x1, XYZ Company enters into a construction contract with a customer. The contract price is P10,000,000.Information on the contract follows:20X1 20X2 20X3Contract costs incurred during the year P2,645,132 P236,451 P2,657,000Estimated costs to complete 2,697,451 2,116,777 -Progress Billings 5,000,000 3,000,000 2,000,000Collections on progress billings 2,000,000 4,000,000 4,000,000 Using the cost-to-cost method, compute the following: Note: Use up to two (2) decimal places in presenting the answer for percentage of completion. Use six (6)decimal places when applying the percentage.4. Balance of "Contract Liability" at the end of 20x1 _____________5. Percentage of completion for 20x2 _____________6. Revenue that should be recognized in 20x2 _____________arrow_forward

- Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts: a. What are the profitability indexes of the projects? b. What should Fabulous Fabricators do? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Contract A NPV $1.98 million Use of Facility 100% B $1.01 million 57% C $1.49 million 43% Print Done - X ☑arrow_forwardWhat amount is presented as ABC Co's statement of financial position as contract liability?arrow_forwardPARAMOUR Co. was contracted by LOVER, Inc. for the construction of a flyover in 20x1. The contract price is P10M. Information on costs is as follows: 20x1 20x2 Total costs incurred to date 1,600,000 6,000,000 Estimated costs to complete 6,400,000 1,500,000 How much revenue is recognized in 20x2? 8M 6M 4M What is the percentage of the progress completed in 20x2? 80% 60% 40% 16%arrow_forward

- This subject is Accounting for Special Transactionsarrow_forwardAthena Co. started work on an P8M fixed-price construction contract in 20x1. Information on the contract is as follows: 20x1 20x2 20x3 Costs incurred per year 2,850,000 3,670,000 1,600,000 Estimated costs to complete 4,275,000 1,630,000 - Requirement: Compute for the amounts recognized in profit or loss in 20x1, 20x2, 20x3, respectively.arrow_forwardA Company is trying to decide which one of two contracts it will accept. The costs and revenues associated with each are listed below: Contract revenue Materials Contract X Contract Z $ 260,000 $ 200,000 10,000 10,000 Labor costs 88,000 120,000 Depreciation on 8,000 10,000 equipment Cost incurred for 1,500 1,500 consulting advice Allocated portion of overhead 5,000 3,000 The equipment was purchased last year and has no resale value. Which of these amounts is relevant for the selection of one contract over another? OA. Contract revenue and labor costs OB. Materials, consulting advice, and allocated overhead OC. Cost of consulting advice and allocated overhead OD. Contract revenue, labor costs, depreciation on equipment and allocated portion of overhead OE. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning