FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

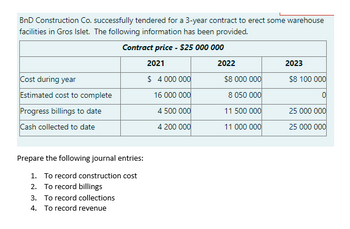

Transcribed Image Text:BnD Construction Co. successfully tendered for a 3-year contract to erect some warehouse

facilities in Gros Islet. The following information has been provided.

Contract price - $25 000 000

Cost during year

Estimated cost to complete

Progress billings to date

Cash collected to date

Prepare the following journal entries:

1. To record construction cost

2. To record billings

3. To record collections

4. To record revenue

2021

$ 4 000 000

16 000 000

4 500 000

4 200 000

2022

$8 000 000

8 050 000

11 500 000

11 000 000

2023

$8 100 000

이

25 000 000

25 000 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Segment Reporting With respect to interim reporting, FASB addresses examples of costs that benefit more than one accounting period (i.e., month) and how these costs should be accounted for on interim reports. Please provide three examples of these types of costs, the requirement for reporting them, and also indicate which FASB rule governs the application of the process. Please use this link to access the FASB CodificationLinks to an external site..arrow_forwardWhich of the following accounts would be debited in the journal entry to record the issuance of direct materials? O A. Cost of Goods Sold O B. Finished Goods Inventory OC. Raw Materials Inventory O D. Work-in-Process Inventoryarrow_forwardAccess the FASB’s Accounting Standards Codification at the FASB website (www.fasb.org) and select Basic View for free access. Required: Determine the specific nine-digit Codification citation (XXX-XX-XX-XX) for accounting for each of the following items: What are the five key steps to applying the revenue recognition principle? What are indicators that control has passed from the seller to the buyer, such that it is appropriate to recognize revenue at a point in time? Under what circumstances can sellers recognize revenue over time?arrow_forward

- TASKS Prepared supporting documents for Requested Materials to Purchase such as: (1) Purchase Request (PR), (2) Request for Quotation (RFQ), (3) Abstract for Quotation (AFQ), (4) Purchase Order (PO), & (5) Inspection and Acceptance Report (IAR). Prepared additional attachments such as: (1) Report of Waste Materials, (2) Request for pre-repair inspection and evaluation report. Issued Materials at the Warehouse (there are thousands of inventories) Posting of Purchase Requests to the Philippine Government Electronic Procurement System (PhilGEPS). (there are too many steps and details to keep in mind) Prepared Certificate of Creditable Tax Withheld at Source Updated the Summary of Withholding Taxes (SAWT) in the BIR System. Updated the Monthly Alphalist of Payees (MAP) and Quarterly Alphalist of Payees (QAP) in the BIR System. Remitted Creditable Withholding Tax (CWT) to the BIR via online.. Updated Bin Cards Updated Stock Cards. Reconciled the individual records of Inventories in the Bin…arrow_forwardDiscuss the role of performance reports in the Responsibility Accounting process.arrow_forwardCurrent Attempt in Progress Expenses are recognized when they are billed by the supplier. O they are paid. the invoice is received. they contribute to the production of revenue.arrow_forward

- For each of the following expenses, select the best allocation basis. A. Value of insured assets. B. Square feet of space occupied. C. Proportion of total purchase orders for each operating department. D. Number of employees in department. Maintenance department expenses of the operating departments. Payroll department expenses of all departments. Purchasing department expenses for the operating departments. Insurance expenses of all departments.arrow_forwarddevratarrow_forwardStandard cost are used primarily for: Estimating future costs. To produce financial statements for external users. To judge the performance of accounting managers. To judge the performance of managers involved in the manufacturing process.arrow_forward

- do all charts have to have live item that state Total Revenue?arrow_forwardA seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of merchandise previously purchased on credit on April 13. The seller's cost of the merchandise returned was $480. The merchandise is not defective and is restored to inventory. The seller has not yet received any cash from the customer.arrow_forwardA schedule set up to combine similar general ledger accounts, the total of which appears on the working trial balance as a single amount, is referred to as a: Supporting schedule, Lead schedule, Corrobrating schedule, or Reconciling schedulearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education