FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

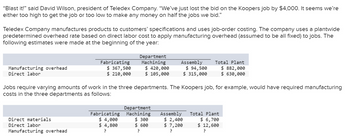

Transcribed Image Text:"Blast it!" said David Wilson, president of Teledex Company. "We've just lost the bid on the Koopers job by $4,000. It seems we're

either too high to get the job or too low to make any money on half the jobs we bid."

Teledex Company manufactures products to customers' specifications and uses job-order costing. The company uses a plantwide

predetermined overhead rate based on direct labor cost to apply manufacturing overhead (assumed to be all fixed) to jobs. The

following estimates were made at the beginning of the year:

Manufacturing overhead

Direct labor

Fabricating

$367,500

$ 210,000

Direct materials

Direct labor

Manufacturing overhead

Department

Machining

$ 420,000

$ 105,000

Fabricating

$ 4,000

$ 4,800

?

Jobs require varying amounts of work in the three departments. The Koopers job, for example, would have required manufacturing

costs in the three departments as follows:

Assembly

$ 94,500

$ 315,000

Department

Machining

$300

$ 600

?

Total Plant

$ 882,000

$630,000

Assembly Total Plant

$ 6,700

$ 12,600

?

$ 2,400

$ 7,200

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sampson Jewelry Corporation manufactures custom jewelry. In the past, Sampson has been using a traditional overhead allocation system based solely on direct labor hours. Sensing that this system was distorting costs and selling prices, Sampson has decided to switch to an activity-based costing system using three activity cost pools. Information on these activity cost pools are as follows: Activity Cost Pool Total Cost Total Activity Labor Related $40,000 8,000 Direct labor hours Machine Related $50,000 12,500 Machine Hours Quality Control $12,000 800 Inspections Sampson has received an order and will complete as Job #309 and expect to incur $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections. Sampson needs a markup of 40% on the job.Required:A). Calculate the activity rate and compute is the expected cost of job#309 under the activity-based costing system? What should be the quote on this job?…arrow_forwardCarlise Corp., which manufactures ceiling fans, currently has two product lines, the Indoor and the Outdoor. Carlise has to overhead of $132,720. Carlise has identified the following information about its overhead activity cost pools and the two product lines: Quantity/Amount Consumed by Indoor Line Quantity/Amount Consumed by Outdoor Line Activity Cost Pools Cost Driver Materials handling Number of moves Quality control Number of inspections Machine maintenance Number of machine hours Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Indoor Model Outdoor Model Total Cost Assigned to Pool $21, 120 $71,760 4,600 inspections $39,840 29,000 machine hours 19,000 machine hours 600 moves 500 moves 5,800 inspections Overhead Assignedarrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. A. Wood used to produce desks ($125.00 per desk) B. Production labor used to produce desks ($15 per hour) C. Production supervisor salary ($45,000 per year) D. Depreciation on factory equipment ($60,000 per year) E. Selling and administrative expenses ($45,000 per year) F. Rent on corporate office ($44,000 per year) G. Nails, glue, and other materials required to produce desks (varies per desk) H. Utilities expenses for production facility I. Sales staff commission (5% of gross sales)arrow_forward

- Antz is a custom manufacturer of electronic circuit boards. Antz develops bids for jobs based on an estimate of the materials needed and a labor estimate. Overhead is applied based on direct labor hours. A 15 percent profit margin is then added to each job for the final bid. During 2004, Antz had the following costs:Materials............................................. $175,000Labor (all direct) ................................ 25,000Overhead ............................................ 250,000After some consideration the manager of Antz decided that overhead was not caused totally by direct labor. Approximately one-half of the overhead represented the cost of purchasing, storing, and issuing materials to production. Thus, the manager has decided to develop a multiple overhead rate system.Antz has been given two jobs to bid on. Estimated materials and labor are as follows:Job 1 Job 2Materials costs................................ $15,000 $50,000Labor…arrow_forwardA company uses job-order costing with manufacturing overhead (MOH) applied on the basis of machine hours (MHs). In the past, the company's pre-determined overhead rate (POHR) has fluctuated from period to period due primarily to differences in the expected usage of their machine. For this period, the machine has a capacity of 450 MHs, but based on anticipated production, only 375 MHs are expected to be required. The company's MOH is relatively fixed, estimated at $11,250 for both levels of MHs. At the end of the period, actual production used 413 MHs and total actual MOH amounted to $10.500. 1. How much less MOH would be applied during the month using capacity MHs rather than the traditional method?arrow_forwardWheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs and expenses for the coming year follow: Bike parts Factory machinery depreciation Factory supervisor salaries Factory direct labor Factory supplies Factory property tax Advertising cost Administrative salaries Administrative-related depreciation Total expected costs Required: 1. Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour. 2. Determine the amount of applied overhead if 18,600 actual hours are worked in the upcoming year. Required 1 Required 2 Complete this question by entering your answers in the tabs below. $ 341,800 61,500 140,000 211,998 Predetermined Overhead Rate 39,400 33,750 22,500 55,000 19, 200 $925,148 Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour. Note: Round your answer to 2 decimal…arrow_forward

- Isaacson's Fine Furnishings manufactures upscale custom furniture. Isaacson's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,170,000 of manufacturing overhead to individual jobs. However, Delores Johnson, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $735,000 of manufacturing overhead while the Finishing Department incurs $435,000 of manufacturing overhead. Johnson has identified machine hours (MH) as the primary manufacturing overhead cost driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing Department The Isaacson's plant completed Jobs 450 and 455 on May 15. Both jobs incurred a total of 7 DL hours throughout the entire production process. Job 450 incurred 1 MH in the Machining Department and 6 DL hours in the Finishing Department (the other DL hour occurred in the Machining…arrow_forwardKirsten believes her company's overhead costs are driven (affected) by the number of direct labor hours because the production process is very labor intensive. During the period, the company produced 4,600 units of Product A requiring a total of 760 labor hours and 2,100 units of Product B requiring a total of 160 labor hours. What allocation rate should be used if the company incurs overhead costs of $14,720?arrow_forwardAn advertising agency is estimating costs for promoting a music festival. The job will require 380 direct labor hours at a cost of $86 per hour. Overhead costs are applied at a rate of $83 per direct labor hour. 1. What is the total estimated cost for this job? 2. If the company applies a markup of 20% of total costs (price quote is 120% of total costs), what price should it quote for this job? 1. Total estimated job cost 2. Price quotearrow_forward

- Speedy Auto Repairs uses a job-order costing system. The company's direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. Speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated output Fixed overhead cost Variable overhead cost per direct labor-hour 24,000 $ 288,000 $ 1.00 Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was available with respect to his job: $ 615 $208 9 Direct materials Direct labor cost Direct labor-hours used Compute Mr.…arrow_forward“Blast it!” said David Wilson, president of Teledex Company. “We’ve just lost the bid on the Koopers job by $3,000. It seems we’re either too high to get the job or too low to make any money on half the jobs we bid.” Teledex Company manufactures products to customers’ specifications and uses a job-order costing system. The company uses a plantwide predetermined overhead rate based on direct labor cost to apply its manufacturing overhead (assumed to be all fixed) to jobs. The following estimates were made at the beginning of the year: Department Total Plant Fabricating Machining Assembly Manufacturing overhead $ 355,250 $ 406,000 $ 91,350 $ 852,600 Direct labor $ 203,000 $ 101,500 $ 304,500 $ 609,000 Jobs require varying amounts of work in the three departments. The Koopers job, for example, would have required manufacturing costs in the three departments as follows: Department Total Plant Fabricating Machining Assembly Direct materials $ 3,300 $ 200 $…arrow_forwardSpeedy Auto Repairs uses a job-order costing system. The company’s direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics’ hourly wages. Speedy’s overhead costs include various items, such as the shop manager’s salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated output 40,000 Fixed overhead cost $ 640,000 Variable overhead cost per direct labor-hour $ 1.00 Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was available with respect to his job: Direct materials $ 707 Direct labor cost $ 230 Direct…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education