FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

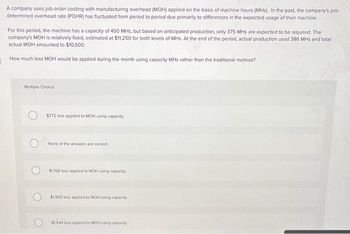

Transcribed Image Text:A company uses job-order costing with manufacturing overhead (MOH) applied on the basis of machine hours (MHS). In the past, the company's pre-

determined overhead rate (POHR) has fluctuated from period to period due primarily to differences in the expected usage of their machine.

For this period, the machine has a capacity of 450 MHs, but based on anticipated production, only 375 MHs are expected to be required. The

company's MOH is relatively fixed, estimated at $11,250 for both levels of MHs. At the end of the period, actual production used 386 MHs and total

actual MOH amounted to $10,500.

How much less MOH would be applied during the month using capacity MHs rather than the traditional method?

Multiple Choice

$772 less applied to MOH using capacity.

None of the answers are correct

$1358 less applied to MOH using capacity.

$1,930 less applied to MOH using capacity

$1,544 less applied to MOH using capacity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kirsten believes her company's overhead costs are driven (affected) by the number of direct labor hours because the production process is very labor Intensive. During the period, the company produced 4,700 units of Product A requiring a total of 770 labor hours and 2,200 units of Product B requiring a total of 170 labor hours. What allocation rate should be used if the company Incurs overhead costs of $15,980? Multiple Choice $17.00 per labor hour $2.32 per unit $20.75 per labor hour for Product A and $94 per labor hour for Product B None of these.arrow_forwardHakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $26.87 per unit, while product B has been assigned $7.62 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information: Cost Pools Activity Costs $ 415,000 120,000 44,000 The following cost information pertains to the production of A and B, just two of Hakara's many products: Machine setup Materials handling Electric power Number of units produced Direct materials cost Direct labor cost Number of setup hours Pounds of materials used Kilowatt-hours Product A Product B A 5,000 $ 22,000 $ 39,000 Cost per Unit Cost Drivers Setup hours Pounds of materials Kilowatt-hours 200 2,000 4,000 B 20,000 $ 26,000 $ 37,000 Activity Driver Consumption 5,000 15,000 22,000 200 2,000 4,000 Required: 1. Use…arrow_forwardFrame Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine- hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour O $24,000 O $110,400 $86,400 Casting Customizing 19,000 1,000 $ 138,700 $ 1.60 The estimated total manufacturing overhead for the Customizing Department is closest to: $60,379 11,000 8,000 $ 86,400 S 3.00arrow_forward

- Bluefield Corporation has two product lines, A and B. Bluefield has identified the following information about its overhead and potential cost drivers: Total overhead Cost drivers Number of labor hours Number of machine hours Required: 1. Suppose Bluefield Corporation uses a traditional costing system with number of labor hours as the cost driver. Determine the amount of overhead assigned to each product line if Product A requires 64 percent of the labor hours and Product B requires 36 percent. 2. Suppose Bluefield uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line if Product A requires 17,500 machine hours and Product B requires 32,500. Complete this question by entering your answers in the tabs below. Required 1 Required 2 $ 79,000 2,200 50,000 Suppose Bluefield Corporation uses a traditional costing system with number of labor hours as the cost driver. Determine the amount of overhead assigned to…arrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 53,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,080,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or…arrow_forward2arrow_forward

- A company uses job-order costing with manufacturing overhead (MOH) applied on the basis of machine hours (MHs). In the past, the company's pre-determined overhead rate (POHR) has fluctuated from period to period due primarily to differences in the expected usage of their machine. For this period, the machine has a capacity of 450 MHs, but based on anticipated production, only 375 MHs are expected to be required. The company's MOH is relatively fixed, estimated at $11,250 for both levels of MHs. At the end of the period, actual production used 413 MHs and total actual MOH amounted to $10.500. 1. How much less MOH would be applied during the month using capacity MHs rather than the traditional method?arrow_forwardAnton believes his company's overhead costs are driven (affected) by the number of machine hours because the production process is heavily automated. During the period, the company produced 3,000 units of Product A requiring a total of 100 machine hours and 2,000 units of Product B requiring a total of 25 machine hours. What allocation rate should be used if the company incurs overhead costs of $10,000?arrow_forwardDakota Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Dakota allocates manufacturing overhead costs using direct manufacturing labor costs. Dakota provides the following information: E (Click the icon to view the information.) Read the requirements. Requirement 1. Compute the actual and budgeted manufacturing overhead rates for 2017. (Enter your answer as a number (not as a percentage) rounded to two decimal places, X.XX.) Actual manufacturing overhead rate Budgeted manufacturing overhead rate = Data table Budget for 2017 Actual Results for 2017 Direct material costs 2,250,000 $ 2,150,000 Direct manufacturing labor costs 1,700,000 1,650,000 Manufacturing overhead costs 3,060,000 3,217,500 Print Donearrow_forward

- Large, Inc., manufactures and sells two products: Product G8 and Product 00. Historically, the firm has used a traditional costing system, with direct laborurs as an activity base, to allocated manufaturing overhead to products. Data concerning the expected production of each product and the expected total direct labor-hours (DLHS) required to produce that output appear below: Product GS Product 00 Total direct labor-hours Product G8 Product 00 Activity Cost Pools Labor-related Expected Production 780 380 The direct labor rate is $22.90 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $121.10 $121.50 Machine setups Order size Activity Measures DLHS setups MHS Direct Labor-Hours Per Unit The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: 5.8 2.8 Estimated Overhead Cost $ 59,555 58,390 369,508 $487,453 Total Direct Labor- Hours…arrow_forwardAssume that company makes only two products: Product A and Product B. The company’s activity-based costing system has allocated $96,750 to an activity called machine setups. It is considering allocating the machine setups cost to its products using either the number of setups or setup hours as the activity measure. It gathered the following data with respect to these two potential activity measures: Product A Product B Number of machine setups 30 45 Number of setup hours per setup 6 6 If the company uses number of setup hours as the activity measure, how much machine setup activity cost would be allocated to Product A?arrow_forwardThe JOC-10847 company uses a job-order costing system with a predetermined overhead rate using direct labor hours as the allocation base. The company made the following estimates at the beginning of last year: Direct labor-hours required for the estimated production Fixed manufacturing overhead cost Variable manufácturing overhead cost per direct labor-hour 153,000 $ 654,000 $ 4.60 The JOC-10847 company started and completed Product A989 last year. It recorded the following information for Product A989: Direct materials Direct labor cost Direct labor hours used Number of units produced $ 330 $ 220 34 hours 50 units The JOC-10847 company uses a markup percentage of 110% of its total manufacturing cost in determining selling price. The selling price per unit the company would charge for Product A989 is closest to: (Carry out your calculations up to 2 decimal places) O$ 33.17 O$ 14.19 O$ 31.44 O$ 29.81arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education