FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

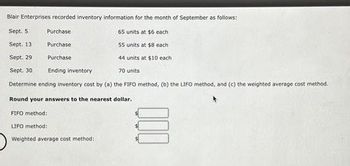

Transcribed Image Text:Blair Enterprises recorded inventory information for the month of September as follows:

Sept. 5

Sept.

65 units at $6 each

55 units at $8 each.

Sept. 29

44 units at $10 each

Sept. 30

70 units

Determine ending inventory cost by (a) the FIFO method, (b) the LIFO method, and (c) the weighted average cost method.

Round your answers to the nearest dollar.

Purchase

Purchase

Purchase

Ending inventory.

13

FIFO method:

LIFO method:

Weighted average cost method:

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The inventory records for Radford Company reflected the following: Beginning inventory @ May 1 First purchase @ May 7 Second purchase @ May 17 Third purchase @ May 23 Sales @ May 31 1,700 units @ $5.00 1,800 units @ $5.20 2,000 units @ $5.30 1,600 units @ $5.40 5,400 units @ $6.90 If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded) for May? Multiple Choice $5.17 $5.23 $6.90 $5.30arrow_forward< Inventory by Three Methods; Cost of Goods Sold The units of an item available for sale during the year were as follows: Jan. 1 May 15 Aug. 7 Inventory Nov. 20 Purchase 12 units at $2,040 17 units at $2,100 There are 20 units of the item in the physical inventory at December 31. Determine the cost of ending inventory and the cost of goods sold by three methods, presenting your answers in the following form: Round your final answers to the nearest dollar. Purchase Purchase 21 units at $1,800 30 units at $1,950 Inventory Method a. First-in, first-out method b. Last-in, first-out method c. Weighted average cost method Feedback Ending Inventory Cost of Goods Sold 0 X 0 X 0 Cost X $ 114,660 ✓ 0 X 0 Xarrow_forwardThe following units of an inventory item were available for sale during the year: Beginning inventory 9 units at $52 First purchase 19 units at $54 Second purchase 26 units at $55 Third purchase 13 units at $57 The firm uses the periodic inventory system. During the year, 22 units of the item were sold. The value of ending inventory rounded to the nearest dollar using average cost is (Round average cost per unit to three decimal places.) a. $1,170 b. $1,144 Oc. $2,462 Od. $1,236arrow_forward

- The following data has been provided by Lee Company regarding its inventory purchases and sales throughout the year. Transaction Units Cost per Unit January 1 Balance 185 $86 March 14 Sale 54 May 23 Purchase 136 90 August 21 Sale 100 November 5 Purchase 171 91 November 18 Sale 100 November 30 Sale 100 December 5 Sale 100 December 10 Purchase 25 95 Required: Compute the cost of goods sold and ending inventory using the perpetual inventory system for the LIFO cost flow assumption. Ending inventory Cost of goods soldarrow_forwardFrom the following, calculate the cost of ending inventory and cost of goods sold for the LIFO method, ending inventory is 50 units. Note: Round your answers to the nearest cent. Beginning inventory and purchases January 1 April 101 May 15 July 22 August 19 September 30 November 10 December 15. 5 Cost of ending inventory Cost of goods sold 10 12 15 18. 20 32 16 THIE cont $1.40 1.90 2.40 2.65 3.40 3.60 3.80 4.20 Answer is complete but not entirely correct. $ $ 204.75 365.40arrow_forwardWeighted average cost flow method under perptual inventory system. The following units of a particular item were availabe for sale during the calendar year. Jan. 1 Inventory 4,000 units at $20 April 19 Sale 2,500 units June 30 Purchase 6,000 units at $24 Sept. 2 Sale 4,500 units Nov. 15 Purchase 1,000 units at $25 Instructions: The firm uses the weighted averaghe cost method with a perpetual inventory system. Determine the cost of merchandise sold for each sale and the inventory balance after each sale. (chapter 7 question EX 7-9 page 380- immediate accounting I textbook)arrow_forward

- From the following, calculate the cost of ending inventory and cost of goods sold for the FIFO method, ending inventory is 58 units. Note: Round your answers to the nearest cent. Beginning inventory and purchases Units Unit cost January 1 6 $ 1.60 April 10 9 2.10 May 15 13 2.60 July 22 14 2.85 August 19 19 3.60 September 30 19 3.80 November 10 33 4.00 December 15 15 4.40 1. Cost of ending inventory 2. Cost of goods soldarrow_forwardneed answerarrow_forwardYou have the following information for Coronado Inc. for the month ended June 30, 2022. Coronado uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $23 June 4 Purchase 135 26 June 10 Sale 110 53 June 11 Sale return 15 53 June 18 Purchase 55 29 June 18 Purchase return 10 29 June 25 Sale 65 59 June 28 Purchase 35 33 Calculate ending inventory, cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost.arrow_forward

- Use this inventory information for the month of March to answer the following questions. Assuming that a periodic inventory system is used, what is ending inventory (rounded) under theaverage-cost method? What is cost of goods sold on a FIFO basis? What is ending inventory under the LIFO method?arrow_forwardThe accounting records of Larkspur Electronics show the following data. Beginning inventory 3,000 units at $4 Purchases 9,000 units at $8 Sales 9,500 units at $10 Determine cost of goods sold during the period under a periodic inventory system using the average-cost method.arrow_forwardFrom the following, calculate the cost of ending inventory and cost of goods sold for the FIFO method, ending inventory is 54 units. Note: Round your answers to the nearest cent. Beginning inventory and purchases January 1 April 10 May 15 July 22 August 19 September 30 November 10 December 15 Cost of ending inventory Cost of goods sold Units 4 11 11 16 EX 17 21 31 17 Unit cost $ 2.50 3.00 3.50 3.75 4.50 4.70 4.90 5.30arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education