FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

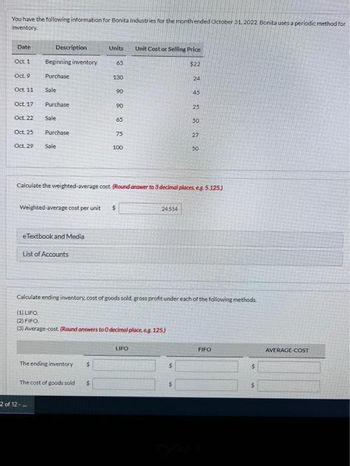

Transcribed Image Text:You have the following information for Bonita Industries for the month ended October 31, 2022. Bonita uses a periodic method for

inventory.

Date

Description

Oct. 1

Oct. 9

Oct. 11

Oct. 17

Oct 22

Oct. 25

Oct. 29 Sale

Beginning inventory

Purchase

Sale

Purchase

Sale

Purchase

2 of 12-

Weighted average cost pe

eTextbook and Media

List of Accounts

Units

The ending inventory $

65

The cost of goods sold $

130

90

90

65

75

Calculate the weighted-average cost. (Round answer to 3 decimal places, eg. 5.125)

cost per unit $

100

Unit Cost or Selling Price

Calculate ending inventory, cost of goods sold, gross profit under each of the following methods.

(1) LIFO.

(2) FIFO

(3) Average-cost. (Round answers to 0 decimal place, eg 125)

LIFO

2 2 2 2 2 2 2

24514

$22

FIFO

$

$

AVERAGE COST

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- You have the following information for Sheridan Inc. for the month ended October 31, 2025. Sheridan uses a periodic system for inventory. Date Oct. 1 Oct. 9 Oct. 11 Oct. 17 Oct. 22 Oct. 25 Description Beginning inventory Purchase Sale Purchase Sale Purchase Oct. 29 Sale eTextbook and Media Ending inventory Cost of goods sold Gross profit Units $ 65 Weighted-average cost per unit $ $ 130 $ 95 e Textbook and Media 95 1. LIFO. 2. FIFO. 3. Average-cost. (Round answers to O decimal places, e.g. 125.) 65 75 105 Calculate the weighted-average cost. (Round answer to 3 decimal places, e.g. 5.125.) Calculate ending inventory, cost of goods sold, and gross profit under each of the following methods. Unit Cost or Selling Price $22 LIFO 24 $ 45 $ 25 50 27 50 FIFO $ $ AVERAGE-COSTarrow_forwardQ/ Here are the inventory records for AT Co for the month of Mar. Date Account name Quantity Unit Cost 1- Mar Balance 100 10 17- Mar Purchase 70 14 19- Mar 23- Mar Sale 60 Sale 50 25- Mar Purchase 40 15 27- Mar Purchase 30 17 31- Mar Sale 50 Required: Using LIFO method under the perpetual system to find Cost of Goods sold and ending inventory.arrow_forwardBramble has the following inventory data: July 1 Beginning inventory 29 units at $5.90 Purchases 118 units at $6.50 14 Sale 78 units 21 Purchases 59 units at $7.10 30 Sale 55 units Assuming that a perpetual inventory system is used, what is the value of ending inventory on a LIFO basis for July? O $459.50 O $897.50 O $1357.00 O $684.60arrow_forward

- 5.The following data pertain to Cross Company (assume a perpetual inventory system) for the month ended January 31, 2019: Date Description Units Unit Cost Unit Selling Price Jan.1 Beg. Inventory 10 $50 5 Purchase 25 52 10 Sale (6) $80 16 Sale (10) 82 20 Purchase 12 55 25 Sale (20) 85 Required: 1. Compute the cost of goods sold and ending inventory under FIFO. 2. Compute Gross Margin under FIFOarrow_forwardVinubhaiarrow_forwardThe accounting records of Kingbird Electronics show the following data. Beginning inventory Purchases Sales 3,060 units at $7 7,140 units at $9. 8,590 units at $12 Determine cost of goods sold during the period under a periodic inventory system using (a) the FIFO method, (b) the LIFO method, and (c) the average-cost method. Cost of goods sold FIFO SA $ LIFO $ Average-cost $arrow_forward

- You have the following information for Van Gogh Inc. for the month ended October 31, 2025.Van Gogh uses a periodic method for inventory. Date Description Units unit cost Selling price per unit 1-Oct Beginning inventory 60 $24 9-Oct Purchase 120 $26 11-Oct Sale 100 $35 17-Oct Purchase 100 $27 22-Oct Sale 60 $40 25-Oct Purchase 70 $29 29-Oct Sale 110 $40 1. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profitrate under LIFO.2. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profit rateunder FIFO.3. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profit rateunder Average-cost (round cost per unit to three decimal places.) Please dont provide solution image based thankuarrow_forwardsharadarrow_forwardneed answerarrow_forward

- Haresharrow_forwardUse this inventory information for the month of March to answer the following questions. Assuming that a periodic inventory system is used, what is ending inventory (rounded) under theaverage-cost method? What is cost of goods sold on a FIFO basis? What is ending inventory under the LIFO method?arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 23 units @ $11 5 Sale 11 units 17 Purchase 24 units @ $12 30 Sale 18 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale. b. Determine the inventory on September 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education