Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

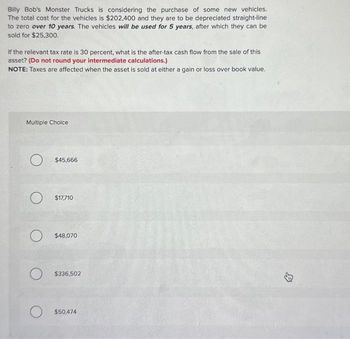

Transcribed Image Text:Billy Bob's Monster Trucks is considering the purchase of some new vehicles.

The total cost for the vehicles is $202,400 and they are to be depreciated straight-line

to zero over 10 years. The vehicles will be used for 5 years, after which they can be

sold for $25,300.

If the relevant tax rate is 30 percent, what is the after-tax cash flow from the sale of this

asset? (Do not round your intermediate calculations.)

NOTE: Taxes are affected when the asset is sold at either a gain or loss over book value.

Multiple Choice

O

$45,666

$17,710

$48,070

$336,502

$50,474

↓

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Consider an asset that costs $1,156,294 and is depreciated straight-line to zero over its 10-year tax life. The asset is to be used in a 3-year project; at the end of the project, the asset can be sold for $214,463. If the relevant tax rate is 0.24, what is the aftertax cash flow from the sale of this asset (SVNOT)?arrow_forwardVishnuarrow_forwardPaulita's Products Inc. is considering the new piece of equipment that costs P75,000. The equipment is expected to generate revenues before-tax cash inflows of P25,000 per year for five year. The equipment would be depreciated using straight-line method over its five-year useful life. Upon retirement, the machine is expected to have a market value of P8,000. The company considers the maximum impact of income taxes in all of its capital investment decisions. The company has a 35 percent income tax rate and desires an after-tax return of 12 percent on its investment. The present value of 1, end of 5 years at 12% is 0.56743 and for ordinary annuity is 3.60478. The net present value of the equipment is: c. P 21,248 b. P 4,539 a. P 7,042 d. P 5,453arrow_forward

- Johnny's lunches is considering purchasing a new energy-efficient grill. The grill will cost $37,000 and will be depreciated straight-line over 3 years. It will be sold for scrap metal after 5 years for $9250. The grill will have no effect on revenues but will save Johnny's $18,500 in energy expenses. The tax rate is 30%. a. What is the operating cash flows in each year? b. What are the total cash flows in each year c. Assuming the discount rate is 11%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased.arrow_forwardYour facility is undergoing a major expansion, which will require significant capitalinvestment into new machinery. The total cost of the machinery will be $7.2 Million, and theywill be purchased outright immediately. This machinery is considered a 7-year MACRSasset. However, you expect to use it for only six years before selling it for $1.5 Million. What is the gains tax owed on the machinery sale at the end of year 6 if the tax rate is 21%? a. $45,108b. $169,692c. $315,000d. $0arrow_forwardHancheta Inc. is considering the purcase of a new vehicle for P350,000. The firm's old vehicle has a book value of P85,000, but can only be sold for P60,000. The new vehicle will be depreciated using a 5 year useful life and the straight line method. It is expected to save P62,000 after taxes from the reduced fuel and maintenance expenses. Tabletop Raul is in the tax bracket and has a 12% cost of capital. Compute for the accounting rate of return on initial investment.arrow_forward

- Please solve it as soon as possible! . Consider an asset with an initial cost of $100,000 and no salvage value. Compute the difference in the present value of the tax shields if CCA is calculated at 20% declining balance compared to if CCA is calculated using a five-year, straight line write off. For your calculation use 30% as the tax rate and 16% as the required return. (The half-year rule applies.) The difference, to the nearest dollar, is A S1.724 B $4,129 C S4.483 d. 59,517 e.$49,969arrow_forwardAnalysts project the FIN340 Company's upcoming 5 years of (undiscounted) cash flow is as follows: Projected (Undiscounted) Future Cash Flows $3,900,000 $4,056,000 $4,218,240 $4,386,970 $4,562,449 Year 1 Year 2 Year 3 Year 4 Year 5 Other key assumptions regarding the FIN340 Company are provided below: • The annual cash flow growth rate assumed in the above projections is 4.0%/year. •The FIN340 Company's terminal value (value of all cash flows in year 6 & beyond) is projected at 2.0 times the discounted value of Year 5 cash flow. The discount rate (required rate of return) for the FIN340 Company is 8.0%. The FIN340 Company has 1,100,000 shares outstanding. • The company carries no debt and is fully financed with equity. Using the Discounted Cash Flow (DCF) Model, calculate the fair market value per share for the FIN340 Company stock (in other words, the maximum price an investor would be willing to pay per share). A. $3.55 B. $60.68 OC. $20.89 D. $19.20 OE. $15.24arrow_forwardMoore & Moore (MM) is considering the purchase of a new machine for $50,000, installed. MM will use the MACRS accelerated method to depreciate the machine, which is classified as 5-year property (see the following MACRS table for depreciation rates). MM expects to sell the machine at the end of its 4-year operating life for $10,000. If MM's marginal tax rate is 40%, what will the after-tax cash flow be when it disposes of the machine at the end of Year 4? Annual depreciation rates for years 1 through 6 are respectively as follows: 20%, 32%, 19%, 12%, 11%, 6%. A. $7,656 B. $8,059 C. $8,484 D. $8,930 E. $9,400arrow_forward

- Consider an asset that costs $1,075, 196 and is depreciated straight-line to zero over its 15-year tax life. The asset is to be used in a 5-year project; at the end of the project, the asset can be sold for $109, 800. If the relevant tax rate is 0.39, what is the aftertax cash flow from the sale of this asset (SVNOT)?arrow_forwardEmma's Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of 4 years. The estimated pretax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital. Emma's Bakery has a 10% after-tax required rate of return and a 30% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes using the initial investment in the oven and its estimated terminal disposal value. Assume all cash flows occur at year-end except for initial investment amounts. E (Click the icon to view the estimated cash flows for the oven.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Data Table i Requirements А В D E 1 Relevant Cash Flows at End of Each Year 1. Calculate (a) net present value, (b) payback period, and (c) internal rate of return. 2. Calculate accrual accounting rate of return based on…arrow_forwardJohnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $32,000 and will be depreciated straight- line over 3 years. It will be sold for scrap metal after 5 years for $8,000. The grill will have no effect on revenues but will save Johnny's $16,000 in energy expenses. The tax rate is 30%. Required: a. What are the operating cash flows in each year? b. What are the total cash flows in each year? c. Assuming the discount rate is 12%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? Complete this question by entering your answers in the tabs below. Required A Required B Required C What are the operating cash flows in each year? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year 1 2 3 Operating Cash Flowsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education