FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

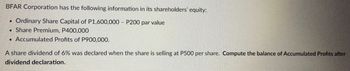

Transcribed Image Text:BFAR Corporation has the following information in its shareholders' equity:

Ordinary Share Capital of P1,600,000 - P200 par value

Share Premium, P400,000

Accumulated Profits of P900,000.

●

A share dividend of 6% was declared when the share is selling at P500 per share. Compute the balance of Accumulated Profits after

dividend declaration.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Brenda Limited has an enterprise value of $10 million, total debt of $4 million and 2 million shares outstanding. The latest balance sheet of the firm reports assets worth $8 million. The per-share market value of the equity is: Select one: a. $2.00 b. $3.00 c. $4.00 d. $5.00arrow_forwardConsider firm X and Y.The firm had total earrings of $400,000 and shares outstanding of $95,000. Firm X per share market value is 4.5, Firm X per share book value is$4.5. Firm Y per share had total earnings of $300,000 and shares outstanding of $192,500. FirmY per share market value is $24.5 Firm Y per share book value is $312.875. a. Assume that firm X acquires FirmY by issuing long term debt to purchase all the shares outstanding at a merger premium of$6.875. Assuming that neither firms has any debt before merger, what would be the total assets for the new company XY? b.Assume that Firm Y acquires Firm X by issuing long term debt to purchase all the shares outstanding at a merger premium of $2.375. Assuming that neither firm has any debt before the merger, what would be the total assets for the new company YX round your answer to four decimal places after the pointarrow_forwardSanders plc issued 50, 000 equity shares of 25p each at a premium of 50p per share. The cash received was correctly recorded but the full amount was also recorded in the equity share capital account. Which of the followings corrects this error? O A. Decrease share capital £25, 000, Increase share premium £25,000 O B. Increase share premium £25,000, Increase cash £25,000 O C. Increase share capital £25,000, Increase cash £25,000 O D. Decrease share premium £25, 000, Increase share capital £25,000 O E. Decrease share capital £37, 500, Increase share premium £37,500 OF. Decrease share capital E25, 000, Increase cash £25,000arrow_forward

- State the stockholder’s equity of the Alphabet Corporation if it has a current net profit of $1,500,000, beginning-of-the-period retained earnings of $3,675,000, 1 million shares of common stock issued at a par value of $1 per share, and paid-in capital in excess of par of $12.50 per share?arrow_forwardXYZ Corporation had the following balance sheet information: Total assets: $500,000Total liabilities: $200,000Shareholders' equity: $300,000If XYZ Corporation has 50,000 shares outstanding, what is the book value per share?arrow_forwardThe equity section of Windsor SA appears below as of December 31, 2022. Share capital-preference (6% preference shares, R$50 par value, authorized 94,600 shares, outstanding 84,600 shares) Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares) Share premium-ordinary Retained earnings Net income Earnings Per Share: Income from continuing operations Discontinued operations, net of tax R$125,960,000 Net income 31,020,000 R$ R$4,230,000 Net income for 2022 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of R$11,280,000 (before tax) as a result of discontinued operations. Preference dividends of R$253,800 were declared and paid in 2022. Dividends of R$ 940,000 were declared and paid to ordinary shareholders in 2022. 10,000,000 Compute earnings per share data as it should appear on the income statement of Windsor SA. (Round answers to 2 decimal places, e.g. 1.48.) 19,270,000 156,980,000 R$190,480,000arrow_forward

- Before Riverbed Ltd. engages in the treasury share transactions listed below, its general ledger reflects, among others, the following account balances (par value is £30 per share). Share Premium-Ordinary Share Capital-Ordinary £91,700 £269,400 Retained Earnings (a) Bought 390 treasury shares at £39 per share. (b) Bought 300 treasury shares at £45 per share. (c) Sold 350 treasury shares at £41 per share. (d) Sold 100 treasury shares at £37 per share. £81,900 Record the treasury share transactions (given below) under the cost method of handling treasury shares; use the FIFO method for purchase-sale purposes. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardOn June 30, 2020, when ABC shares were selling for $ 65 each, the equity accounts had the following balances: Common shares (par value $ 50: 50,000 issued) $ 2,500,000 Capital contributed in excess of par value 600,000 Retained earnings 4,200,000 A 100% share dividend is declared and distributed, the balance of the Common Shares account after recording the dividend will be: a. $2,500,000 b. $7,300,000 c. $3,100,000 d. $5,000,000arrow_forwardSturdy Stone Tools, Inc., announced a 100 percent stock dividend. Determine the impact (increase,decrease, no change) of this dividend on the following:1. Total assets.2. Total liabilities.3. Common stock.4. Total stockholders’ equity.5. Market value per share of common stock.arrow_forward

- Star Ltd. presents the following information from the Statement of Financial Position: Equity £ Capital (120, 000 shares of £1 120,000 each) Retained Profits Share premium Total Equity 22,000 50,000 192,000 Star Ltd. issues 20, 000 ordinary shares for a price of £2. Considering the previous information and the economic transaction of issuing ordinary shares, which of the following statements is correct? O a. The company increases cash in £20,000 and share premium decreases in the same amount. O b. The company decreases cash in £40,000 and total equity remains unchanged. O c. The company increases cash in £40,000 and equity increases in the same amount. O d. None of the answers is true.arrow_forwardUte Company reported the following capital structure during the current year: 5% cumulative preference share capital, par value P100, 25,000 shares issued and outstanding Ordinary Share capital, par value P35, 100,000 shares issued and outstanding The entity reported net income of P5,000,000 for the current year. The entity paid P125,000 in preference dividends in the current year. 7. What amount should be reported as the basic earnings per share? a. 48.75 b. 50.00 c. 51.25 2,500,000 3,500,000arrow_forwardThe following is from BC Corp. balance sheet: Common Stock (1 million shares) Retained Earnings $15,000,000 15,000,000 30,000,000 Additional information: Earnings = $6,600,000 P/E ratio = 20 a. What is the impact on the B/S if the firm declares a 10% stock dividend? b. What is the value of the stock dividend to an investor who owns 100 shares?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education