FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. What is the weighted average number of ordinary shares outstanding that should be used for the computation of book value per share and basic earnings per share?

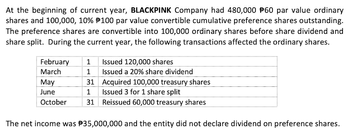

Transcribed Image Text:At the beginning of current year, BLACKPINK Company had 480,000 $60 par value ordinary

shares and 100,000, 10% 100 par value convertible cumulative preference shares outstanding.

The preference shares are convertible into 100,000 ordinary shares before share dividend and

share split. During the current year, the following transactions affected the ordinary shares.

February 1

Issued 120,000 shares

March

1

Issued a 20% share dividend

May

31

Acquired 100,000 treasury shares

Issued 3 for 1 share split

June

1

October 31 Reissued 60,000 treasury shares

The net income was $35,000,000 and the entity did not declare dividend on preference shares.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following best describes the market capitalization of a company? Select one: a. it represents the total value of the company b. it is the product of the numbers of shares and the price per share c. it represents the total wealth associated with the company's earnings d. it is the most someone would pay for the stockarrow_forwardCan you help me with #11-#13?arrow_forwardThe return on equity is calculated using which of the following formulas? Multiple Choice Net income Stockholders' equity Net income - Average stockholders' equity Net income ÷ Common Stock Net income ÷ Retained earningsarrow_forward

- What does the price-to-earnings (P/E) ratio indicate? A) The percentage of earnings paid out as dividends B) The market price per share divided by earnings per share C) The rate of return on shareholders' equity D) The book value of equity per sharearrow_forwarda. Times interest earned ratio times b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield % %24arrow_forwardHow are dividends per share for common stock used in the calculation of the following? O A. O B. O c. OD. Dividends per share payout ratio Numerator Numerator Denominator Denominator Earnings per share Numerator Not used Not used Denominatorarrow_forward

- Ratios concerned with returns from, and the performance of, shares are 1.Market ratios 2.effeciency ratio 3.liquidity ratios 4.solvency ratioarrow_forwardThe price-earnings ratio on common stock is calculated as a.market price per share of common stock, divided by earnings per share on common stock b.market price per share of common stock, divided by dividends per share of common stock c.earnings per share of common stock, divided by market price per share of common stock d.dividends per share of common stock, divided by earnings per share on common stockarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education