FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

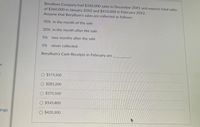

Transcribed Image Text:Beryllium Company had $330,000 sales in December 20X1 and expects total sales

of $360,000 in January 20X2 and $410,000 in February 20X2.

Assume that Beryllium's sales are collected as follows:

70% in the month of the sale

20% in the month after the sale

5%

two months after the sale

5% never collected.

Beryllium's Cash Receipts in February are

O $573,500

O $283,200

O $375,500

O $145,800

lings

O $420,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $74,000 in June, $68,000 in July, and $88,000 in August? Cash collected $fill in the blank 1arrow_forwardomework (required) Anderson Corporation has found that 80% of its sales in any given month are credit sales, while the remainder are cash sales. Of the credit sales, Anderson Corporation has experienced the following collection pattern: 25% received in the month of the sale 50% received in the month after the sale 18% received two months after the sale 7% of the credit sales are never received Cash sales Collections on credit sales: 25% Month of sale 50% Month after 18% Two months after Total cash collections Anderson Corporation Cash Collections Budget For the Months of January through March January February $ $ 33,000 Part 2 of 4 33,000 50,000 12,960 128,960 Points: 0.2 of 2 January sales.. February sales March sales. November sales for last year were $90,000, while December sales were $125,000. Projected sales for the next three months are as follows: Save $ 165,000 $ 130,000 $ 200,000 Requirement Prepare a cash collections budget for the first quarter, with a column for each month…arrow_forwardWhispering Company has the following sales projections for its second and third quarters: Аpril $300,000 Мay $320,000 June $340,000 July $360,000 August $350,000 September $330,000 Normal cash collection experience has been that 40% of sales are collected during the month of sale, 20% in the month following sale, and 35% in the second month following sale. The remaining 5% of sales is never collected.arrow_forward

- Page Company makes 30% of its sales for cash and 70% on account. 60% of the credit sales are collected in the month of sale, 25% in the month following sale, and 12% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current year: Month Total sales Total cash receipts in Month 4 will be: Multiple Choice $27,230. $47,900. 1 2 3 $ 60,000 $ 70,000 $50,000 $30,000 £36 230arrow_forwardYou collect 75% of a month's sales in the month of the sale and 25% of sales in the following month. May sales June sales July sales O $105 O $35 $120 Compute cash inflows for June. $135 $140 $100 not enough information, because sales revenue differsarrow_forwardPardee Company makes 30% of its sales for cash and 70% on account. 60% of the account sales are collected in the month of sale, 25% in the month following sale, and 12% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current year: Month 1 2 3 4 Total sales $78,000 $80,000 $68,000 $48,000 Total cash receipts in Month 4 will be: A. 38,780 B.68,000 C.53,180 D.50,600arrow_forward

- Mountaineers expects total sales of $702,500 for January and $351,000 for February. Assume that Mountaineers's sales are collected as follows: November sales totaled $398,000, and December sales were $407,000. Prepare a schedule of cash receipts from customers for January and February. Round answers to the nearest dollar. (If an input field is not used in the table leave the input field empty, do nothing enter a zero.)arrow_forwardEarthie's Shoes has 55% of its sales in cash and the remaining 45% are credit sales. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardCash Collections for Belcher Motors found that 35% of its sales were cash and the remaining 65% are credit sales. Of the credit sales, the company collected 55% in the month of sale, 40% collected the month after the sale, and 5% collected the second month after the sale. May Sales were $100 000, April Sales were $115,000, and June Sales were 136,000. How much will be collected in the 3rd quarter if July sales are $180,000, August sales are 167,000, and September sales are $152,000, and include a total column for the 3rd quarter total.arrow_forward

- 5. Pacific Place has developed the following sales forecast for the following months. Month Sales May $500,000 June $650,000 July $380,000 August $300,000 The collection policy for customers is: 40 percent in the month of sale 60 percent in the following month after sale How much is the expected total cash collections from customers in June? a)$260,000 b)$590,000 c)$610,000 d)$300,000 e)$560,000arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August? NOTE: Enter amounts rounded to the nearest whole dollar. Cash sales Cash for collections the month of sale Cash for collections the month after sale Cash for collections two months after sale TOTAL cash receipts S S LAarrow_forwardK- Mer Company expects its November sales to be 25% higher than its October sales of $150.000 Al sales are on credit and are collected as follows: 35% in the month of the sale and 60% in the following month. Purchases were $130,000 in October and are expected to be $150.000 in November Purchases are paid 35% in the month of purchase and 65% in the following month. The cash balance on November 1 is $13.900 The cash balance on November 30 will be G A $32.525 OB $4,725 OC $160,525 OD. $18.625arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education