FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

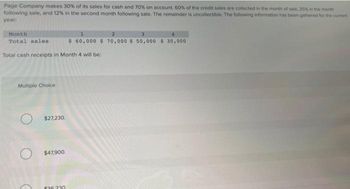

Transcribed Image Text:Page Company makes 30% of its sales for cash and 70% on account. 60% of the credit sales are collected in the month of sale, 25% in the month

following sale, and 12% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current

year:

Month

Total sales

Total cash receipts in Month 4 will be:

Multiple Choice

$27,230.

$47,900.

1

2

3

$ 60,000 $ 70,000 $50,000 $30,000

£36 230

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonna's Re-Appliance Store collects 54% of its accounts receivable in the month of sale and 36% in the month after the sale. Given the following sales, how much cash will be collected in February? Round to the nearest penny, two decimal places. Nonna's Re-Appliance Store data Month December January February Sales $21,512 $63,966 $72,252arrow_forwardDuring March, Sam Company had cash sales of $35,000 and sales on account of $210,000. In April, payments on account totaled $175,000. The journal entry prepared by Sam to record the March sales would include a debit to: A. Cash for $35,000, debit to accounts receivable for $210,000, and credit to sales revenue for $245,000 B. Cash for $35,000, debit to deferred revenue for $210,000, and credit to sales revenue for $245,000 C. Cash for $35,000, debit to accounts payable for $210,000, and credit to sales revenue for $245,000 D. Cash and credit to sales revenue for $35,000arrow_forwardDream Big Pillow Co., pays 65% of its purchases in the month of purchase, 30% the month after the purchase, and 5% in the second month following the purchase. It made the following purchases at the end of 2017 and the beginning of 2018: Nov. 2017 Dec. 2017 Jan. 2018 Feb. 2018 Mar. 2018 $61,000 $52,000 $36,000 $38,000 $46,000 Given the above purchases, how much cash will be paid in quarter 2018? Cash paid $fill in the blank 1arrow_forward

- Nonna's Re-Appliance Store collects 52% of its accounts receivable in the month of sale and 37% in the month after the sale. Given the following sales, how much cash will be collected in February? Round to the nearest penny, two decimal places. Month Sales Nonna's Re-Appliance Store data December $20,688 January $62,044 February $69,259arrow_forward. With regard to accounts payable: Explain the rationale of taking a cash discount, such as 4/8, n/30. Assume a purchase of $1,000,000. include computations Additionally, determine the approximate balance of accounts payable, if a company stretches its payables to 40 days and on average, they make purchases of $1,000,000 per day from their vendors.arrow_forwardPardee Company makes 30% of its sales for cash and 70% on account. 60% of the account sales are collected in the month of sale, 25% in the month following sale, and 12% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current year: Month 1 2 3 4 Total sales $78,000 $80,000 $68,000 $48,000 Total cash receipts in Month 4 will be: A. 38,780 B.68,000 C.53,180 D.50,600arrow_forward

- On average, your firm sells $32,300 of items on credit each day. The average inventory period is 27 days and your operating cycle is 47 days. What is the average accounts receivable balance? $872,100 $1.292.000 $904,400 $646,000 $1,518,100arrow_forwardplease dont give solutions in an image thnxarrow_forwardKarim Corp. requires a minimum $9,000 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid monthly). Any excess cash is used to repay loans at month-end. The cash balance on July 1 is $9,400, and the company has no outstanding loans. Forecasted cash receipts (other than for loans received) and forecasted cash payments (other than for loan or interest payments) follow. July August September Cash receipts $ 25,000 $ 33,000 $ 41,000 Cash payments 29,500 31,000 33,000 Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) KARIM CORP. Cash Budget For July, August, and September July August September Beginning cash balance $9,400 Total cash available Preliminary cash balance Ending cash…arrow_forward

- Financial information for Strawberry’s Place is as follows: Cash at 1/1/20X1 is $10,000. The firm desires to maintain a minimum balance of $10,000 at the end of each month. Total monthly sales are as follows: DecemberJanuaryFebruary 20X020X120X1 $120,000150,000 (est.)160,000 (est.) The sales are 40 percent cash and 60 percent credit card. Visa is the only acceptable credit card at Strawberry’s, and assume the charges are converted to cash the day of the sale. The brokerage charge is 2 percent of the sale. Expected other income is $2,000 from interest to be received in February. In addition, in January, a range with a net book value of $300 is expected to be sold for cash, resulting in a $1,000 gain on the sale. Food and beverages are paid for the month following the sale and average 40 percent and 25 percent, respectively. Food sales are four times beverage sales. Total sales consist of only food and beverage sales. Labor is paid for the last day of the month and…arrow_forwardDream Big Pillow Co., pays 65% of its purchases in the month of purchase, 30% the month after the purchase, and 5% in the second month following the purchase. It made the following purchases at the end of 2017 and the beginning of 2018: Nov. 2017 Dec. 2017 Jan. 2018 Feb. 2018 Mar. 2018 $58,000 $48,000 $33,000 $39,000 $45,000 Given the above purchases, how much cash will be paid in quarter 2018? Cash paid $arrow_forwardKeep Calm Company provided the following information for the current year: Accounts receivable, January 1 2,100,000 Accounts receivable, December 31 2,700,000 Collections of accounts during the year 9,000,000 Inventory, January 1 4,500,000 Purchases during the year 5,800,000 All sales are made on account. The mark up on cost is 20% What is the estimated inventory at December 317arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education