Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:omework (required)

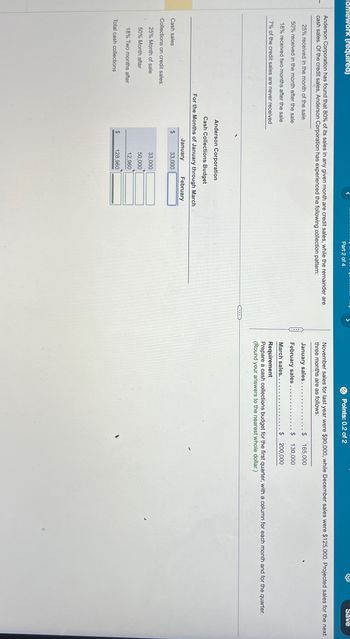

Anderson Corporation has found that 80% of its sales in any given month are credit sales, while the remainder are

cash sales. Of the credit sales, Anderson Corporation has experienced the following collection pattern:

25% received in the month of the sale

50% received in the month after the sale

18% received two months after the sale

7% of the credit sales are never received

Cash sales

Collections on credit sales:

25% Month of sale

50% Month after

18% Two months after

Total cash collections

Anderson Corporation

Cash Collections Budget

For the Months of January through March

January

February

$

$

33,000

Part 2 of 4

33,000

50,000

12,960

128,960

Points: 0.2 of 2

January sales..

February sales

March sales.

November sales for last year were $90,000, while December sales were $125,000. Projected sales for the next

three months are as follows:

Save

$ 165,000

$ 130,000

$

200,000

Requirement

Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter.

(Round your answers to the nearest whole dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardDo not give answer in imagearrow_forwardAlderman Corporation has found that 70% of its sales in any given month are credit sales, while the remainder are cash sales. Of the credit sales, Alderman Corporation has experienced the following collection pattern 20% received in the month of the sale 40% received in the month after the sale 22% received two months after the sale 18% of the credit sales are never received Cash sales Collections on credit salos 20% Month of sale 40% Month after 22% Two months after EXCE November sales for last year were $110,000, while December sales were $115,000 Projected sales for the next three months are as follows: January sales.. February sales. March sales. $ 160,000 120,000 $ 165,000 Requirement Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter (Round your answers to the Alderman Corporation Cash Collections Budget For the Months of January through March January In (2) (2)arrow_forward

- owearrow_forwardPlease solve this question general Accountingarrow_forwardNovember sales for last year were $100,000, while December sales were $115,000. Projected sales for the next three months are as follows: January sales... February sales. March sales... $ 165,000 $ 125,000 . $ 190,000 Requirement Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter. (Round your answers to the nearest whole dollar.)arrow_forward

- Monette Corporation has found that 70% of its sales in any given month are credit sales, while the remainder are cash sales. Of the credit sales, Monette Corporation has experienced the following collection pattern: 25% received in the month of the sale 50% received in the month after the sale 16% received two months after the sale 9% of the credit sales are never received Cash sales Collections on credit sales: 25% Month of sale 50% Month after 16% Two months after Total cash collections Monette Corporation Cash Collections Budget For the Months of January through March January C November sales for last year were $100,000, while December sales were $115,000. Projected sales for the next three months are as follows: January sales. February sales March sales... $ 160,000 130,000 190,000 .$ Requirement Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter. (Round your answers to the nearest whole dollar.)arrow_forwardplease answer with complete solutionarrow_forwardsolve jan feb march quater fast please do itarrow_forward

- Alpha Company makes all its sales on account. Accounts receivable payment experience is as follows: Percent paid in the month of sale 35% Percent paid in the month after the sale 54% Percent paid in the second month after the sale 6% Alpha provided information on sales as follows: Мay $150,000 June $125,000 July $136,000 August (expected) $142,000 How much of May's sales are expected to be uncollectible?arrow_forwardAssume Laksko's has credit sales of $462,400 in March, $507,500 in April, and $550,200 in May. Also assume that 64 percent of sales are collected in the month of sale, 35 percent are collected in the following month, and the remainder are never collected. Credit purchases are $224,600 in March, $236,700 in April, and $252,700 in May. Credit purchases are paid in 30 days. Interest is $12,400 a month, wages and other expenses are $64,400 a month. Fixed assets purchases of $119,500 are scheduled for April with additional purchases of $56,400 in May. The April 1 cash balance was $321,060 and taxes of $180,000 must be paid on April 15. What is the cash balance at the end of May?arrow_forwardHelp my questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT