Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

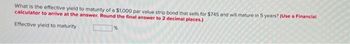

Transcribed Image Text:What is the effective yield to maturity of a $1,000 par value strip bond that sells for $745 and will mature in 5 years? (Use a Financial

calculator to arrive at the answer. Round the final answer to 2 decimal places.)

Effective yield to maturity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that today you purchased a Treasury Note with the following characteristics: Par (face) value = $1,000 Maturity = five years from today Coupon interest rate =5% ALL OTHER THINGS BEING EQUAL: If the prevailing interest rates for instruments of similar risk and maturity were to increase from 5% to 10% next week, what would happen to the value of your bond in the secondary market? Explain. (It is not necessary to calculate the yield to maturity. Simply explain the general effects of the change in rates)arrow_forwardNeed help finding the current yield for both bond P and D, & the capital yield gains for both bonds P and D. Thank you in advancearrow_forwardneed help with finding the current yield and capital gains yield for bond p and bond d, thank youarrow_forward

- Assume that today you purchased a Treasury Note with the following characteristics: Par (face) value = $1,000 Maturity = five years from today Coupon interest rate =5% ALL OTHER THINGS BEING EQUAL: If the prevailing interest rates for instruments of similar risk and maturity were to increase from 5% to 10% next week, what would happen to the value of your bond in the secondary market? Explain. (It is not necessary to calculate the yield to maturity. Simply explain the general effects of the change in rates)arrow_forwardA bond with a coupon rate of 10 percent sells at a yield to maturity of 11 percent. If the bond matures in 10 years, what is the Macaulay duration? Note: Do not round intermediate calculations. Round your answer to 3 decimal places. Macaulay duration yearsarrow_forwardWhat is the market price of a bond if the face value is $1,000 and the yield to maturity is 5.7%? The bond has a 5.15% coupon rate and matures in 14 years. The bond pays interest semiannually. Please express answer as $X.XX or XX.XX and use rounding guideline included in "Course Information" module. Do not round until the final result.arrow_forward

- What is the yield to call of a 20-year to maturity bond that pays a coupon rate of 6.54 percent per year, has a $1,000 par value, and is currently priced at $1,104? The bond can be called back in 7 years at a call price $1,056. Assume annual coupon payments. Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) You should use Excel or financial calculator.arrow_forwardCalculate the YTM based on the information provided and explainthe difference between the Yield to Maturity rate and the originalcoupon rate. YTM Bond Details: A bond is currently selling for $850 with 15 years until it matures.The bond has a current coupon rate of 6% and makes paymentssemi-annually. You purchase the bond today 1/1/2023 as yoursettlement date and you are interested in knowing what the YTMwill be. **Note, when calculating the YTM the bond price (% of par)and face value (% of par) will not be percentages, please usenumbers for their respective section. The Yield Calculation is alreadybuilt into excel, all you have to do is type is =yield.arrow_forwardassume the interest rate on a 1-year t bond is currently 7% and the rate on a 2-year bond is 9%. If the maturity risk premium is .5% what is a reasonable forecast of the rate on a 1 year T bond next year. Round to 2 decimals placesarrow_forward

- You find a bond with 27 years until maturity that has a coupon rate of 9 percent and a yield to maturity of 10 percent. What is the Macaulay duration? The modified duration? Note: Do not round intermediate calculations. Round your answers to 3 decimal places.arrow_forwardA bond with a coupon rate of 8 percent sells at a yield to maturity of 7 percent. If the bond matures in 10 years, what is the Macaulay duration? Note: Do not round intermediate calculations. Round your answer to 3 decimal places.arrow_forwardA bond that matures in 7.5 years and pays semi-annual payments of 20.1 is priced at 98.70. What is the coupon rate if the face value is, as always, 1,000? ( well explain all point of question with proper answer).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education