FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

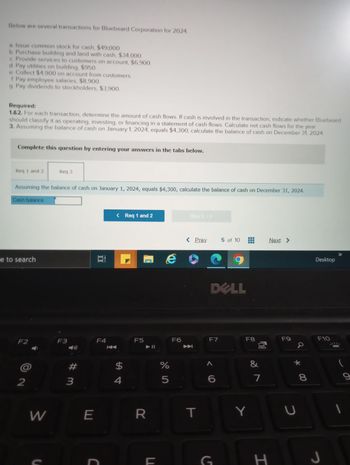

Transcribed Image Text:Below are several transactions for Bluebeard Corporation for 2024

a. Issue common stock for cash, $49,000.

b. Purchase building and land with cash, $34,000.

c. Provide services to customers on account, $6,900.

d. Pay utilities on building, $950.

e. Collect $4,900 on account from customers.

of Pay employee salaries, $8,900.

g. Pay dividends to stockholders, $3,900.

Required:

1.&2. For each transaction, determine the amount of cash flows. If cash is involved in the transaction, indicate whether Bluebeard

should classify it as operating, investing, or financing in a statement of cash flows. Calculate net cash flows for the year.

3. Assuming the balance of cash on January 1, 2024, equals $4,300, calculate the balance of cash on December 31, 2024

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Assuming the balance of cash on January 1, 2024, equals $4,300, calculate the balance of cash on December 31, 2024.

Cash balance

e to search

F2

@

2

Req 3

W

F3

#m

3

E

Et

F4

< Req 1 and 2

$

4

F5

C

R

F

e

%

5

F6

Req 3 >

< Prev

玉

T

DELL

F7

< 6

5 of 10

G

‒‒‒

T

F8

Y

00

&

7

H

Next >

F9

a

* 00

U

8

Desktop

F10

J

|

9

![du

Homework

X

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ftamusa blackbo

ar Nam... ball polisll (77) 5 [4/4] Movie - Ashab... 2 109 Fredonia St, Sa... 2142 Sargent St, San... 142 Sargent St, San...

Below are several transactions for Bluebeard Corporation for 2024.

a. Issue common stock for cash, $49,000.

b. Purchase building and land with cash, $34,000.

c. Provide services to customers on account, $6,900.

Question 5 - Chapter 4 Homewo X

d. Pay utilities on building, $950.

e. Collect $4,900 on account from customers.

f. Pay employee salaries, $8,900.

g. Pay dividends to stockholders, $3,900.

Req 1 and 2

Complete this question by entering your answers in the tabs below.

ere to search

Required:

1.&2. For each transaction, determine the amount of cash flows. If cash is involved in the transaction, indicate whether Bluebeard

should classify it as operating, investing, or financing in a statement of cash flows. Calculate net cash flows for the year.

3. Assuming the balance of cash on January 1, 2024, equals $4,300, calculate the balance of cash on December 31, 2024.

F2

Req 3

lerun common stock for cach $40.000

F3

For each transaction, determine the amount of cash flows. If cash is involved in the transaction, indicate whether Bluebeard

should classify it as operating, investing, or financing in a statement of cash flows. Calculate net cash flows for the year.

(Enter N/A if the question is not applicable to the statement. List cash outflows as negative amounts.)

Transaction

Activity Stream

Et

F4

K

F5

11

Cash Flows

e

F6

▶

Saved

Operating, Investing

or Financing

< Prex

F7

X

5 of 10

DOLL

+

F8

Next >

F9

a

Desktop

F10

F1](https://content.bartleby.com/qna-images/question/d1c8773d-3f1d-494c-b776-10604035d8d4/6ab42e24-793a-4d69-96d0-1a74ef84ce65/4zowtyn.jpeg)

Transcribed Image Text:du

Homework

X

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ftamusa blackbo

ar Nam... ball polisll (77) 5 [4/4] Movie - Ashab... 2 109 Fredonia St, Sa... 2142 Sargent St, San... 142 Sargent St, San...

Below are several transactions for Bluebeard Corporation for 2024.

a. Issue common stock for cash, $49,000.

b. Purchase building and land with cash, $34,000.

c. Provide services to customers on account, $6,900.

Question 5 - Chapter 4 Homewo X

d. Pay utilities on building, $950.

e. Collect $4,900 on account from customers.

f. Pay employee salaries, $8,900.

g. Pay dividends to stockholders, $3,900.

Req 1 and 2

Complete this question by entering your answers in the tabs below.

ere to search

Required:

1.&2. For each transaction, determine the amount of cash flows. If cash is involved in the transaction, indicate whether Bluebeard

should classify it as operating, investing, or financing in a statement of cash flows. Calculate net cash flows for the year.

3. Assuming the balance of cash on January 1, 2024, equals $4,300, calculate the balance of cash on December 31, 2024.

F2

Req 3

lerun common stock for cach $40.000

F3

For each transaction, determine the amount of cash flows. If cash is involved in the transaction, indicate whether Bluebeard

should classify it as operating, investing, or financing in a statement of cash flows. Calculate net cash flows for the year.

(Enter N/A if the question is not applicable to the statement. List cash outflows as negative amounts.)

Transaction

Activity Stream

Et

F4

K

F5

11

Cash Flows

e

F6

▶

Saved

Operating, Investing

or Financing

< Prex

F7

X

5 of 10

DOLL

+

F8

Next >

F9

a

Desktop

F10

F1

Expert Solution

arrow_forward

Step 1

The cash flows of the company are divided into three types of activities like financing, operating, and investing. The operating cash flow generally includes cash flows from day-to-day operations. The cash inflows increase the cash balance.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I get both sides to balance? Assets =Liabilities and Stockholders Equity? I cant seem to find the shareholders equity amount. Assets Liabilities and Stockholders Equity Cash $ 7,000.00 Accounts Payable $14,000 Accounts Recievable $ 19,000.00 Long-Term Debt $140,000 Inventory $170,000.00 Shareholders Equity $7,000 PP&E $ 70,000.00 266,000 $161,000 Cash $ 7,000.00 inventory of TV $ 170,000.00 PP&E 70000 Accounts Recievable $ 19,000.00 Accounts Payable $14,000 Long-Term Debt $140,000 Shareholders Equity XXarrow_forwardPlease do not give solution in image format thankuarrow_forwardQUESTION I Below are the balances available for Delima Berhad as at 31 December 2015: Statement of Financial Position of Delima Berhad as 31 December 2015 RM 170,000,000 115,000,000 150,000,000 435,000,000 Non-current assets Current assets (except cash at hank) Cash at bank Issued share capital 100,000,000 ordinary shares Retained profits Non-current liability 50,000,000 5% redeemable preference shares Current liabilities Additional information: On 1 January 2016, the directors decided on the following matters 100,000,000 3. To redeem 5% redeemable preference shares at a premium of 10% 240,000,000 55,000,000 20,000,000 435,000,000 1. To issue bonus shares of one (1) ordinary shares for every ten (10) shares held to the existing shareholders. 2. To repurchase 2,000,000 ordinary shares at RM1.50 each for cancellation. (u 4 To issue 30,000,000 ordinary shares at RMI. The application were paid and fully subscribed Required: a) Prepare journal entries to record above transactions b) Prepare…arrow_forward

- What is the D/E Ratio=Total Debt/Total Equity? Equity Ratio=Total Shareholders equity/Total assets? Debt Ratio = Total Debt / Total assets Lola's Company Balance Sheet December 31st, 2020 Assets Cash and Cash Equivalents $100,000 Accounts Receivable $150,000 Inventory $200,000 Prepaid Expenses $50,000 Property, Plant and Equipment $500,000 Total Assets $1,000,000 Liabilities Accounts Payable $100,000 Notes Payable $200,000 Accrued Expenses $50,000 Total Liabilities $350,000 Owner's Equity Common Stock $250,000 Retained Earnings $400,000 Total Owner's Equity $650,000 Total Liabilities and Owner's Equity $1,000,000 Statement of Owner's Equity December 31st, 2020 Owner's Equity at Beginning of Year $400,000 Net Income for the Year $130,000 Issuance of Common Stock $50,000 Dividends Paid ($30,000) Owner's Equity at End of Year $550,000 Lola's Company Statement of Cash Flow December 31st, 2020 Cash Flows from Operating Activities Net Income Depreciation Expense $100,000 $50,000 Increase in…arrow_forwardStudypug.com Received $45,000 cash from Alex Xu as an additional investment in exchange for common stock. Which of the following is the journal entry the company should record? a. Cash 45,000 Common Stock 45,000 b. Common Stock 45,000 Cash 45,000 c. Cash 45,000 Dividends 45,000 d. Common Stock 45,000 Sales Revenue 45,000arrow_forwardThe balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net Income is $150,600. 2. Sales on account are $1,215,500. (All sales are credit sales.) 3. Cost of goods sold is $973,400. Complete this question by entering your answers in the tabs below. a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity 2024 19.9 % 13.9 % %6 $208,600 60,000 86,000 3,100 times %6 390,000 390,000 700,000 580,000 (338,000) (178,000)…arrow_forward

- board emaining Time: 1 hour, 12 minutes, 24 seconds. uestion Completion Status: OD.Does not affect total equity, but transfer amounts between the components of equity. QUESTION 4 What is the total amount of cash and other assets the corporation receives from its stockholders in exchange for its stock? O A. It always equal the stated value. O B. It always equal the par value. O C. It is referred to as paid-in capital. D. It is always below the stated value. QUESTION 5 Use the following company information to calculate net cash provided or used by investing activities: (1) Equipment with a book value of $131.250 and an original cost of $225,000 was sold at a loss of $12.750. (2) Paid $46,500 cash for a new truck. (3) Sold land costing $24,000 for $27.000 cash, realizing a $3,000 gain. LA Dchsend troseuncctock for SA5 750ench Click Save and Submit to save and submit. Click Save All Answers to save all answers. hparrow_forwardPlease help me with show all answers I will give upvote thankuarrow_forwardPlease answer with reasonarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education