FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

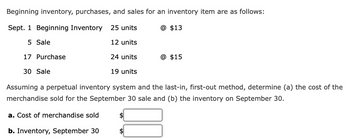

Transcribed Image Text:Beginning inventory, purchases, and sales for an inventory item are as follows:

Sept. 1 Beginning Inventory 25 units

@ $13

5 Sale

12 units

17 Purchase

30 Sale

a. Cost of merchandise sold

24 units

b. Inventory, September 30

19 units

Assuming a perpetual inventory system and the last-in, first-out method, determine (a) the cost of the

merchandise sold for the September 30 sale and (b) the inventory on September 30.

$

@ $15

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 57 units @ $25 7 Sale 46 units 15 Purchase 41 units @ $27 24 Sale 18 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of the goods sold on October 24 and (b) the inventory value on October 31. a. Cost of the goods sold on October 24 $ 464 b. Inventory value on October 31 A 324 Xarrow_forwardBeginning inventory, purchases, and sales for Item MMM8 are as follows: November 1 Inventory 109 16 9 Sale 91 16 Purchase 129 14 25 Sale 77 Assuming a perpetual inventory system and using the Last-in, first-out (FIFO) method, determine the inventory value on November 30.arrow_forwardPlease help mearrow_forward

- Beginning inventory, purchases, and sales for an inventory item are as follows: Sept. 1 Beginning inventory 21 units @ $21 5 Sale 12 units 17 22 units 30 Sale 24 units Assuming a perpetual inventory system and the first-in, first-out method, determine (a) the cost of the merchandise sold for the September 30 sale and (b) the inventory on September 30. a. Cost of merchandise sold b. Inventory, September 30 Purchase @ $22arrow_forwardBeginning inventory, purchases, and sales for Item 88-HX are as follows: July 1 86 units @ $21 8 69 units 15 95 units @ $23 27 80 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on July 27 and (b) the inventory on July 31. a. Cost of goods sold on July 27 b. Inventory on July 31 Inventory Sale Purchase Salearrow_forwardPerpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory Oct. 7 Sale 72 units @ $19 51 units Oct. 15 Purchase 61 units @ $22 29 units Oct. 24 Sale Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 b. Inventory on October 31arrow_forward

- FIFO and LIFO costs under perpetual inventory system The following units of an item were available for sale during the year: DATA Beginning inventory Sale First purchase Sale Second purchase Sale Ending inventory Quantity 8,100 5,000 15,400 12,600 15,900 13,100 8,700 REQUIRED: a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? a. FIFO method b. LIFO method Price Inventory Cost Using formulas and cell references from the problem data, perform the required analysis. Formulas entered in the green cells orange cells. Transfer amounts to CNOWv2 for grading. $160 $300 $167 Formulas $300 $172 $300arrow_forwardBeginning inventory, purchases, and sales for Item MMM8 are as follows: November 1 Inventory 102 16 9 Sale 89 16 Purchase 128 0 25 Sale 83 Assuming a perpetual inventory system and using the Last-in, first-out (FIFO) method, determine the inventory value on November 30.arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 24 units @ $10 5 Sale 17 units 17 Purchase 10 units @ $15 30 Sale 8 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale.$fill in the blank 1arrow_forward

- Periodic Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 50 units @ $102 Mar. 10 Purchase 50 units @ $112 Aug. 30 Purchase 30 units @ $120 Dec. 12 Purchase 70 units @ $126 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar. Cost of Merchandise Inventory and Cost of Merchandise Sold Inventory Method Merchandise Inventory Merchandise Sold a. First-in, first-out (FIFO) $fill in the blank 1 $fill in the blank 2 b. Last-in, first-out (LIFO) fill in the blank 3 fill in the blank 4 c. Weighted average cost fill in the blank 5 fill in the blank 6arrow_forwardBeginning inventory, purchases, and sales for Item FK7 are as follows: Sep 1 inventory 115 units at $225 10 sales 100 units 18 purchase 110 units at $260 27 sales 105 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30.arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 5 Sale 17 Purchase 30 Sale 32 units 0 19 units 35 units @ $26 35 units Assuming a perpetual inventory system and the first-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale. b. Determine the inventory on September 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education