FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Beginning inventory, purchases, and sales data for DVD players are as follows:

| Date | Line Item Description | Units and Cost |

|---|---|---|

| Nov. 1 | Inventory | 43 units at $92 |

| 10 | Sale | 31 units |

| 15 | Purchase | 52 units at $96 |

| 20 | Sale | 29 units |

| 24 | Sale | 8 units |

| 30 | Purchase | 40 units at $102 |

The business maintains a perpetual inventory system, costing by the last-in, first-out method.

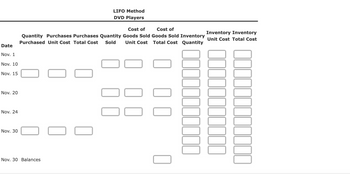

Transcribed Image Text:**LIFO Method for DVD Players**

This chart is used to track the inventory and cost of goods sold for DVD players using the Last-In, First-Out (LIFO) method.

**Columns:**

1. **Date**: Specific dates in November when transactions are recorded.

2. **Quantity Purchased**: Number of units bought on each date.

3. **Purchases Unit Cost**: Cost per unit for purchased items.

4. **Purchases Total Cost**: Total cost for the purchased items on a specific date.

5. **Quantity Sold**: The number of units sold on each date.

6. **Cost of Goods Sold Unit Cost**: Cost per unit of goods that were sold.

7. **Cost of Goods Sold Total Cost**: Total cost for all units sold on that date.

8. **Inventory Quantity**: Remaining quantity in stock after each transaction.

9. **Inventory Unit Cost**: Cost per unit of remaining inventory.

10. **Inventory Total Cost**: Total cost of remaining inventory.

**Rows:**

- Dates vary from Nov. 1 to Nov. 30, including significant points like transaction days and the ending balance day.

- A final balance is recorded on Nov. 30 to summarize inventory details.

This template helps in calculating and tracking inventory cost-flow assumptions under the LIFO method for better financial management and accounting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardplease answer complete question otherwise skip it, please answer in text formarrow_forwardSalmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to ending inventory using LIFO. Units Sold at Retail Activities Units Acquired at Cost 150 units @ $10.00 220 units @ $12.00 Date Beginning Inventory May 1 Purchase 5 140 units @$20.00 Sales 10 100 units @ $13.00 Purchase 15 Sales 90 units@ $21.00arrow_forward

- Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for portable game players are as follows: Apr. 1 Inventory 79 units @ $97 10 Sale 54 units 15 Purchase 32 units @ $102 20 Sale 30 units 24 Sale 14 units 30 Purchase 27 units @ $106 The business maintains a perpetual inventory system, costing by the first-in, first-out method. Question Content Area a. Determine the cost of the merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Merchandise Sold Unit Cost column and in the Inventory Unit Cost column. Perpetual Inventory AccountFirst-in, First-out MethodPortable Game Players Date QuantityPurchased PurchasesUnitCost PurchasesTotalCost QuantityCost ofMerchandiseSold Cost ofMerchandiseSoldUnit Cost Cost ofMerchandiseSoldTotal…arrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 21 units @ $14 11 Purchase 13 units @ $17 14 Sale 27 units 21 Purchase 8 units @ $21 25 Sale 11 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using FIFO. Cost of Inventory Purchases Goods Sold Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 21 $ 14 $ 294 11 13 17 221 21 14 $ 294 13 $ 17 221 14 21 $ 14 2$ 294 17 102 21 8 21 168 $4 25 2$ 21 $4 168 3 21 63 Total Cost of goods sold $4 627 Ending inventory value %24 %24 %24 %24arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for portable DVD players are as follows: Apr. 1 Inventory 52 units @ $74 10 Sale 37 units 15 Purchase 23 units @ $77 20 Sale 20 units 24 Sale 12 units 30 Purchase 35 units @ $81 The business maintains a perpetual inventory system, costing by the first-in, first-out method. Determine the cost of the merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. a. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Merchandise Sold Unit Cost column and in the Inventory Unit Cost column. Cost of the Merchandise Sold Schedule First-in, First-out Method Portable DVD Players Date Quantity Purchased Purchases Unit Cost Purchases Total Cost Quantity Cost of Merchandise Sold Cost of Merchandise Sold Unit Cost Cost of Merchandise Sold…arrow_forward

- Perpetual inventory using LIFO Beginning inventory, purchases, and sales data for DVD players are as follows: Date Line Item Description Units and Cost Nov. 1 Inventory 66 units at $43 10 Sale 44 units 15 Purchase 81 units at $46 20 Sale 45 units 24 Sale 12 units 30 Purchase 27 units at $48 The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. LIFO MethodDVD Players Date QuantityPurchased PurchasesUnit Cost PurchasesTotal Cost QuantitySold Cost ofGoods SoldUnit Cost Cost ofGoods SoldTotal Cost InventoryQuantity InventoryUnit Cost InventoryTotal Cost Nov. 1…arrow_forwardPlease help me. Thankyou.arrow_forwardBeginning inventory, purchases, and sales data for portable game players are as follows: Apr. 1 Inventory 35 units @ $72 10 Sale 25 units 15 Purchase 46 units @ $75 20 Sale 26 units 24 Sale 8 units 30 Purchase 28 units @ $80 The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Merchandise Sold LIFO Method Portable Game Players Date Quantity Purchased Purchases Unit Cost Purchases Total Cost Quantity Sold Cost of Merchandise Sold Unit Cost Cost of Merchandise Sold Total Cost Inventory Quantity Inventory Unit Cost…arrow_forward

- Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for portable DVD players are as follows: Apr. 1 Inventory 57 units @ $47 10 Sale 37 units 15 Purchase 30 units @ $49 20 Sale 25 units 24 Sale 17 units 30 Purchase 24 units @ $51 The business maintains a perpetual inventory system, costing by the first-in, first-out method. Determine the cost of the merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. a. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Merchandise Sold Unit Cost column and in the Inventory Unit Cost column. Cost of the Merchandise Sold Schedule First-in, First-out Method Portable DVD Players Date Quantity Purchased Purchases Unit Cost Purchases Total Cost Quantity Cost of Merchandise Sold Cost of Merchandise Sold Unit Cost Cost of Merchandise Sold…arrow_forwardPerpetual inventory using LIFO Beginning inventory, purchases, and sales data for DVD players are as follows: 69 units at $46 51 units Nov. 1 Inventory 10 Sale 15 Purchase 20 Sale 24 Sale 30 Purchase The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Date Nov. 1 Nov. 10 Nov. 15 Nov. 20 Nov. 24 Nov. 30 U 83 units at $48 46 units 12 units 29 units at $50 Cost of Cost of Inventory Inventory Quantity Purchases Purchases Quantity Goods Sold Goods Sold Inventory Unit Cost Total Cost Purchased Unit Cost Total Cost Sold Unit Cost Total Cost Quantity Nov. 30 Balances LIFO Method DVD Playersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education