FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

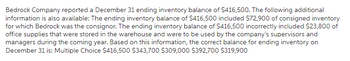

Transcribed Image Text:Bedrock Company reported a December 31 ending inventory balance of $416,500. The following additional

information is also available: The ending inventory balance of $416,500 included $72,900 of consigned inventory

for which Bedrock was the consignor. The ending inventory balance of $416,500 incorrectly included $23,800 of

office supplies that were stored in the warehouse and were to be used by the company's supervisors and

managers during the coming year. Based on this information, the correct balance for ending inventory on

December 31 is: Multiple Choice $416,500 $343,700 $309,000 $392,700 $319,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Bonita Industries took a physical inventory on December 31 and determined that goods costing $210,000 were on hand. Not included in the physical count were $24,000 of goods purchased from Metlock, Inc., FOB, shipping point, and $24,500 of goods sold to Whispering Winds Corp. for $34,000, FOB destination. Both the Metlock purchase and the Whispering Winds sale were in transit at year-end.What amount should Bonita report as its December 31 inventory? Ending Inventory $enter the Ending Inventory in dollarsarrow_forwardSun Co. uses a periodic inventory system. Beginning inventory on Jan. 1 was overstated by $32,000, and its ending inventory on December 31 was understated by $62,000. These errors were not discovered until the next year. So, cost of goods sold for this year was:arrow_forwardStallman Company took a physical inventory on December 31 and determined that goods costing $200,000 were on hand. Not included in the physical count as $25,000 of gods purchased from Pelzer Corporation, f.o.b. shipping point and $22,000 of goods sold to Alvarez Company for $30,000 f.o.b. destination. Both the Pelzer purchase and the Alvarez sale were reported in transit at year end. What amount should Stallman report as its December 31, intentory? O $220,000 O $200,000arrow_forward

- sharadarrow_forwardBased on its physical count of inventory in its warehouse at year-end, December 31, 2014, Madison Company planned to report inventory of $35,300. During the audit, the independent CPA developed the following additional information: a. Goods from a supplier costing $700 are in transit with UPS on December 31, 2014. The terms are FOB shipping point (explained in the “Required” section). Because these goods had not yet arrived, they were excluded from the physical inventory count. b. Madison delivered samples costing $1,740 to a customer on December 27, 2014, with the understanding that they would be returned to Madison on January 15, 2015. Because these goods were not on hand, they were excluded from the inventory count. c. On December 31, 2014, goods in transit to customers, with terms FOB shipping point, amounted to $6,000 (expected delivery date January 10, 2015). Because the goods had been shipped, they were excluded from the physical inventory count. d. On…arrow_forwardThe management of Bartleby Graduate Co. has engaged you to assist in the preparation of year-end (December 31) financial statements. You are told that on November 30, the correct inventory level was 145,730 units. During the month of December, sales totaled 138,630 units including 40,000 units shipped on consignment to Course Hero Certification Corp. A letter received from Course Hero indicates that as of December 31, it has sold 11,000 units and was still trying to sell the remainder. A review of the December purchase orders to various suppliers shows the following. Bartleby Graduate Co. uses the "passing of legal title" for inventory recognition. Purchase Invoice Date Quantity in Date Shipped Date Received Terms Order Date Units 12/31/20 12/05/20 12/06/20 12/18/20 12/22/20 01/02/21 01/02/21 01/03/21 12/20/20 01/05/21 01/07/21 01/02/21 12/17/20 01/05/21 12/29/20 01/04/21 4,200 01/05/21 12/22/20 01/07/21 01/02/21 01/06/21 01/07/21 FOB Destination 3,600 FOB Destination FOB Shipping…arrow_forward

- Crimson reported inventory amounting to P1,727,500 in its December 31, 2022 statement of financial position. Upon verification of the inventory ledger, the following compositions were found: Item 1 Raw materials inventory in the warehouse 2 Office supplies 3 Work in process inventory 4 Shipping cartons 5 Newly finished goods inventories in the factory, including goods specifically segregated per sales contract (considered sold), P50,000 6 Finished goods out on approval, at cost 7 Advances to supplier for materials ordered 8 Damaged and unsalable finished goods, at cost 9 Merchandise items in the showroom at 50% on cost 10 Prepaid insurance on inventories 11 Goods held on consignment, at sales price (cost is P37,500) 12 Merchandise in the hand of the agents including 40% profit on sales 13 Merchandise inventories in transit to customers, FOB Destination at cost 14 Raw materials in transit, FOB origin 15 Goods returned by customer in good condition 16 Items in receiving department,…arrow_forwardConcord Inc. took a physical inventory at the end of the year and determined that $832000 of goods were on hand. In addition, the following items were not included in the physical count. Concord, Inc. determined that $97000 of goods purchased were in transit that were shipped f.o.b. destination (goods were actually received by the company three days after the inventory count). The company sold $39500 worth of inventory f.o.b. destination that did not reach the destination yet. What amount should Concord report as inventory at the end of the year?arrow_forwardMarigold Inc. tookaphysical inventory at the end of the year and determined that $777000 of goods were on hand. In addition, Marigold, Inc. determined that $ 57500 of goods that were in transit that were shipped f.o.b. shipping point were actually received two days after the inventory count and that the company had $ 87000 of goods out on consignment. What amount should Marigold report as inventory at the end of the year? O $ 921500. O $777000. O $854000. O $864000.arrow_forward

- Crimson reported inventory amounting to P1,727,500 in its December 31, 2022 statement of financial position. Upon verification of the inventory ledger, the following compositions were found Item 1 Raw materials inventory in the warehouse 2 Office supplies 3 Work in process inventory 4 Shipping cartons 5 Newly finished goods inventories in the factory, including goods specitically segregated per sales contract (considered sold), P50,000 6 Finished goods out on approval, at cost 7 Advances to supplier for materials ordered 8 Damaged and unsalable finished goods, at cost 9 Merchandise items in the showroom at 50% on cost 10 Prepaid insurance on inventories 11 Goods held on consignment, at sales price (cost is P37,500) 12 Merchandise in the hand of the agents including 40% profit on sales 13 Merchandise inventories in transit to customers, FOB Destination at cost 14 Raw materials in transit, FOB origin 15 Goods returned by custormer in good condition 16 Items in receiving department,…arrow_forwardQ: Which misstatement below is more difficult to detect? Explain.(i)The inventory costing $ 150,000 being ordered by customers before the year end was excluded from the ending inventory balance as they are set aside for delivery after year end. The ending balance of inventory as on the statement of financial position was $ 600,000.(ii) Inventory list shows 40 boxes of rice but only 38 boxes were found in the warehouse.(iii) The inventory has a cost of $600,000 and realizable value of $540,000 as the items are outdated. The ending balance of inventory as on the statement of financial position was $ 600,000.arrow_forwardBonita Inc. took a physical inventory at the end of the year and determined that $845000 of goods were on hand. In addition, the following items were not included in the physical count. Bonita, Inc. determined that $98000 of goods purchased were in transit that were shipped f.o.b. destination (goods were actually received by the company three days after the inventory count). The company sold $39000 worth of inventory f.o.b. destination that did not reach the destination yet. What amount should Bonita report as inventory at the end of the year? $982000. $943000. $845000. $884000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education