ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

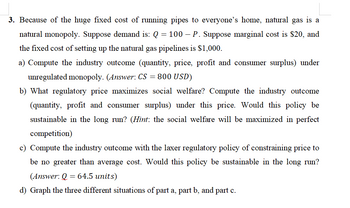

Transcribed Image Text:3. Because of the huge fixed cost of running pipes to everyone's home, natural gas is a

natural monopoly. Suppose demand is: Q = 100 - P. Suppose marginal cost is $20, and

the fixed cost of setting up the natural gas pipelines is $1,000.

a) Compute the industry outcome (quantity, price, profit and consumer surplus) under

unregulated monopoly. (Answer: CS = 800 USD)

b) What regulatory price maximizes social welfare? Compute the industry outcome

(quantity, profit and consumer surplus) under this price. Would this policy be

sustainable in the long run? (Hint: the social welfare will be maximized in perfect

competition)

c) Compute the industry outcome with the laxer regulatory policy of constraining price to

be no greater than average cost. Would this policy be sustainable in the long run?

(Answer: Q = 64.5 units)

d) Graph the three different situations of part a, part b, and part c.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- With regard to market structure, answer the following: (a) A monopolist never produces in the inelastic portion of its demand curve. True or false? Why? (b) Draw a figure showing a monopolist producing at the lowest point on its long-run average cost curve. (c) What is third degree price discrimination? Why does a monopolist practice it? What are the conditions are necessary for the monopolist to be able to practice it? Give a real-world example of third degree price discrimination? (c) If the price elasticity of demand is -3 in market 1 and -2 in market 2 and the price in market 1 is $12, what price should a monopolist practicing third degree price discrimination set in market 2?arrow_forwardThe following graph gives the demand (D) curve for water services in the fictional town of Streamship Springs. The graph also shows the marginal revenue (MR) curve, the marginal cost (MC) curve, and the average total cost (ATC) curve for the local water company, a natural monopolist. On the following graph, use the black point (plus symbol) to indicate the profit-maximizing price and quantity for this natural monopolist. PRICE (Dollars per hundred cubic feet) 40 36 32 28 24 20 0 0 1 2 3 5 6 7 8 QUANTITY (Hundreds of cubic feet) MR 4 True ATC MC O False 9 10 D The water company is experiencing economies of scale. Which of the following statements are true about this natural monopoly? Check all that apply. + Monopoly Outcome The water company must own a scarce resource. It is more efficient on the cost side for one producer to exist in this market rather than a large number of producers. In order for a monopoly to exist in this case, the government must have intervened and created it.…arrow_forwardPlease explain why this answer is correct.arrow_forward

- Consider a monopoly market in which the market demand curve is given by P = 240 - 2Q, the marginal revenue curve is MR = 240 – 4Q, the marginal cost curve is MC = 2Q, and there are zero fixed costs. Suppose the government intervenes and turns the market into a competitive market, and all the firms in the market have the same marginal cost curve as the monopolist, MC = 2Q, and zero fixed costs. How much is the resulting gain in total surplus? 400 800 300 600arrow_forwardThe graph above shows the cost and revenue curves for a natural monopoly that provides electrical power to the town of Fanaland. If unregulated, the monopolist operates to maximize its profit. (a) Identify the monopolist’s profit-maximizing quantity and price. (b) Assume the town government of Fanaland regulates the monopolist’s price to achieve the allocatively efficient quantity. What price would the government set in order to achieve the allocatively efficient quantity? (c) Will producing the allocatively efficient quantity be economically feasible for the monopolist? Explain. (d) Suppose instead the town government wants to regulate the monopolist to earn zero economic profit. What price would the government set to have the monopolist earn zero economic profit? (e) Based on your answer to part (d), will the deadweight loss increase, decrease, or stay the same as that of the unregulated monopolist? Explain.arrow_forwardConsider the electricity industry, in which there are very large fixed costs but also in which variable costs are directly proportional to total output so that the marginal cost of each unit produced is small and constant. a) Assuming that one firm has an electricity monopoly, draw a diagram that shows the price the monopolist charges and the quantity the monopolist sells at this price. Be sure to include marginal cost, average total cost, marginal revenue, and demand curves in your diagram. What happens if the electricity industry is perfectly competitive? More specifically, let us assume that the marginal cost curve from part (a) is equal to the perfectly competitive market supply curve. In this case, show in a diagram what the perfectly competitive equilibrium price and quantity in this industry are. What will happen to the number of firms producing electricity in the long run? What does this say about the desirability of monopoly vs. perfect competition in this industry?…arrow_forward

- Question 2: Suppose a monopoly firm produces bicycles and can sell 10 bicycles per month at a price of $700 per bicycle. In order to increase sales by one bicycle per month, the monopolist must lower the price of its bicycles by $100 to $600 per bicycle. What is the marginal revenue of the eleventh bicycle?arrow_forwardYou own a road resurfacing business called Dahyun Bricks services located in Seoul. You are the only reservicing business in South Korea. Therefore, you have a local monopoly. Your experience running the company for many years has taught you that market demand for your service can be described by the demand function: p = 20 - Q. The cost function is c =q². Therefore, marginal cost equals 2q. Quantity refersto square metre of road resurfacing. Note the Q denotes aggregate market demand and q denotes your production. Of course, if you are the only supplier than q = Q. a) Compute profit maximising price and output. Compute profits. b) The monopoly profit that you have been earning has attracted attention from another firm that will set up operations in South Koreaand compete for market share. You are concerned with losing market share and profit. So, you offer the potential entrant the following deal. Both firms agree to maximise industry profits (joint profits). The potential entrant…arrow_forwardWhen Pfizer registers its latest drug patent application, it will have created a monopoly for that product by restricting ____ a)entry into the market. b)amount of product advertising. c)the number of product compliments. d)demand for the product.arrow_forward

- Question 4. Consider a monopolist facing a demand curve of the form D(p) = 100 – 2p where p is the - unit price. Suppose the monopolist has a constant marginal cost of production of $2 a unit. Bunter was asked to determine the price which would maximize consumer surplus. Here is his solution: Total surplus as a function of price is 50(100 – 2x)dx. The derivative of this with respect to p is -(100-2p). This is maximized by making p as large as possible, i.e., p = 50. Is Bunter correct? If not, what is the error that Bunter has made?arrow_forwardSuppose a monopoly's price elasticity of demand equals-5 and the marginal cost of production equals $500.00. The profit-maximizing price is $ 625 (Enter a numeric response using a real number rounded to two decimal places.) What will be the firm's markup? When maximizing profit, the monopoly's markup is______percent. (Round your response to the nearest percent.)arrow_forwardQuestion 2. A monopolist sells the same product at the same price into two different markets. The demand for the product in market #1 is denoted D₁ (p) = 30 - 2p where p is the unit price. The demand for the product in market #2 is given by D₂ (p) = 80 - 3p. (a) If the monopolist sets a price of $20 per unit, what is the total demand? (b) Explain why elasticity of total demand is not defined at a unit price of $15.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education