FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

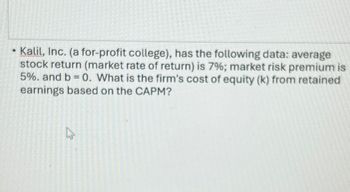

Transcribed Image Text:Kalil, Inc. (a for-profit college), has the following data: average

stock return (market rate of return) is 7%; market risk premium is

5%. and b = 0. What is the firm's cost of equity (k) from retained

earnings based on the CAPM?

12

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 16. O'Brien Inc. has the following data: TRF = 5.00%; RPM = 6.00%; and b = 1.10. What is the firm's cost of equity from retained earnings based on the CAPM? a. 11.83% b. 13.22% C. 11.25% d. 8.93% e. 11.60% istiqaarrow_forwardDefine profitability raitos return on assets and return on equity. According to the following metrics: ROA Return on Assets: 14%; ROE Return on Equity: 305%. What is the profitability the of example company? Why or why not is this company profitable?arrow_forwardIf the D/E ratio of a firm is 1.4, what is the firm's weight on equity? Hint: the formula is on your excel project sheet. Use decimal notation (14.26% would be 14.26).arrow_forward

- You have the following data: D1 = $1.80; P0 = $36.00; and g = 3.00% (constant). What is the cost of equity from retained earnings based on dividend growth approach? a. 8.00% b. 8.50% C . 5.00% d. 7.70%arrow_forwardAssuming net income and shareholders equity are positive, and at least $1 in liabilities, the Return on Investment is: Always higher than the Return on Equity. Always equal to the Return on Equity. Sometimes equal to the Return on Equity. Always lower than the Return on Equity.arrow_forwardIf we know that a firm has a net profit margin of 4.3%, total asset turnover of 0.77, and a financial leverage multiplier of 1.37, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? The firm's ROE is %. (Round to two decimal places.) What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? (Select from the drop-down menus.) Observe the modified DuPont formula (see) and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Dupont system is that ROE is broken into three distinct components. Starting at the right we see how has increased assets over the owners' original equity. Next, moving to the left, we see how efficiently the firm used its sales. to…arrow_forward

- Provide Answer with calculation and explanationarrow_forwardD O Assume that Kish Inc. hired you as a consultant to help estimate its cost of capital. You have obtained the following data: Do = $0.90; Po = $47-50; and g = 7.00% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? Do not round your intermediate calculations. a. 2.03% b. 8.77% O c. 9.03% O d. 8.89% O e. 2.17% Q Search B G 8 40 E hp X Dropbox promotion fo 25 alt a W ctri *** prisc X delete backspace pause homearrow_forwardK-Life financial services Limited uses risk-adjusted return on capital (RAROC) to measure performance on several aspects. In this regard, imagine that an investment officer wants to execute a transaction with the following characteristics: Probability of default (PD) = 30 basis points Loss given default (LGD) = 55% Exposure at default (EAD) = K 1.45 million Expected loss (EL) = K 2,750 This is a loan to a company in the Agro industrial. The firm’s economic capital (EC) model is based on the 99% confidence level, with an average standard deviation of 2.15%. The risk-free rate of return is 6%. Assume that the bank has set a RAROC hurdle rate of 15% and this transaction has a net profit of K10, 500. REQUIRED: Compute the K-life’s risk-adjusted rate of return on this transaction. Now assume that K-life could also have made a loan for the same amount to a firm in the service industry, and that the standard deviation for economic capital purposes in this case is 1.29%. Compute the bank’s…arrow_forward

- To help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: Do = $1.45; Po = $22.50; and g = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? 11.68% 12,30% 12.56% 12.94% 13.36% O O o O o Oarrow_forward(a) Compute the expected book value per share at time 1. (b) Compute the expected earnings per share of DTI at time 2. (c) Compute the expected value of the ex-dividend stock price at time 2. (d) Compute the expected value of the ex-dividend stock price at time 0. (e) Compute the expected return (over a single-period) on the stock of DTI at time 0 (in %).arrow_forwardget all answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education