Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

WHAT IS THE ANSWER?

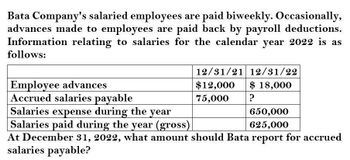

Transcribed Image Text:Bata Company's salaried employees are paid biweekly. Occasionally,

advances made to employees are paid back by payroll deductions.

Information relating to salaries for the calendar year 2022 is as

follows:

Employee advances

Accrued salaries payable

Salaries expense during the year

Salaries paid during the year (gross)

12/31/21 12/31/22

$12,000 $ 18,000

75,000 ?

650,000

625,000

At December 31, 2022, what amount should Bata report for accrued

salaries payable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Lemurs payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31.arrow_forwardPayroll Accounting Jet Enterprises has the following data available for its April 30, 2019, payroll: *All subject to Social Security and Medicare matching and withholding of 6.2% and 1.45%, respectively. Federal unemployment taxes of 0.70% and state unemployment taxes of 0.90% are payable on $405,700 of the wages earned. Required: 1. Compute the amounts of taxes payable and the amount of wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. ( Note: Round to the nearest penny.) 2. CONCEPTUAL CONNECTION Jet would like to hire a new employee at a salary of $65,000. Assuming payroll taxes are as described above (with unemployment taxes paid on the first $9,000) and fringe benefits (e.g., health insurance, retirement, etc.) are 25% of gross pay, what will be the total cost of this employee for Jet?arrow_forwardWallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forward

- Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: sales salaries, 4,275; officers salaries, 2,175; office salaries, 825. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 13,350.arrow_forwardOn December 31, 2021, what amount should PO report for accrued salaries payable? *see attached a. P 100,000b. P 94,000c. P 82,000d. P 35,000arrow_forwardSheridan Company’s salaried employees are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar year 2021 is as follows: 12/31/20 12/31/21Employee advances $ 24000 $ 37000Accrued salaries payable 162000 ?Salaries expense during the year 1420000Salaries paid during the year (gross) 1250000 At December 31, 2021, what amount should Sheridan report for accrued salaries payable? $125000. $175000. $332000. $170000.arrow_forward

- At December 31, 2021, what amount was reported by Brown Company as accrued salaries payable? Choices: P90,000 P84,000 P72,000 P22,000arrow_forwardSiomai Company salaried employees are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar year 2021 is as follows: • Employee advances, Dec. 31, 2020 - P12,000 • Employee advances, Dec. 31, 2021 - P18,000 • Accrued salaries payable, Dec. 31, 2021- P100,000 • Salaries expense during the year- P815,000 • Salaries paid during the year (gross) 780,000 On December 31, 2020, what amount should Siomai report as accrued salaries payable?arrow_forwardThe employees of UMPISA NA NG KALBARYO COMPANY are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar years 2018 and 2019 are as follows. On December 31, 2019, what amount should the company report as accrued salaries payable? a. P100,000 b. P94,000 c. P82,000 d. P35,000arrow_forward

- Please answer! Thankzarrow_forwardQUESTIONS (answer with solutions) A. Popcorn Company pays its employees' salaries bi-weekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar year 2020 is as follows: 31/12/2019 31/12/2020 Employee advances Accrued salaries payable 12,000.00 18,000.00 15,000.00 ? Salaries expense during the year 815,000.00 Salaries paid during the year (gross) 780,000.00 At December 31, 2020, what amount should Popcorn company report for accrued salaries payable? B. Face Company grants all employees two weeks paid vacation for each full year of employment. Unused vacation time can be accumulated and carried forward to succeeding years, and will be paid at the salaries in effect when vacations are taken or when employment is terminated. There was no employee turnover in 2020. Additional information relating to the year ended December 31, 2020 is as follows: Liability for accumulated vacations at December 31, 2019 25,000.00…arrow_forwardLewis Company's salaried employees are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar year 2016 is as follows: 12/31/15 12/31/16 Employee advances Accrued salaries payable $12,000 $ 18,000 75,000 ? Salaries expense during the year 650,000 Salaries paid during the year (gross) 625,000 At December 31, 2016, what amount should Lewis report for accrued salaries payable? a. $100,000. b. $84,000. c. $92,000. d. $55,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning