Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question solution general accounting

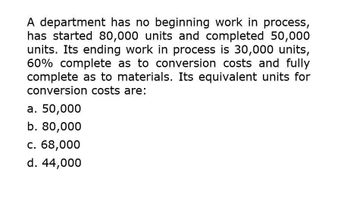

Transcribed Image Text:A department has no beginning work in process,

has started 80,000 units and completed 50,000

units. Its ending work in process is 30,000 units,

60% complete as to conversion costs and fully

complete as to materials. Its equivalent units for

conversion costs are:

a. 50,000

b. 80,000

c. 68,000

d. 44,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardA firm has 100,000 in direct materials costs, 50,000 in direct labor costs, and 80,000 in overhead. Which of the following is true? a. Prime costs are 150,000; conversion costs are 180,000. b. Prime costs are 130,000; conversion costs are 150,000. c. Prime costs are 150,000; conversion costs are 130,000. d. Prime costs are 180,000; conversion costs are 150,000.arrow_forward

- The cost of direct materials transferred into the Rolling Department of Kraus Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardMazomanie Farm completed 20,000 units during the quarter and has 2,500 units still in process. The units are 100% complete with regard to materials and 55% complete with regard to conversion costs. What are the equivalent units for materials and conversion?arrow_forwardCool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?arrow_forward

- Conversion cost is 250,000; Prime cost is 200,000; OH rate is 150% of Direct labor cost; Indirect materials used is 10,000 and indirect labor is 24,000. Work in process, beginning is 6,000; FG Inventory increased by 4,000; actual OH is 156,000 and cost of sales is 350,000 at actual cost. Assume that under or overapplied overhead is immaterial. Wat is the ending balance of WIP account?arrow_forwardThe equivalent production under weighted average costing method is arrived at as follows: Finished and transferred 20,000 x 100% 20,000 In process, Feb. 28 3,000 x 2/3 2,000 22,000 With beginning work in process consisting of 5,000 units, 1/5 done, what should be the equivalent production under FIFO? а. 23,000 b. 21,000 C. 22,000 d. 19.000arrow_forward1) Department W had 2,160 units, one-third completed at the beginning of the period. 13,000 units were transferred to Department X from Department W during the period, and 1,550 units were one-half completed at the end of the period. Assume the completion ratios apply to direct materials and conversion costs. 12,280 units b.10,840 units c.16,710 units d.13,055 units 2) If the contribution margin ratio for France Company is 39%, sales were $424,000, and fixed costs were $105,000, what was the income from operations? a.$60,360 b.$48,288 c.$105,000 d.$165,360arrow_forward

- The following department data are available: Total materials costs OMR 180,000 Equivalent units of materials 60,000 Total conversion costs OMR 105,000 Equivalent units of conversion costs 30,000 What is the total manufacturing cost per unit? Select one: O a. OMR 3.50. O b. OMR 4.75. O c. OMR 3.00. O d. None of the answers are correct e. OMR 6.90.arrow_forwarda. The following data relates to Process 1 Material Input 1,000 units costing Ghc02,000 Lakour costs Ghc10,000 Departmental Overheads Ghc8,000 Normal loss is 4% of input and is sold as scrap for Ghc15 per unit Actual output = 940 units Required: Calculate the average cost per unit in process 1 and produce the process account, abnormal gain and loss account and the scrap account b. Using a practical example, indicate how to determine sales volume variancearrow_forwardA department has total conversion costs of $153,300 and total materials costs of $250,025. If the department has 36,500 equivalent units of production for materials and 73,000 equivalent units of production for conversion costs, what is the total manufacturing cost per unit? O $11.05 O $8.95 $9.50 O $2.65arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,