Based on the pure expectations theory, is the following statement true or false? A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an Investment in another one-year CD after one year. True False The yield on a one-year Treasury security is 5.1500%, and the two-year Treasury security has a 7.7250% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 8.8086% 11.8139% 13.1611% 10.3631% Recall that on a one-year Treasury security the yield is 5.1500% and 7.7250% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.5%. What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your Intermediate calculations.) 7.9398% 10.6486% 9.3409% 11.8629% Suppose the yield on a two-year Treasury security is 5.83 %, and the yield on a five-year Treasury security is 6.20%. Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your Intermediate calculations.) 6.45% 5.46% 6.53%

Based on the pure expectations theory, is the following statement true or false? A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an Investment in another one-year CD after one year. True False The yield on a one-year Treasury security is 5.1500%, and the two-year Treasury security has a 7.7250% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 8.8086% 11.8139% 13.1611% 10.3631% Recall that on a one-year Treasury security the yield is 5.1500% and 7.7250% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.5%. What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your Intermediate calculations.) 7.9398% 10.6486% 9.3409% 11.8629% Suppose the yield on a two-year Treasury security is 5.83 %, and the yield on a five-year Treasury security is 6.20%. Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your Intermediate calculations.) 6.45% 5.46% 6.53%

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Question

Pls help correctly with steps and all parts or skip. I will like for complete answer.

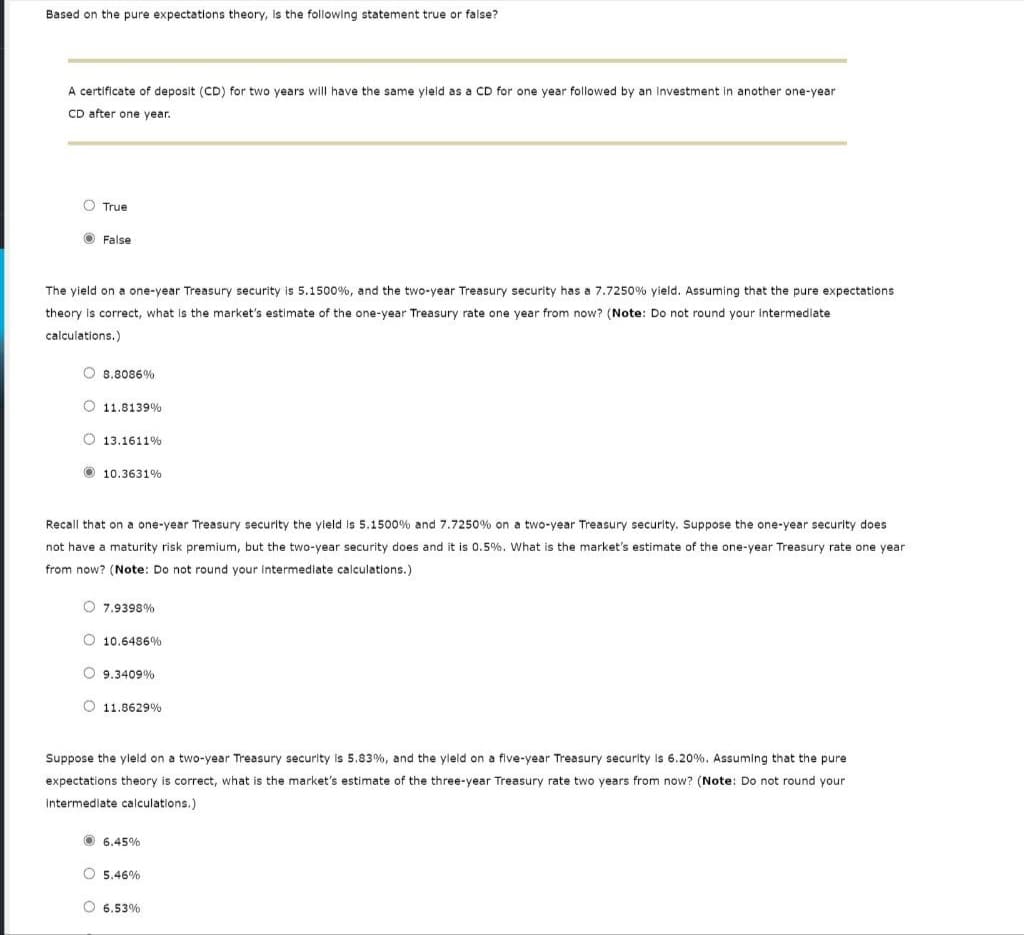

Transcribed Image Text:Based on the pure expectations theory, is the following statement true or false?

A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an Investment in another one-year

CD after one year.

True

False

The yield on a one-year Treasury security is 5.1500%, and the two-year Treasury security has a 7.7250% yield. Assuming that the pure expectations

theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate

calculations.)

8.8086%

11.8139%

13.1611%

10.3631%

Recall that on a one-year Treasury security the yield is 5.1500 % and 7.7250% on a two-year Treasury security. Suppose the one-year security does

not have a maturity risk premium, but the two-year security does and it is 0.5%. What is the market's estimate of the one-year Treasury rate one year

from now? (Note: Do not round your intermediate calculations.)

7.9398%

10.6486%

9.3409%

11.8629%

Suppose the yield on a two-year Treasury security is 5.83%, and the yield on a five-year Treasury security is 6.20%. Assuming that the pure

expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not round your

Intermediate calculations.)

6.45%

5.46%

6.53%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning