Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

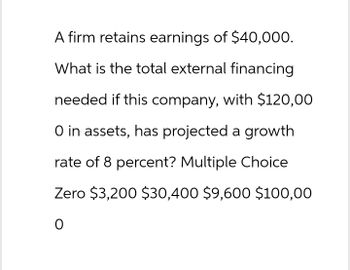

Transcribed Image Text:A firm retains earnings of $40,000.

What is the total external financing

needed if this company, with $120,00

O in assets, has projected a growth

rate of 8 percent? Multiple Choice

Zero $3,200 $30,400 $9,600 $100,00

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 5. Business and financial risk Aa Aa The impact of financial leverage on return on equity and earnings per share Consider the following case of Lost Pigeon Aviation: Suppose Lost Pigeon Aviation is considering a project that will require $200,000 in assets. The project is expected to produce earnings before interest and taxes (EBIT) of $40,000. Common equity outstanding will be 25,000 shares. The company incurs a tax rate of 35%. If the project is financed using 100% equity capital, then Lost Pigeon Aviation's return on equity (ROE) on the project will be In addition, Lost Pigeon's earnings per share (EPS) will be Alternatively, Lost Pigeon Aviation's CFO is also considering financing the project with 50% debt and 50% equity capital. The interest rate on the company's debt will be 12%. Because the company will finance only 50% of the project with equity, it will have only 12,500 shares outstanding. Lost Pigeon Aviation's ROE and the company's EPS will be if management decides to…arrow_forwardNonearrow_forwardProblem 01-04 (algo) A firm's current profits are $950,000, These prafits are expected to grow indefinitely at a constant annual rate of 6 percent. If the firm's apportunity cost of funds is 8 percent, determine the value of the firm: Instructions: Enter your respanses rounded to two decimal places. a. The instant before It pays out current profits as dividends. million b. The instant after it pays out current profits as dividends. millionarrow_forward

- You are given the following information concerning a firm: Assets required for operation: $5,000,000 Revenues: $8,400,000 Operating expenses: $7,900,000 Income tax rate: 40%. Management faces three possible combinations of financing: 100% equity financing 30% debt financing with a 6% interest rate 60% debt financing with a 6% interest rate What is the implication of the use of financial leverage when interest rates change?arrow_forwardPlease solve question 2 with excel function PV, thanksarrow_forwardIntro Nickelon's free cash flow during the current year is $150 million, which is expected to grow at a constant rate of 5% in the future. The weighted average cost of capital is 11%. Part 1 What is the firm's total corporate value (in $ million)? 0+ decimals Submitarrow_forward

- Q1/ Ipswich Corporation is considering an investment opportunity with the expected net cash inflows of $300,000 for four years. The residual value of the investment, at the end of four years, would be $70,000. The company uses a discount rate of 14%, and the initial investment is $290,000. Calculate the NPV of the investment?arrow_forwardA firm has target debt-equity ratio of 0.60. The flotation cost for equity is 5% and the flotation cost for debt is 3%. The firm needs $10,000,000 investment to undertake a project. How much should the firm raise to account for flotation costs and the initial investment need of the project? O $10,395,010 O $10,416,667 $11,000,821 $10,572,912 O $10,443,864arrow_forwardGrowth firmarrow_forward

- The question is attarrow_forwardThe FCFE (free cash flow to the equity) is projected to be $0.3 billion forever, the cost of equity equals 15% and the WACC is 10%. If the market value of the debt is $1.0 billion, what is the value of the equity using the free cash flow valuation approach? The firm does not have any short-term investments that are unrelated to operations. O $2 billion ⒸS3 billion $4 billion $1 billionarrow_forwardplease answer question attached belowarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education